A few months ago, we took our first trip into the world of debt financing, with a look at The Private Lending Explosion.

We know the idea of lending money can be intimidating. So today we’re going to break down the different categories of private lending, and explain how it all works.

We’ll show you some real-world examples of different companies issuing debt through Percent, and talk about the risks and rewards of each type.

This issue gets a bit deep. But this can be a terrific asset class, so we’ve made it easily digestible for you.

Note: This issue is sponsored by our friends at Percent. As always, we think you’ll find it informative and fair.

Let’s go 👇

Table of Contents

A golden moment for private credit

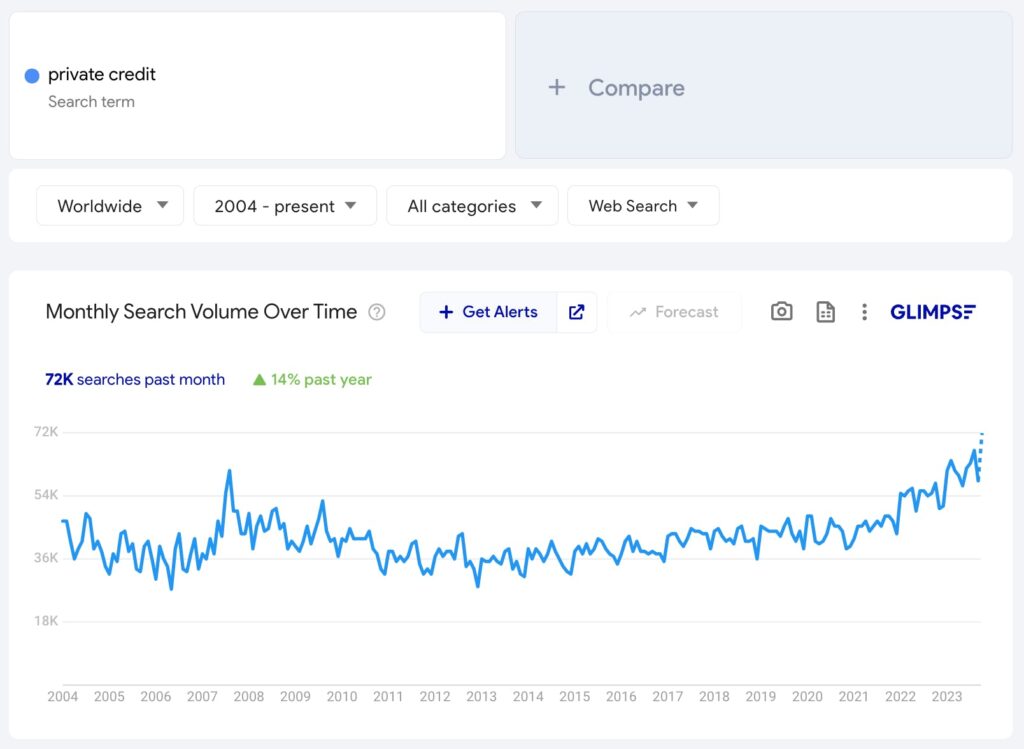

The most interesting thing about the private credit market is what’s happening today.

The market is opening up to ordinary, retail investors for the first time ever. It’s a golden moment.

Percent is today’s sponsor, because they are the only platform exclusively dedicated to private credit. They provide accredited investors access to a wide variety of high-yield, short-duration offerings (9-month average).

These shorter-term investments are more responsive to current market conditions and interest rates. This means you can regularly calibrate your investments to meet your needs.

- Get as much as 20% APY and more (That’s high)

- Investment minimums as low as $500 (That’s low)

- Alts.co readers can earn up to a $500 bonus with their first investment (That’s neat)

Why did private credit get so big?

