New here? Read up on our past Crypto issues to get the most from this post.

June 3rd, 2022 | ± 7 minutes

CONTENTS:

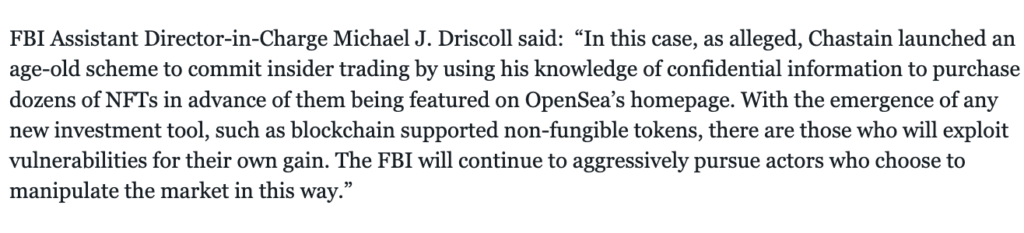

Wow, what a week for Crypto (and NFT) fans. We’re all familiar with shilling in the world of Crypto, but this week Nate Chastain, former head of Product at OpenSea, has been charged with insider trading, the first case of its kind in the world of NFTs.

In this issue, we’ll recap how it went down, and how blockchain technology makes it possible to uncover scams like these. Plus, we have a mock-up example of how shady traders can use social media to pump and dump.

Juicy!

Let’s go!

P.S. Are you a fan of Colin’s writing? See what he’s working on and follow him on Twitter at @seo_colinlma

Table of Contents

The First Insider Trading Case Involving NFTs

When I wrote last week’s article, I didn’t intend to follow it up with another article on NFTs, but the most recent news is too juicy to pass up.

On June 1, 2022, Nate Chastain was arrested on wire fraud and money laundering charges involving insider trading. The two charges, brought by the U.S. Attorney’s Office of the Southern District of New York, each carry a maximum of twenty years in prison. This is the first time anyone has been charged with insider trading charges related to NFTs.

How It Happened

Nate Chastain was Head of Product at Opensea, the largest NFT trading marketplace. On its homepage, OpenSea features NFT collections/projects. Here are collections that are currently featured on OpenSea:

Choosing which NFTs to put on the homepage was not (and still is not) an automated process. So OpenSea’s employees decided which collections would be featured – knowledge that Mr. Chastain used to his full advantage.

NFTs featured on the homepage are likely to gain an additional boost in activity,to increase the value of these projects rapidly, often by as much as 5x or more.

Mr. Chastain used this knowledge to buy NFTs before before featured on OpenSea’s homepage. This allowed him to confidently make trades because he knew that there was a strong likelihood that the value of the NFTs he bought would increase.

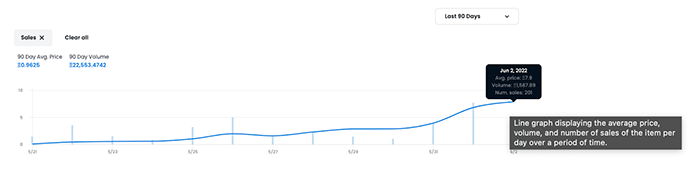

According to Loopify, he made about 20 $ETH from these trades. At the time, $ETH hovered between $2,000 and $4,000:

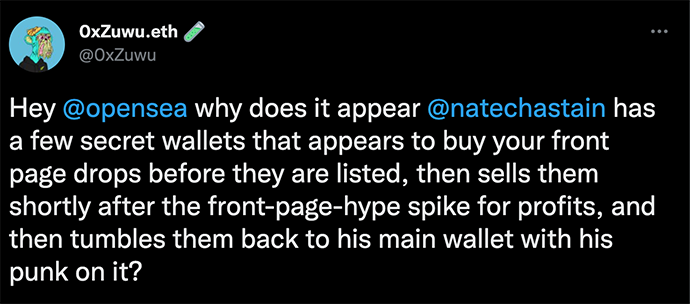

Mr. Chastain was smart enough to buy these NFT projects from multiple cryptocurrency wallets that weren’t publicly linked to him. However, he wasn’t careful enough – Twitter user Zuwu could track multiple wallets to Mr. Chastain – made possible because of the transparency of blockchain technology. Yay for web3!

