Today, we’re looking at the intersection of climate change and wine.

It’s an important topic for both wine lovers and investors, as a changing climate will affect the wine industry within our lifetimes.

What sort of effects are we talking about? And what will this mean for wine production & investing going forward?

This issue includes some commentary from Vinovest CEO Anthony Zhang, and also Justin Knock, the “Master of Wine” (awesome title) over at Oeno

Let’s find out more 👇

Table of Contents

Crisis breeds innovation

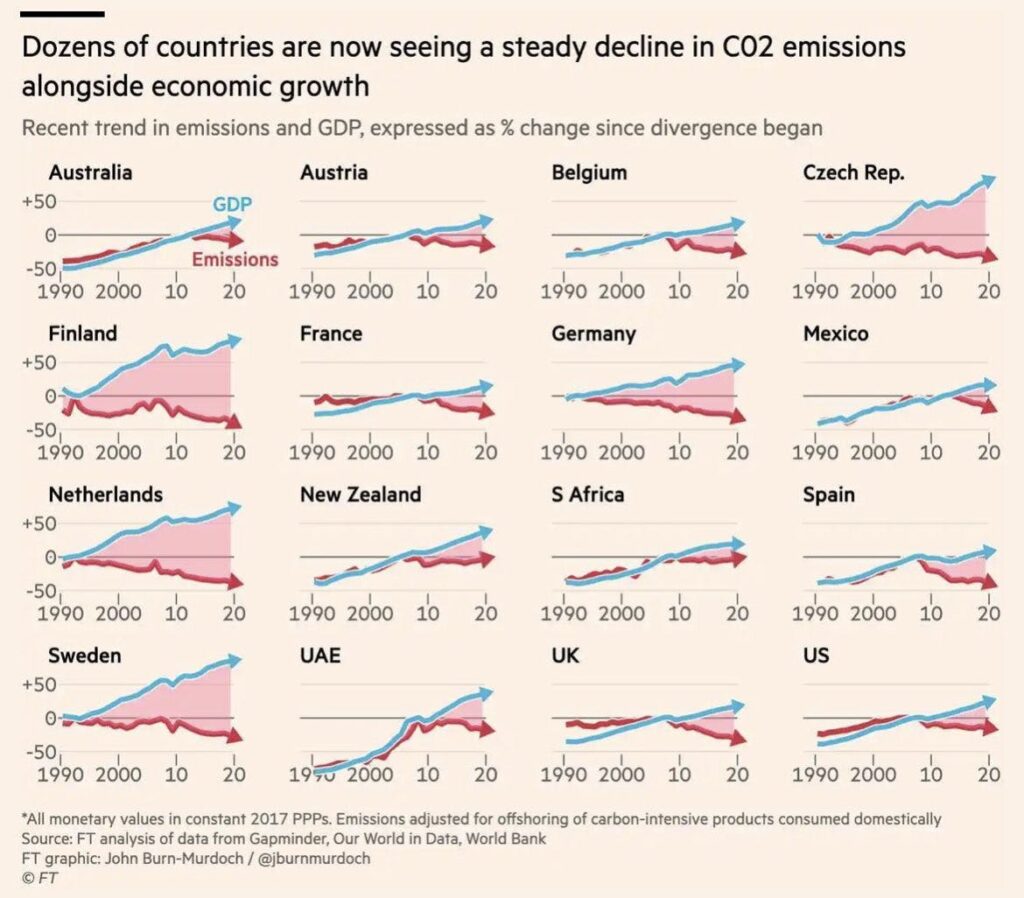

Whelp, we have some bad news and good news. The bad news is that 2022 was the worst year ever for CO2 emissions. Hooray!

But the silver lining is that humanity is finally moving in the right direction on climate change.

We’re now getting many things right:

For example:

- The world’s car fleet is officially electrifying, especially in the US. Tesla is no longer the only game in town, and this year American EV owners will finally receive a $7,500 tax credit — which will further accelerate adoption.

- “Poor countries” will now be compensated for environmental harm caused by emissions from wealthy nations.

- Finally, and amazingly, renewable energy is expected to become the world’s largest source of electricity by 2025. Huge.

It’s refreshing to see wealthy countries finally learn how to decouple carbon emissions from economic growth. This is especially significant for nations like Australia and New Zealand that historically have relied on coal.

