Today, you’re getting a special dispatch from Altea, our private investing community.

We’ve got three investment ideas for you to digest.

Fifty 200L barrels of 100% Agave tequila

Karuizawa 2024 230L cask

Drink up.

Table of Contents

Aging Tequila Barrel investment opportunity

Deal Basics

Fifty 200L barrels of 100% Agave tequila

- Investment size: $260k ($10k minimum)

- Hold period: 3 – 5 years

- Potential IRR: 35% to 40%

- Fees: 2% management | 20% carry | nominal one-time subscription TBC

- Via: Altea

Fill out a quick expression of interest here. For accredited investors only.

Deal Overview

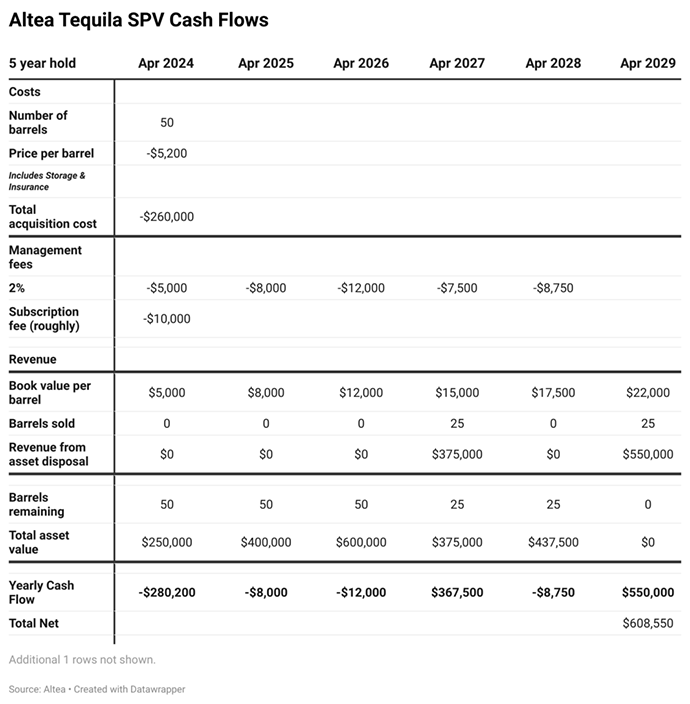

Altea will acquire 50 barrels of 100% agave tequila through this SPV to buy and hold for at least 3 years as the spirits age.

The barrels will be acquired, stored, and disposed of through our network of tequila brokers, private collectors, and exclusive brands in Jalisco, Mexico, over the course of 3 to 5 years.

What’s the opportunity

The first thing you need to know about the tequila industry is that it’s massive. Well over $10 billion a year and growing.

The second is that there are four main types of tequila:

- Blanco (Silver or Plata) Tequila: Unaged or aged for up to two months, it is the purest expression of agave flavor.

- Reposado Tequila: Aged in oak barrels for two months to one year, it has a light golden hue and a smoother taste with a subtle oak influence.

- Añejo Tequila: Aged for at least one year but less than three years in small oak barrels, it has a darker color, smoother taste, and more complex aroma than Blanco and Reposado tequilas.

- Extra Añejo Tequila: Aged for a minimum of three years in oak barrels, it is the smoothest and most complex tequila expression, with a richer flavor and aroma. The oldest we have seen for sale is 15 years old and Compares in complexity to a 40 year old whiskey.

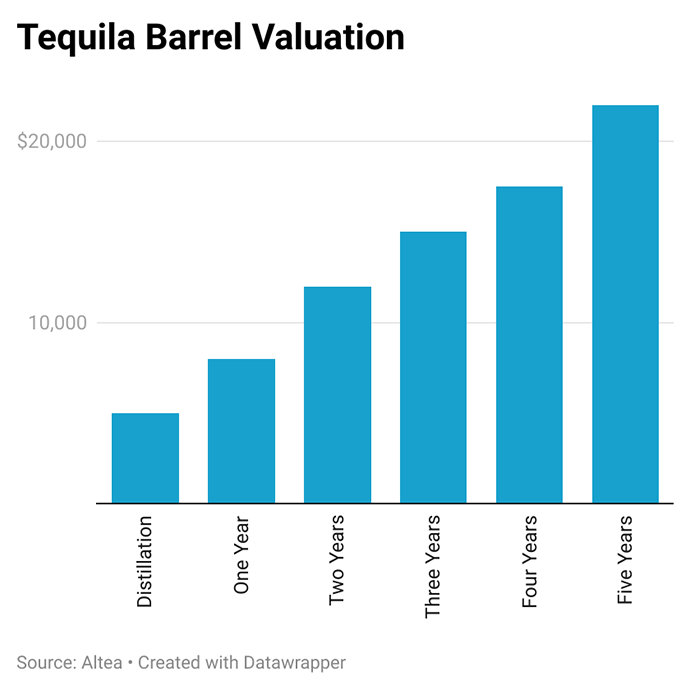

From an investment point of view, age is what we’re looking at because it makes a big difference to price.