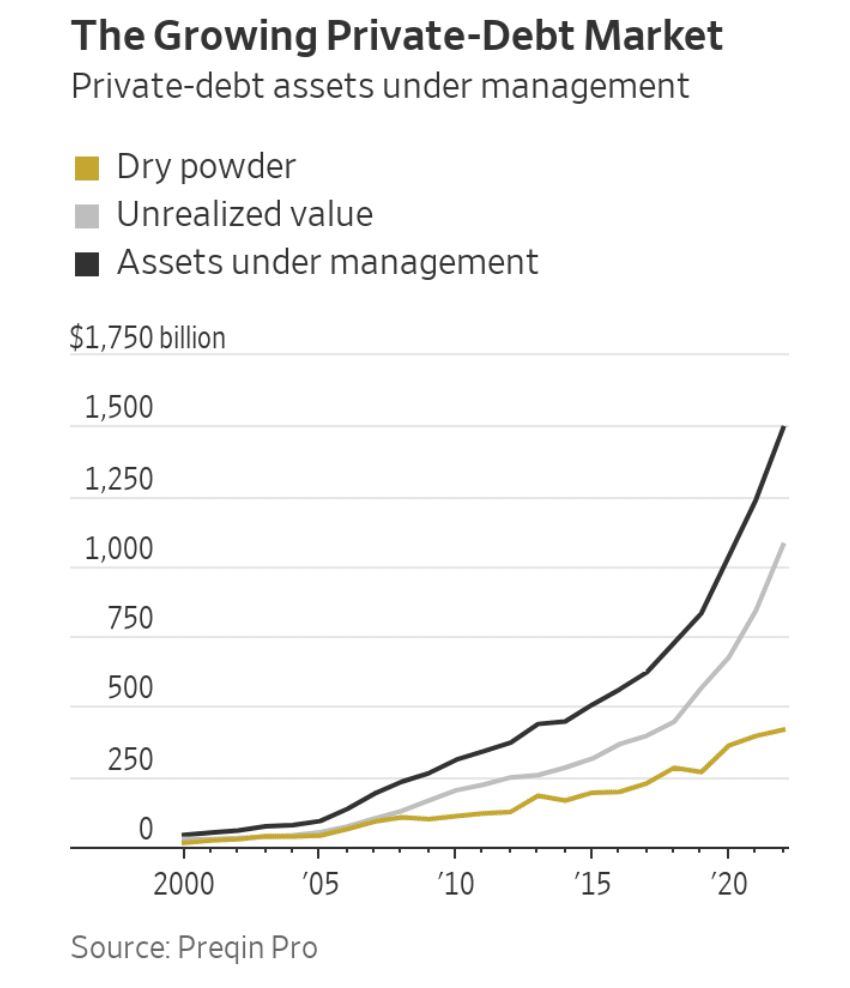

After the Global Financial Crisis of 2008, two big trends took shape in lending markets:

- Interest rates were low, and

- Regulatory scrutiny for banks was high

Basically, banks weren’t lending to companies anymore. They were getting regulated like crazy, and there was no longer any money to be made anyway (since interest rates were low).

But companies still needed alternative sources of financing! The music may slow down, but it never stops. Companies were getting desperate, and they couldn’t turn to banks anymore.

This is what fueled the rise of private credit. Also known as private debt, private lending, or debt financing, it’s all just different terms for the same thing: a market where investors lend money to businesses directly, rather than through banks.

As private credit dealmaking accelerated, the asset class became a $1.5 trillion behemoth. Today it represents about 14% of all US nonfinancial corporate debt.

Lending money to companies sounds compelling, but this asset class is much more nuanced than most investors realize.

The two major ways to group private loans

Over the years, private credit has evolved to meet the financing needs of all sorts of companies. Investors now have a bunch of different ways in which to deploy capital.

It turns out that cutting banks out of the lending process creates tremendous flexibility to negotiate individualized agreements.

Most private credit investments can be assigned to one of two major groups:

- Asset-based loans, and

- Corporate loans

The key differentiator is whether the repayments are from the company as a whole, or specific assets the company holds.

This distinction is important, because it determines the risk analysis.

Different categories have different risks

Think about it like this — a bank doesn’t have different departments for loans that mature in three years instead of five years. But it probably has different departments for mortgage loans and personal loans.

To make a mortgage loan, a bank mostly needs to know the value of a borrower’s home. To make a personal loan, though, a bank needs to know information about a borrower’s income, wealth, and debts. Since the type of risk analysis differs so greatly, the categories differ too.