The problem, of course, is that all of this is still ~30 years overdue. The climate will continue to warm, and that warming will continue to affect us.

How does climate change affect the wine industry?

Europe is wine’s most important continent. Most of the world’s wines come from Europe, and just 3 countries account for over half of all wine production: France, Italy and Spain.

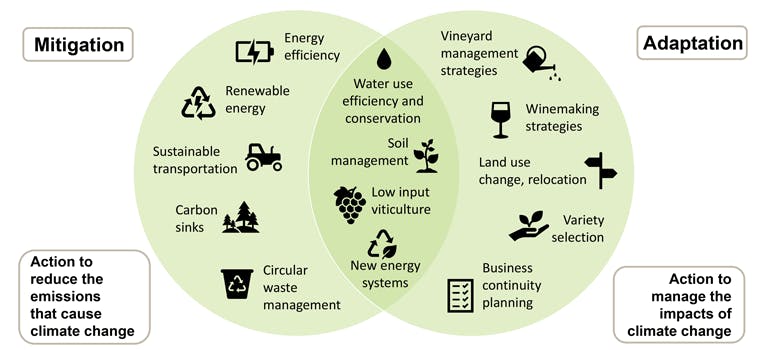

Global warming will eventually require pretty much every industry in the world to change the way they produce goods. But this is especially true for industries that rely on the climate to survive, like wine.

It’s is one of the biggest topics in the industry today. From changing viticultural practices to be more sustainable, to developing more weather-resistant grapes in the lab, millions of dollars are spent each year to adjust to impending climate change.

– Anthony Zhang, Vinovest CEO

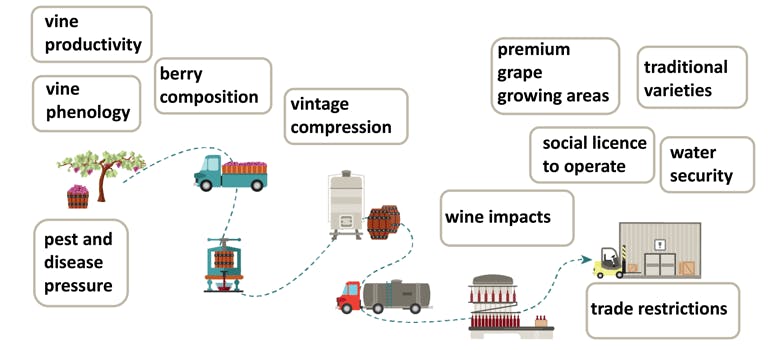

Wine is delicate. It’s fickle. And it’s susceptible to even minor variations in climate. The taste and efficiency of wine production are affected by:

- Soil

- Sunlight

- Latitude

- Altitude (how high above sea level grapevines are)

- Direction (where they’re facing)

But the biggest factor of all is temperature.

A temperature change of just one degree can totally mess with grapes. It can change the growth cycle of grapes, and change the taste entirely.

Higher temperatures also mean more pests.

