Today, we’re digging into Mezcal, one of our favorite alternative investments. We’ll explore the state of the market, recent trends, and the latest innovations.

This issue is timely: One month from today, we’re traveling to the heart of Mexico for our first investor field trip. (If you’d like to join, we may have a spot left!)

Note: This issue is free for everyone. Enjoy 🥃

Table of Contents

A note on House of Rare

To make a real return in tequila investing, you’ve gotta have connections, and you can’t pay retail.

That’s where House of Rare comes in. Miguel Ortiz and his team operate a tequila cellar 12 feet underground in Tequila, Mexico, where they age their ultra-premium tequila for 3+ years.

In 2022, we purchased six barrels of tequila through House of Rare, and one of the reasons we chose them is because they solve the storage issue.

You invest in the barrels, in return they store and age them on your behalf. After 3 years, they’ll propose an exit strategy (export the barrels, sell them back to producers, or bottle them into tequila) and return the profits back to you.

House of Rare currently has two live opportunities:

- Retail: You can acquire a barrel from their latest Tequila and Mezcal collection, aged in PX ex-sherry casks. These are among the most sought-after woods for aging. Download the One-Pager.

- Institutional: They offer a diversified Tequila and Whisky barrel portfolio under a Reg D offering. (This is being added to our live deals on Altea)

Interesting in investing in tequila barrels?

Reply to this email for a personal introduction, or email [email protected].

Tell Miguel we sent you! Alts readers get a $500 discount on the PX collection.

Mezcal vs Tequila

Before we start, a quick refresher on the difference between mezcal and tequila:

- Mezcal is the umbrella term for the entire agave liquor category. Mezcal is made from agave, but doesn’t have to be blue agave.

- Tequila is a very special type of mezcal. It can only be made from blue agave (agave azul), and must come from one of five specific regions — mainly from the state of Jalisco, where we are going next month.

It’s like how champagne is a special type of sparkling wine, and bourbon is a special type of whiskey.

State of the markets

It’s no secret that we think tequila could be the next whiskey, or that we’ve invested in six barrels through ALTS 1.

Let’s check in on the markets.

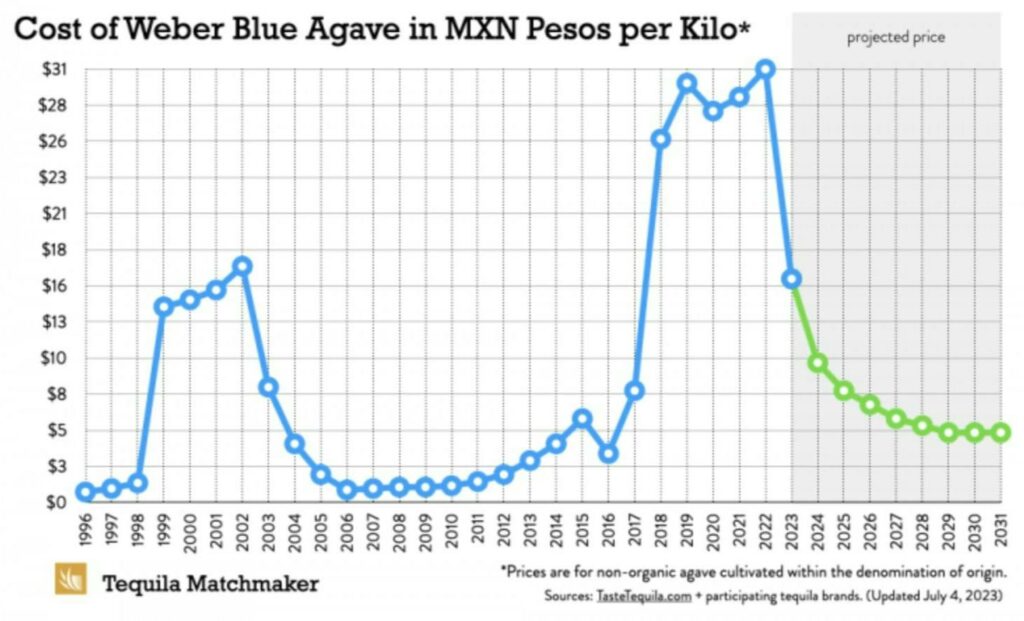

Agave is smack in the middle of a slowdown cycle

It all starts with agave.

For a tequila distillery, the cost of agave may range from 40% to 60% of direct production costs. This percentage can be higher during agave shortages, or lower if other costs (like aging or marketing) are significantly high. So the price of agave is everything.

But here’s the thing: Agave doesn’t behave like other commodities.

It has some unique characteristics which set it apart:

- Long growth cycle: Agave plants take 7 to 10 years to mature. This is much longer than commodities like wheat and corn, which are planted and harvested within the same year. (Agave is closer to something like Christmas Trees.)

- Limited shelf life: Once harvested, agave has a limited shelf life. We’re talking a few weeks, max. This contrasts with commodities like grain, which can be stored in silos for extended periods.