Following these allegations, in September 2021, Mr. Chastain resigned from his position at OpenSea. Shortly after, he attempted to raise $3 million from investors in a seed round to build “Oval”, a rival NFT marketplace that was going to use algorithms to make personalized NFT recommendations.

Price Manipulation Through Social Media

Mr. Chastain was in a unique position to profit from his knowledge, but I don’t think he’s the only one to take advantage of price manipulation for profit.

Although this is the most public case of profiting from price manipulation off NFTs, it is certainly not the first. Crypto and NFT influencers constantly “shill” or promote projects they’ve already bought into. NFT Influencer Farokh has been accused of doing this.

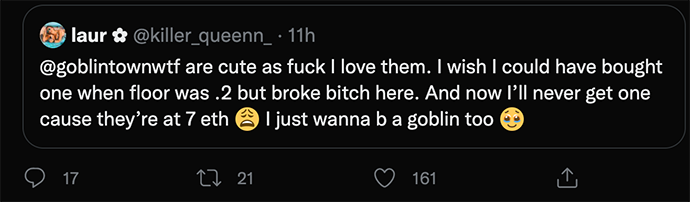

Much of the NFT world uses Twitter, Discord, and other social media platforms to get updates from projects and other investors. Because of this, activity on social media channels can directly influence the price action of NFTs.

Often influencers will provide some great storytelling (and questionable analysis) in the form of Tweets to promote projects they’ve already invested in. If the Tweets go viral or gain enough traction, the value of these NFTs can skyrocket, allowing influencers to profit greatly along the way.

How this works in practice: A worked-through example

Let’s run through an example to paint a more clear picture. For simplicity, I’ve condensed the timeline of these events and ignored fees from buying/selling.

Let’s say I’m an influencer on Twitter and decide to buy 20 NFTs from a brand new collection, ColinTrollz, at .05 $ETH each. With these numbers so far, I’ve spent 1 $ETH.

Day 0

I start leveraging my audience to tweet about why I love this collection. Here is are some examples of some Tweets I make over a couple of days:

“Art so gud @ColinTrollz”

“Here’s why I love @ColinTrollz – a 7 part thread on why you need to invest”

“If you don’t own @ColinTrollz by now, you don’t like profit”

“Make sure to get @ColinTrollz before 1 $ETH”

As an influencer, my Tweets get in front of my followers and others. They start buying ColinTrollz, and the price goes up.

Recap Day 0

- Investment: 1 $ETH

- ColinTrollz I currently own: 20

- Value of 1 ColinTrollz: .05 $ETH

- Current value of my ColinTrollz portfolio: 1 $ETH

- ColinTrollz I’ve sold so far: 0

- Revenue from sales: 0 $ETH

Day 1

Overnight, ColinTrollz go from .05 $ETH to .15 $ETH! Wow, I already 3xed my investment.

I start a series of more Tweets. Everyone who purchased ColinTrollz from day 0 was now financially motivated to engage with my Tweets to improve reach. They are ALSO motivated to make their own Tweets about the project.

These Tweets are getting a lot of eyeballs on @ColinTrollz, and people continue to purchase at a high velocity.

Recap Day 1

- Investment: 1 $ETH

- ColinTrollz I currently own: 20

- Value of 1 ColinTrollz: .15 $ETH

- Current value of my ColinTrollz porfolio: 3 $ETH

- ColinTrollz I’ve sold so far: 0

- Revenue from sales: 0 $ETH

Day 2

By the start of day two, we go from a single ColinTrollz being worth .15 $ETH on Day 1 to now .25 $ETH. I haven’t sold any, so my 20 ColinTrollz are now worth 5 $ETH. I think about selling a few, but I think it can go higher.