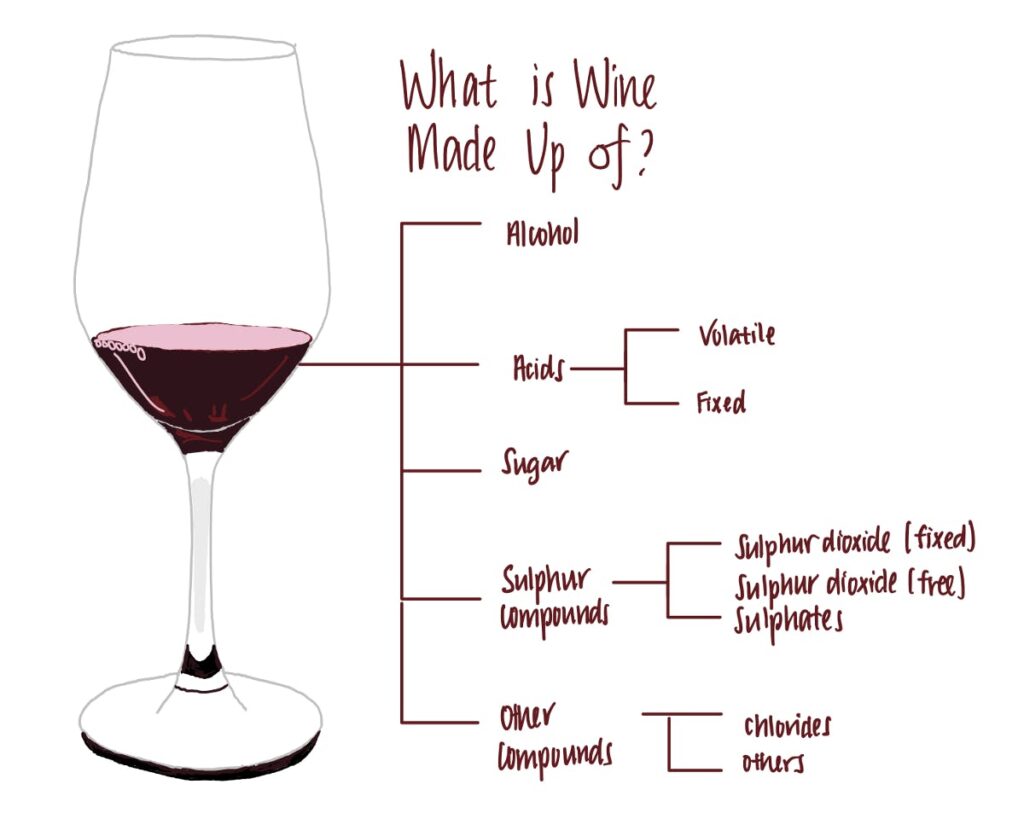

And there’s more. A warming climate literally alters the underlying chemistry of grapes:

- When it’s hotter, berries ripen faster. This results in the release of more sugar and higher alcohol content in your wine. (Not necessarily a bad thing tbh)

- Acidity is a huge factor in flavor. When it’s too hot, the berries’ higher sugar content reduces acidity, and thus “tang”. It means flatter, duller wines. It means that delicate balance of sweetness and tang is harder to get.

- Other chemicals like tannins (which you’ve probably heard of) and anthocyanins (which you probably haven’t) are responsible for depth of flavor. They may break down (or not develop at all), making the taste simpler and shallower.

The impact on wineries

Climate change is already affecting how wineries operate. Growing conditions have become increasingly unpredictable. Harvests are smaller and happening earlier, placing extra pressure on the wineries’ resources.

This has forced wineries to adapt:

- Bordeaux is toying with new experimental plantings

- Champagne wineries are buying land and planting vines in England

- Merlot is being abandoned in many areas and replanted with later-ripening Cabernet Franc

- Barolo and Barbaresco producers in southern Piedmont are buying land and estates in Alto Piemonte, which is further north, more elevated and wooded

- Cava producers in Catalunya planting in much higher areas west of Barcelona

- Producers in the Veneto are moving away from Burgundian-style trellises to traditional pergola methods which provide more shade and elevation

- Domaines in Burgundy are buying land in the Haut Côtes, where land is cheaper, cooler, and at a higher elevation

It’s amazing, but true: Some wineries are just straight-up moving their crops to higher altitudes. But higher altitudes come with their own problems. Water is much harder to come by, the wineries are more difficult to manage, and soil quality is often worse.

Australian producers Brown Brothers were early to the game. A decade ago they shifted their main vineyards to the island of Tasmania — the coldest part of the country which is less susceptible to bushfires. It’s a much better place for extra-delicate grapes like pinot noir.

The International Wineries For Climate Action (or IWCAWINE — a truly horrible acronym) is committed to committing emissions across the wine industry, through direct solutions that avoid purchasing carbon offset credits.

The prices wine drinkers pay

Climate change doesn’t just change the taste of wine – it increases the cost.

Improving infrastructure, dealing with pests, and relocating to higher ground can all be extremely costly. And these production costs are already being passed onto us.

Shorter harvesting periods are another massive problem. The harder a complex flavor profile is to recreate, the more expensive the wine will become.

Wine regions and tourism

Climate change won’t just impact individual wineries; it could hurt tourism for entire regions.

Take 2017 for example. Bordeaux, one of the world’s most popular wine regions, had 40% of its harvest wiped out due to a long-term frost. The economic toll was estimated at $1.7b (enough to buy the Charlotte Hornets from Michael Jordan.)