Similarly, in private credit, asset-based loans and corporate loans are grouped separately, because of the distinct ways of determining their creditworthiness.

Asset-based lending is about understanding the value of the underlying portfolio of assets, while corporate lending requires lenders to understand the health of an entire company.

Asset-based loans

In asset-based lending, loans get repaid from the cash flows from specific assets.

These assets serve as collateral for the loan. If the borrower defaults, the lender can legally seize the assets to recover the value.

While some loans are backed by the performance of one specific asset, it’s more common to see a portfolio of similar assets grouped together.

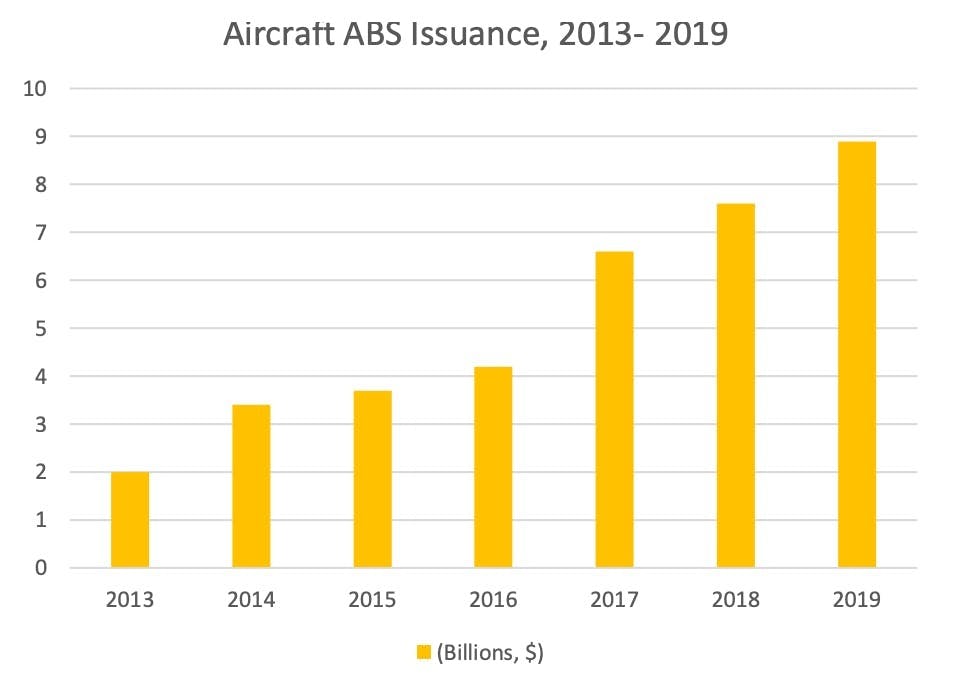

A common misconception from investors is that these assets are always real, material things. Securitizing airplanes, for instance, has recently grown in popularity. And despite what happened in 2008, the market for mortgage-backed securities (which is ultimately secured by actual houses) remains one of the largest in the world.

But in private credit, it’s actually more common for asset-based loans to be secured not by physical things you can touch, but by financial assets.

Asset-based loans are secured by financial assets

Okay, this is where things get a bit confusing.

Private credit asset-based loans are typically secured by a portfolio of other loans.

Here’s how it works:

Essentially, a loan originator extends credit to a bunch of different borrowers, packages those loans together into a portfolio, and then uses that portfolio to secure an asset-based loan.

The loans generate cash flow (in the form of principal and interest payments) which pass through to the investors. If the asset-based loan defaults, the underlying loan portfolio serves as collateral.

Using financial assets to back loans instead of physical assets comes with several advantages:

- Easier valuation. There are standard, well-understood valuation methodologies for loans. This makes them easier to price than physical assets, and means it’s easier for lenders to determine if there’s sufficient collateral to back the loan.

- Better liquidity. If an asset-based loan defaults, it’s quicker and easier to sell a portfolio of loans than to sell a collection of airplanes or houses. (So if things go south, it’s a more efficient recovery process.)

- Greater diversity. Since originators generally have a standardized loan process, they can make a lot of loans. This means a more diversified pool of assets to draw cash flow from, reducing repayment risk.