The value of tequila grows significantly from Blanco–what the spirit is called straight out of the distillation process–through extra añejo, the most valuable and prized version of the spirit.

The prices above are in Mexican pesos (around 15 to the USD), but the math is the same.

The price increases 63% from plata to Añejo in one year and nearly doubles again over the next two years.

So the appreciation profile of tequila looks something like over five years.

Aging tequila does cost money, but those costs aren’t enough to justify the increased price. The oak barrel is anywhere from $500 to $3000; you also need a warehouse (cheap) and insurance (even cheaper).

It’s all down to cash flow.

Even though the tequila industry is worth more than $10 billion annually, most distillers live year to year.

They can’t afford to let their tequila age because they need the pesos today.

Deal Economics

The tequila market is fluid but reasonably consistent. We have a well-thought-out strategy but will maintain flexibility as and when market forces require. This way, we can time the market and be opportunistic as the best offers for the liquid arise.

The initial plan is to hold half the barrels for 3 years, after which we will sell 25 barrels at a minimum.

That will return your investment if all goes well.

Based on prevailing market conditions, we will then decide whether to (a) sell the other 25 as well, completing the transaction and returning capital, or hold the barrels for two more years.

Currently, aging tequila for more than 5 years delivers diminished marginal returns, but if that changes in the next 5 years, we will adjust strategy accordingly.

About the Tequila

The Tequila will be sourced from NOM 1109 distillery, renowned for its quality and history, ensuring a premium product that appeals to both consumers and investors.

The Orendain family has owned NOM 1109 for five generations (125 years), and it is one of the world’s most well-respected family-owned Tequila makers.

We chose this distillery because it produces a spirit without additives or compromises, which is a step up from the more common industrial-made 100% agave tequila options available on the market.

This means that tequila tastes better. But it also gives us the most exit opportunities when we divest the portfolio because the spirit can be used for a wide variety of applications, including wholesale sales, a special edition launch, or a new brand.

How to Invest

Fill out a quick expression of interest here. For accredited investors only.

Karuizawa 2024 Cask

Deal Basics

- Volume: 230 litres

- Cask Type: Sherry Oloroso Hogshead

- Bottles: ~ 329

- ABV: 63.5%

- Price: $90,000 (includes storage and insurance)

- Hold period: 10 years +

- IRR: 22% to 27%

- Fees: None

- Via: Braeburn

You can contact Braeburn directly to book a call or hit reply for a warm intro.

Deal Overview

This is an opportunity to purchase a 230-litre cask of Karuizawa whisky. At maturity, this should yield around 329 750ml bottles.

Only 250 casks are produced annually, and getting your hands on one is exceedingly rare.

About the Karuizawa distillery:

- One of the most cult brands among Japanese whiskies, it closed in 2001. Over the past few years, a major revitalization has been underway in Karuizawa, and now, the Karuizawa Distillery is back and producing single malt whisky again

- Famed for its intense, sherry cask matured drams, its popularity has grown rapidly in recent years.

- In 2001, the Karuizawa Distillery began winning international awards and has since become one of, if not the, most collectible and investable whiskies worldwide.

Learn a bit more about the Karuizawa distillery’s philosophy:

It’s a special place, for sure.

The investment opportunity

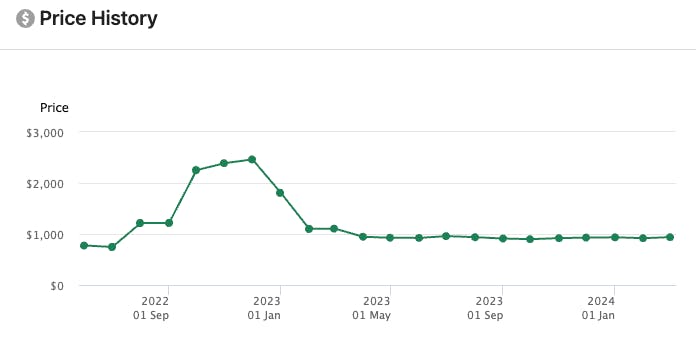

Full casks of Karuizawa whisky rarely come to public auction, so the best way to value them is by the sale price of actual bottles. Even those are fairly infrequent, but ten-year-old bottles sell for around $1,200, and 12-year-olds go for perhaps $1,500.