Warmer winters lead to weaker dormancy of vines, meaning they begin growing earlier and are more susceptible to frost.

Which wine regions are most at risk?

Anthony Zhang from Vinovest suggests that 3 regions are likely to suffer the most over the next 50 years:

- Champagne, France

- Napa Valley, California

- Burgundy, France

Aside from great wines, each of these regions are renowned for their tourism. Napa Valley gets 4m visitors per year, while France is the most visited country on earth, getting 90m tourists per year, a slew of which are thirsty wine tourists.

Champagne

Remember we talked about acidity? Champagne is a region that relies heavily on it. It’s what gives champagne its “kick.” And as we know, acidity becomes far less prevalent during periods of heat and earlier harvests.

Over the past decade, Champagne’s temperature has risen by 1.2 degrees celcius and its harvest has had to be brought forward by two weeks.

California

California is one of the world’s most-impacted regions. Dry spells are increasingly common, and the state has been in the midst of a three-year spell which is the driest since the 1800s.

My old hometown of Santa Barbara will also be affected. Home to some of the most forward-thinking deluxe wineries on the planet, and the setting for the epic road trip film Sideways, Santa Barbara (and more specifically the Santa Ynez valley) will inherit longer heatwaves, less rain, and a climate more similar to inland Glendale or Baja California.

Australia

Here on the other side of the planet, we’re at the tail end of a roughly three-year La Niña cycle. This year has been cooler and wetter than average, but the pendulum is set to swing back, and Australia’s already dangerous bushfire seasons have increased by a month.

In addition to killing an astounding 3 billion animals (many of them cute & fuzzy), Australia’s 2019 bushfires burned down vineyards . But the bigger problem is actually something called smoke taint, where grapes absorb all the smoke, taste like 💩, and can’t even be used).

Other similarly arid, wine-producing regions expected to feel the pinch are:

- Portugal and Spain

- Greece and Italy (especially southern Italy)

- Parts of South Africa that are far from the coast and don’t have higher elevation options will suffer.

- The Riverland regions of South Australia (which relies on river water for irrigation)

- The California central valley which feeds 25% of the US and relies on snowmelt for irrigation

Where will new opportunities be created?

Every crisis presents an opportunity (lame phrase, but true). The shifting global climate is unlocking new possibilities for old and new producers.

Experts estimate that 80% of the world’s wineries are located on just 1% of available grapevine-friendly land.

While most already-established wine regions don’t really stand to benefit from global warming, new wineries are now able to buy cheap land in places they would’ve otherwise ignored.

Scandinavia is one of those places. The region’s typically cold climate is starting to warm up (Sweden’s summers last a whole month longer) making it a viable place for growing wine.

A few Bordeaux wineries are also snapping up land in Norway to try their luck in the nation’s cooler environment. And over in Denmark, wineries in Jutland are prominent on the international scene, and are even winning awards.

Regions that have been on the fringes of producing wine will likely continue their development in the industry – think places like Canada and China. Others that are traditionally “frosted out” from wine-making (Japan, England, and Belgium) are also starting to successfully dip their toes into production.

Other regions that already have cool climates and will likely benefit include:

- England & Germany

- Oregon, Washington & Canada

- Parts of Eastern Europe

- The Finger Lakes in New York state

- Tasmania, Australia

There are even rumblings of new regions being created in mountainous areas not currently associated with wine; like Mexico, Turkey, and even the Alps.

What should wine investors do?

Investors may be interested in buying vintages from emerging wine markets like Scandanavia and Japan. But remember, their wine industries haven’t been around for long, so vintages aren’t worth much — at least not yet.

In the meantime, they’re certainly price competitive. Japan’s award-winning 2017 Cab Sauv-Merlot from Takahata Winery is only about $50 right now. This isn’t a short-term flipping opportunity, though. Consider buying for the long-term.

For traditional vintage wine producers, expect supply to decrease significantly as big regions like Bordeaux and Champagne continue to struggle with supply and production issues. Investors are turning to vintages on the secondary market; accumulating older wines while hoarding the newer stock.

Supply of your favorite wines from your favorite regions is certainly expected to decrease. Wineries and collectors are holding back newer stock, storing them, and buying up vintages that are older and on the secondary market. – Anthony Zhang, Vinovest CEO

Justin from Oeno recommends the following:

Keep an eye on classic regions with potential to mitigate climate change — places where elevation can be improved. This includes Burgundy, Piedmont, parts of Tuscany, the Mosel in Germany, northern California, and Tasmania. Keep an eye on top producers moving into other regions completely.