Of course, not all assets are created equally. As we dig deeper into asset-based loans, we might wonder where the original loans are drawn from. Who are the originators actually lending to?

In practice, asset-based loans fall into two subcategories: those backed by corporate assets and those backed by consumer assets.

Loans backed by corporate assets

In this type of loan, underlying loans are made to other businesses.

These companies are generally smaller, and have trouble getting loans from traditional banks (due to their size)

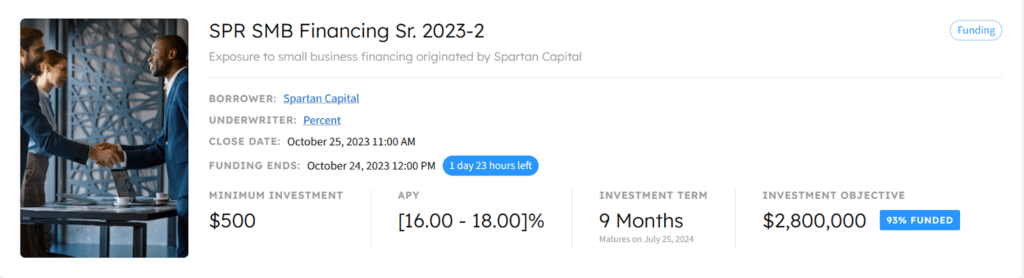

For example, here’s an asset-based loan secured by corporate assets.

As the businesses repay Spartan for the loans, Spartan passes cash flow onto the investors.

Of course, there’s some risk that the underlying loans will default! So as an investor, you need to determine if the 16-18% interest rate compensates you for that risk.

Loans backed by consumer assets

Here, loans are made to people, not other businesses.

These loans are also known as “consumer debt” and come in many forms:

- Personal loans

- Student loans

- Credit cards

- BNLP (Buy Now, Pay Later) loans

- Payday loans

- Consumer litigation finance (Note: we’ll be covering this on Sunday)

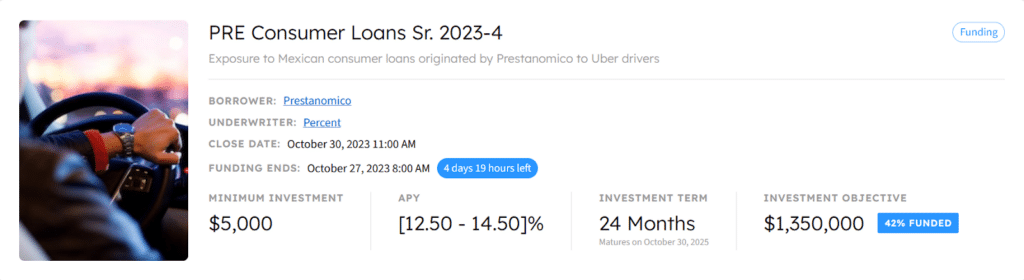

For example, here’s a basket of personal loans made to Uber drivers in Mexico:

Consumer debt tends to be a bit riskier than corporate debt. After all, Uber drivers aren’t “businesses.” You don’t have audited financial statements you can review to see if they’re creditworthy.

And with an average loan amount of $500, making these loans individually wouldn’t really be lucrative for investors.

So this is why the loans are packaged up into a large asset-based loan; so investors like you can get exposure to a unique, high-yield offering you wouldn’t otherwise be able to access.

This stuff seems scary. Layers upon layers of finance, I get it.

But it’s not designed to confuse you — it’s all designed to make things accessible.

Corporate loans

Compared with asset-based loans, corporate loans are easier to understand.

This process is closer to traditional business lending — loans are made directly to a company, which may offer some collateral as security.

Repayment is an obligation of the underlying business as a whole, rather than the performance of specific assets.

This lack of specificity means that investors need to judge companies themselves, in their entirety. But depending on where a business is in its lifecycle, the form of that analysis can differ greatly.

So corporate lending is divided into two subcategories: Mature companies (cash flow lending) and startups (venture lending)

Mature companies (cash flow lending)

Cash-flow lending is loans made to mature companies already generating predictable cash flows.

These loans are usually made to firms with an established business model who need financing to grow.