Like on day 1, I continue Tweeting. Now, I can build even more hype by showing my own gains – I’ve 5xed in my investment in just TWO days!

Again, my army of followers and fellow buyers do the same to continue to raise awareness of the project. More and larger influencers are starting to Tweet about the project. Alpha discord groups start mentioning my Tweets and the project, further snowballing the project’s momentum and generating more sales.

Recap Day 2

- Investment: 1 $ETH

- ColinTrollz I currently own: 20

- Value of 1 ColinTrollz: .25 $ETH

- Current value of my ColinTrollz portfolio: 5 $ETH

- ColinTrollz I’ve sold so far: 0

- Revenue from sales: 0 $ETH

Day 3

Holy shit, I woke up, and now a single ColinTrollz is worth 1 $ETH!

People across the globe are purchasing it at an alarming rate. Now, my 20 ColinTrollz are worth $20 ETH. It’s time to sell a few, so let’s say I sell five at 1 $ETH each, for a total of 5 $ETH. I continue to Tweet aggressively.

Recap Day 3

- Investment: 1 $ETH

- ColinTrollz I currently own: 15

- Value of 1 ColinTrollz: 1 $ETH

- Current value of my ColinTrollz portfolio: 15 $ETH

- ColinTrollz I’ve sold so far: 5

- Revenue from sales: 5 $ETH

Day 4:

ColinTrollz has been picking up steam. It’s going viral, and the price action increases. ColinTrollz releases a ‘teaser announcement’ on Twitter and the value of 1 ColinTrollz skyrockets to 2.5 $ETH. I decide to sell another 10 for 25 $ETH.

Recap Day 4

- Investment: 1 $ETH

- ColinTrollz I currently own: 5

- Value of 1 ColinTrollz: 2.5 $ETH

- Current value of my ColinTrollz portfolio: 7.5 $ETH

- ColinTrollz I’ve sold so far: 15

- Revenue from sales: 30 $ETH

Day 5:

Wow, in just five days, I’ve made more than 29 $ETH in profit and I still have 5 ColinTrollz left, now worth 4 $ETH each. At this point I don’t even need to Tweet anymore, but I do it anyway. What the heck.

However, I decide to keep my leftover 5 ColinTrollz, to see how high the project can really go. After all, I already made 29x my initial investment.

Recap Day 5

- Investment: 1 $ETH

- ColinTrollz I currently own: 5

- Value of 1 ColinTrollz: 4 $ETH

- Current value of my ColinTrollz: 20 $ETH

- ColinTrollz I’ve sold so far: 15

- Revenue from sales: 30 $ETH

Guilty or Innocent – The Potential Ramifications of This Case

Like I said before, the above is a condensed and simplified example. While this example took place over five days, IRL it would take a few weeks.

However, it’s easy to see how influencers can directly influence price with the benefit of huge profits. They are financially motivated to promote projects, even if there is no official affiliation with them.

If Mr. Chastain is found guilty, District Attorneys will almost certainly start looking at other cases of price manipulation, even if influencers’ involvement might be less blatant. After all, the office did say they intend on “targeting price manipulation, etc., etc.).”

Even if this case fails, we should expect more laws targeting NFTs and further cases around NFT price manipulation and scams.

We’re still at a time where NFTs are still relatively new to the world after rising in popularity a year ago. Because of this, there are little to no laws about NFTs, and most jurisdictions have yet to clearly define taxation, I.P. rights, and criminal cases related to NFTS.

For better or worse, this case will be a defining moment in the future of NFTs.

BREAKING: Ex-OpenSea exec Nate Chastain has been charged with NFT insider trading, the bastard illegally made like 20 ETH.

— cam (@privatebankass) June 1, 2022

*Do Kwon who just screwed folks out of like $60 billion w/ LUNA: pic.twitter.com/K8QuCuxojM

That’s it for this week’s Crypto Insider. Did you find it useful?

If you have any questions or would like to discuss anything about this issue (or about Crypto/NFTs in general), feel free to respond to this email. We read everything, as always.

Thanks, Colin