– Justin Knock, Master of Wine at Oeno

What about spirits?

Spirits don’t have the same historical prestige as fine wine, but the spirits market is growing. And while spirits aren’t as susceptible to the environment as wine, climate change still leaves its mark.

Whiskey

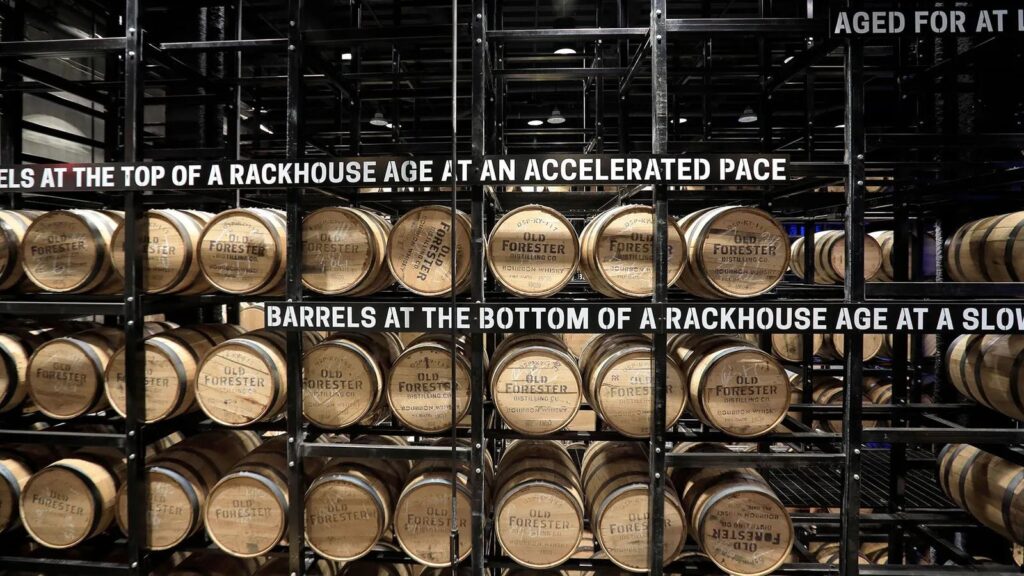

Whiskey is barrel-aged, and rising temperatures influence how the alcohol interacts with the wood — often changing its flavor.

Temperature is also linked to the speed at whiskey ages. Specifically, producers measure this through something known as “angel’s share”. Angel’s share is the amount of whiskey lost to evaporation during the aging process.

In hotter climates, more water than whiskey evaporates, meaning higher alcohol content. These distillers can only age whiskey for a couple of years before it’s ready.

However, in cooler places like Scotland, the aging process can last decades.

As we know, older whiskey is worth more than whiskey aged for just a few years. So if global warming keeps increasing temperatures, the aging process could be cut short, creating upward price pressure on whiskies that are already aged 15+ years.

Tequila

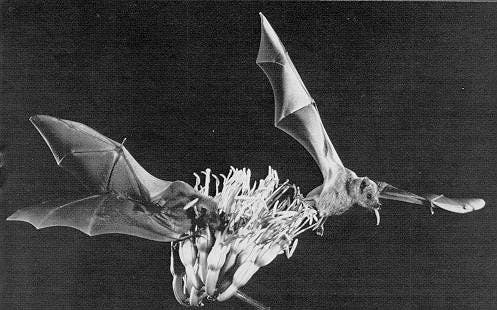

Tequila comes from Blue Agave, a plant that’s used to the hot and dry Mexican conditions. But it’s not the plant itself that’s feeling the pinch of climate change, but rather, its pollinator — The Mexican long-nosed bat.

These bats are endangered as a result of global warming and human disturbance. Without their pollination, agave can’t be refined into alcohol as effectively. And some research suggests the habitat overlap of these two species (agave plants and bats) will drop by 75%!

Gin

Gin typically uses juniper berries and fermented wheat to form the base of a classic G&T. But what if it used fermented peas instead?