So 329 bottles of ten-year-old Karuizawa whisky would be worth around $400,000 today.

That’s roughly 16% IRR.

But what about appreciation, if any?

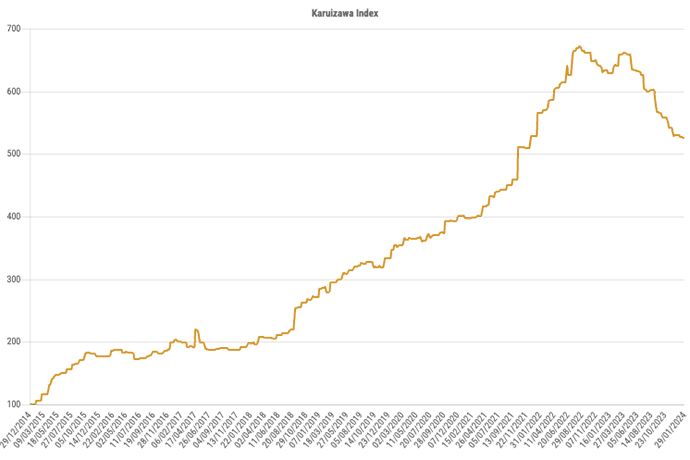

Like all whiskies, Karuizawa has had a rough couple of years, but the rate of decline seems to be slowing. I don’t expect the meteoric appreciation we saw during COVID-19 to happen again.

The aggregate IRR over the last ten years is 19%, including the recent decline.

Let’s chop that in half to assume a 9.5% annual appreciation rate for the next decade.

Annual 9.5% appreciation of Karuizawa whisky plus 16% appreciation from cask aging = $2.3m after ten years

Cask appreciation:

16% –> $90k to $400k

Market appreciation:

9.5% –> $400k to $1m

That yields an IRR of around 27%

The cask appreciation rate is pretty solid. This is typical for aging whisky casks and is more a function of trade finance laws than anything else. The rate may increase or decrease based on interest rates, overall demand for aged whisky, and so forth, but I think a 12% to 20% range is pretty safe.

The bigger variable is the Karuizawa brand itself. Whisky had an incredible couple of years and has returned to earth.

Zoom in on the last quarter of the Karuizawa index above, which looks to have stabilized. The price history of individual bottles tells a similar story.

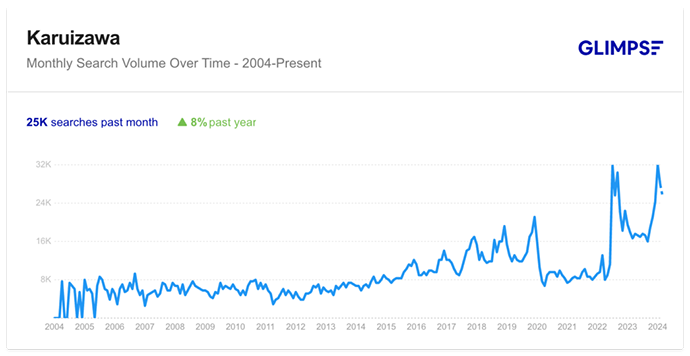

Likewise, search volume for the region continues to climb. Not all of this will be whisky-related, but much of it will.

Bringing the annual Karuizawa appreciation down to 5% gives a 22% IRR, which is still not bad.

How to Invest

You can contact Braeburn directly to book a call or hit reply for a warm intro.

La Leyenda Mezcal Equity

Deal Basics

- Valuation: $5m Cap

- Type: SAFE Note

- Spaces available: 3

- Investment size: $50k

- Via: La Leyenda Mezcal

If you’d like to invest, hit the reply button, and we’ll put you in touch directly with the founders.

Deal Overview

La Leyenda has opened twenty spaces in their round to investors, and they’ve kindly allocated three to Alts members.

The catch: they’re looking for strategic partners who can bring value to the brand besides cash.

There are some perks as well:

- Visit the agave farm

- Access to limited edition products for life

If you’re interested in investing, they’ll also send out a sipping kit to try while you listen to their presentation.

The investment opportunity

The best way to get a feel for the brand and opportunity is to review their deck. They’ll tell the story way better than I will.

How to Invest

If you’d like to invest, hit the reply button, and we’ll put you in touch directly with the founders.