- Supply & demand is tricky: The long cycle makes predicting supply and demand challenging, and leads to big price fluctuations. If there’s a sudden increase in demand for tequila (like we have now), producers can’t just quickly ramp up supply. Conversely, if there’s an overproduction of agave, the market can be oversupplied for years.

When agave prices increase, farmers plant more. But when prices decrease, they often shift to more profitable crops.

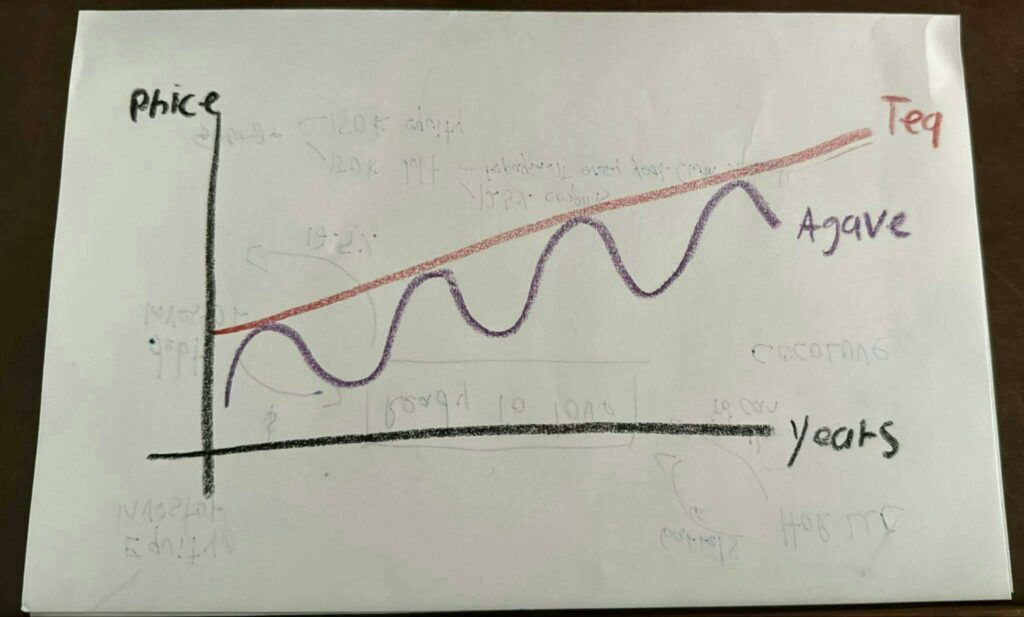

It’s all part of a slow, long-term cyclical dance:

Today, if a farmer has oversupply, he’ll sell for as low as 10 pesos/kilo. But if he has high-quality agave (with a high juice yield), he’ll sell it for 25 pesos/kilo. That’s a huge difference.

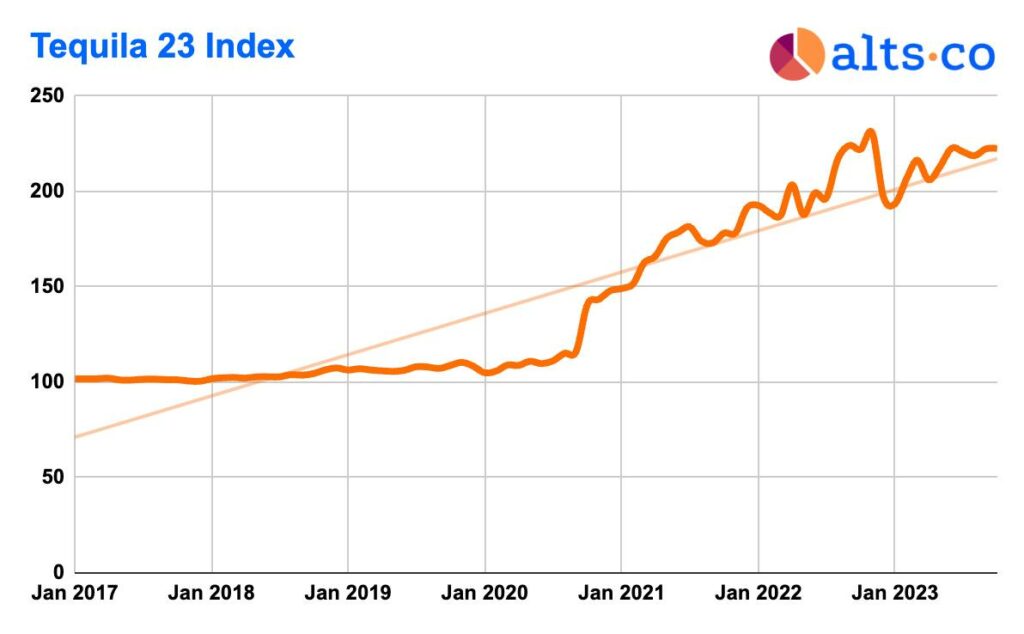

Tequila prices are unaffected

But notably, this slowdown hasn’t impacted tequila prices!

In fact, falling agave prices have allowed tequila makers to realize higher profits compared to a few years ago when the plant was more expensive.

Tequila prices are not expected to come down even as agave continues to go down. Instead, profit margins go up.