This may sound odd, but it turns out that using peas doesn’t actually affect gin’s flavor all that much…

Some environmentally-conscious distillers are starting to use this tactic. Each liter of gin produced with peas can save 2.2kg of carbon emissions. And it’s not too expensive either. The first bottle produced, Nadar Climate Positive Gin, retails for about $52.

Closing thoughts

Justin Knock from Oeno puts it best:

Climate change is the single most important issue in wine production this century. The industry has been acutely aware of climate change for the past two decades, and it’s one of the leading topics of conversation with wine producers at every level.

– Justin Knock, Oeno

Over the next 20-30 years, the world’s most important wine regions will face significant challenges in maintaining the styles and quality they’ve become famous for.

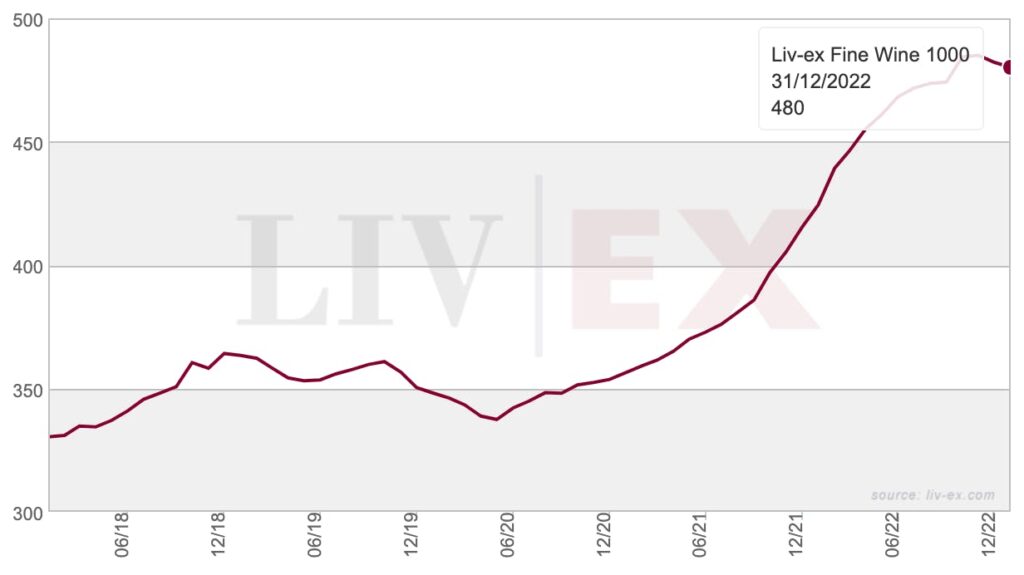

So what does this mean for wine investing? Look, wine is already one of the best alternative asset classes out there, thanks to growing demand and natural scarcity. And this scarcity is about to go into overdrive.

Droughts are becoming deeper and more prolonged. Warm winters are less effective at killing off diseases, so disease pressure can be much higher during the following growing season. Sugar ripeness will happen ahead of phenological maturity, so wines can be less well-balanced. And worst of all, the grapes can flat-out ripen during the hottest parts of summer rather than during the milder temperatures of Autumn.

Wine is delicate as hell, and this is all a very big deal.

But it’s not all bad news.

There will be some pain, but the industry will adapt. New wine markets are already beginning to emerge from regions dismissed by critics and ignored by everyone. England, Sweden, Denmark, and Japan, just to name a few. These places are now officially “on the map.”

And wineries are improving their infrastructure & efficiency around the world, and it’s possible the rising costs will be temporary. Some short-term pain on the costs of your favorite wine is worth the long-term gain.

Meanwhile, supply issues are still running hot, and past vintages are roaring back into vogue. Right now seems like a very good time for long-term wine investors to get ahead of the curve and stock up.

Wine has been at the mercy of a changing environment since well before global warming. But crisis breeds innovation.

Just like climate change is rushing in the electric car era, this short-term pain will force humanity to find new ways to improve production, remove unpredictability, and mitigate global warming’s impact; all of which are good things regardless.

Disclosures

- Our ALTS 1 Fund has a 15.43% allocation to fine wine and whiskey through Vinovest

- Stefan has a small personal holding of Bordeaux wine through Vinovest

- This issue contains affiliate links. This means we may collect a share of sales or other compensation if you purchase something via these links.