A few years ago (when agave prices were high)…

- Farmers were paying 31 pesos per kilo, or $1.80/kilo

- A liter of tequila requires around 8 kilos of agave

- So, each liter of tequila costs $14 – $15

- Quality tequila was wholesaling for $18 – $20/liter

- After accounting for production costs, their margins were almost zero!

But today…

- The current price per kilo of quality blue agave is about 16 pesos, or $0.94/kilo

- So, each liter of tequila now costs just $7.50

- But wholesale price is still $18 – $20/liter

- So now that agave is cheap again, margins are back up.

Basically, even though their costs have decreased, producers don’t charge less per bottle. They don’t pass savings on to consumers.

For producers, now is the time to start saving for when the price of agave inevitably goes back up.

And round and round we go.

Mezcal

Prices for mezcal are on the rise, and there’s a growing trend for new, more exotic, wild agaves.

This has led to the production of “limited run” mezcals using agave that may be over 20 years old (and difficult to source in the future.)

Coupled with the surging global demand, this has significantly increased bottle prices.

Recent trends & innovation

The ‘Premiumization’ of tequila

Over the past 30 years, you may have noticed that wine has gone upmarket, as drinkers have sought higher-quality wines.

But unlike wine (where the difference in taste between expensive and inexpensive stuff isn’t always noticeable) the difference between good and bad tequila is enormous.

This trend towards premiumization reflects a broader shift in consumer tastes. People have shown they’re willing to invest more in tequilas that offer higher quality, superior taste, and artisanal craftsmanship.

Traditional production methods

In addition to cooking in brick ovens and using copper stills, the tahona method is a traditional way of making tequila, where the agave piñas are crushed with a large stone wheel.

Small batches

Smaller batch runs are also sought-after, because there’s more attention to detail and a lesser chance of the flavor being compromised.

The premiumization trend could absolutely affect the biggest tequila producers, like Becle (Cuervo) Diageo (Don Julio) and Bacardi (Patrón).

The world’s tequila powerhouses will need to adapt to these changing trends, or acquire smaller, innovative premium brands.

This is exactly what happened with the craft beer market.

Sustainability and eco-friendly practices

There has been a notable shift towards more sustainable and environmentally friendly production methods, including:

- Water conservation techniques

- Energy-efficient distillation processes

- Initiatives for the replanting of agave plants

Going organic and/or preservative-free is a growing wine trend. Will we see the same thing happen with Tequila?

Well, some producers are exploring organic certification (which I am still skeptical about). But regardless, there has been a notable shift towards more sustainable and environmentally friendly production methods.

– Miguel Ortiz, founder of House of Rare

Cascahuin’s director notes:

We don’t use artificial colors or flavorings, but instead focus on highlighting the natural flavors and aromas of the agave.

– Salvador Rosales Trejo, director of Tequila Cascahuin

Taste Tequila has a list of confirmed additive-free tequila brands.

Innovative aging techniques

One of the things we love most about tequila as an alternative asset is that it has the same appreciation properties as wine & whiskey, without the waiting time.

Unlike wine and whiskey, you don’t need to age tequila for very long to bring out the flavor. (Going from reposado to añejo takes just 3 years.)

But there’s increased experimentation with different barrel types to speed up the aging process even more, including the use of various woods and barrels that previously contained other spirits or wines.

House of Rare, for example, is known for using exotic woods and barrels that have previously held red wine or sherry, contributing to unique and sophisticated tequila and mezcal flavor profiles.

And then there’s Creative Oak, a company on the absolute forefront of aging and flavor innovation.

Creative Oak has created “flavor cuts” (my term) — chips of wood that get infused into the tequila to speed up the production.

To be clear, this type of oak chip infusion isn’t new; it’s been used with wine & whiskey for some time.

But it’s not just about speed! Creative Oak has found that variations in heat exposure and barrel charring can significantly alter tequila’s flavor; resulting in more complex and nuanced tastes.

Think of it like a flavor and aroma equalizer. This means tequila makers can easily experiment with different flavor combinations that suit all kinds of tastes and preferences.

Agave diversification

Particularly in mezcal, using different, sometimes wild, agave species has become fashionable.

This not only creates unique flavor profiles but also emphasizes the importance of biodiversity. The use of rare agave species for limited-edition batches is creating a new niche within the market.

Regulatory developments

There are two big regulatory bodies which play a pivotal role in shaping industry standards:

- COMERCAM, which oversees mezcal, and

- The Tequila Regulatory Council (CRT)

These organizations are not only enforcing quality control, but are also increasingly focusing on promoting sustainable practices and protecting the geographic integrity of these spirits.

A big thanks to Miguel Ortiz and Daniel Sada for their help with this issue. We look forward to meeting you in Jalisco!

Disclosures

- This issue was sponsored by CalTier and L5 Automation.

- We hold six tequila barrels through House of Rare in our ALTS 1 Fund.

- House of Rare did not sponsor this issue. However, they are an affiliate. If you purchase a barrel through House of Rare, you save $500, and we get $500. Win-win.

- Creative Oak is not a sponsor or an affiliate.