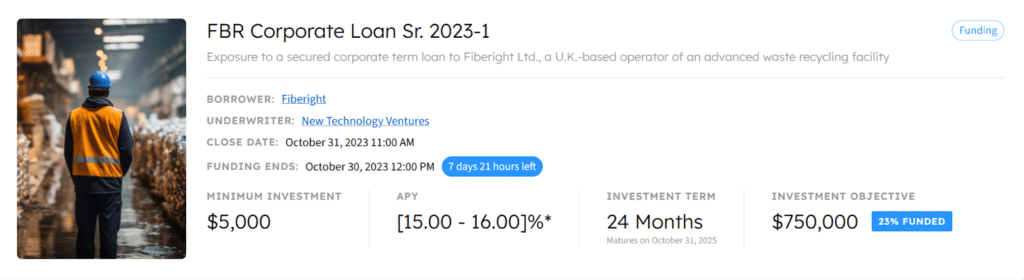

For example, Fiberight is a company that recycles waste. They’re raising capital to fund an expansion of one of their plants. Founded in 2009, the firm has had a few growing pains, but it earned a profit in 2022.

Now, it’s up to you as an investor to decide if new financing can help turn Fiberight’s ability to generate cash flow into sustainable profit.

Startup companies (venture lending)

Startups aren’t commonly associated with the private credit space. Instead, these young firms usually meet their financing needs through venture capital.

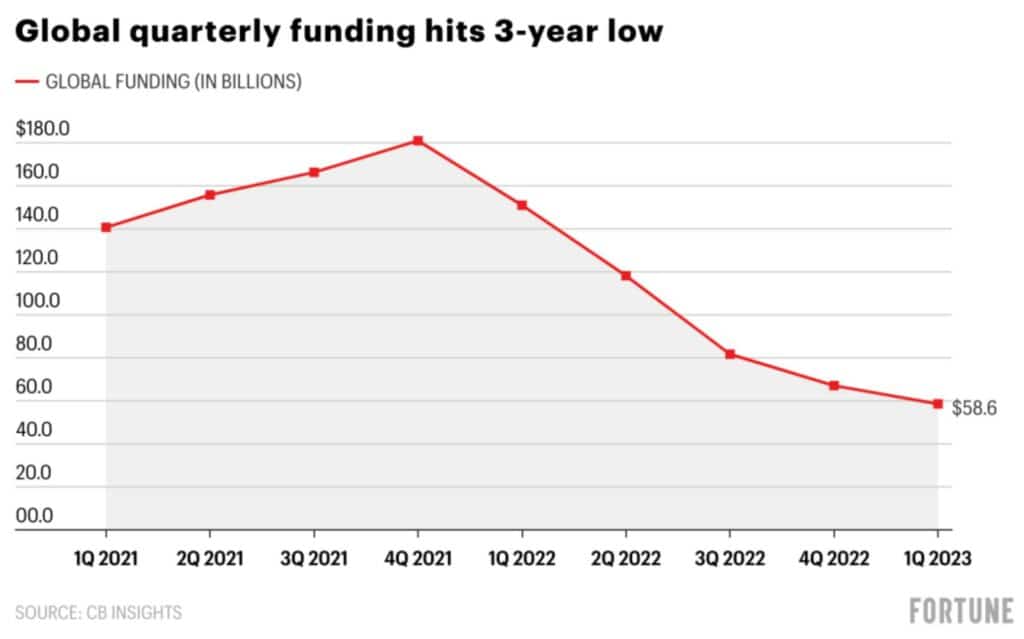

But this is actually changing! Since venture capital funding fell off a cliff starting in 2022 (especially for crypto companies) venture lending (also known as venture debt) has become a compelling alternative.

Private credit can be a good option for startups that need funding between traditional rounds. Raising this money through equity means shares would get diluted (which founders would rather not do).

As such, startups have been increasingly tapping the venture lending space.

Direct lender Owl Rock Capital has seen tech company inquiries about venture debt increase by 5x:

There’s been a very pronounced shift in the last two months. Companies are looking for other alternatives to finance themselves as they prepare to stay private longer than expected. – Pravin Vazirani, co-head of tech investing for Blue Owl

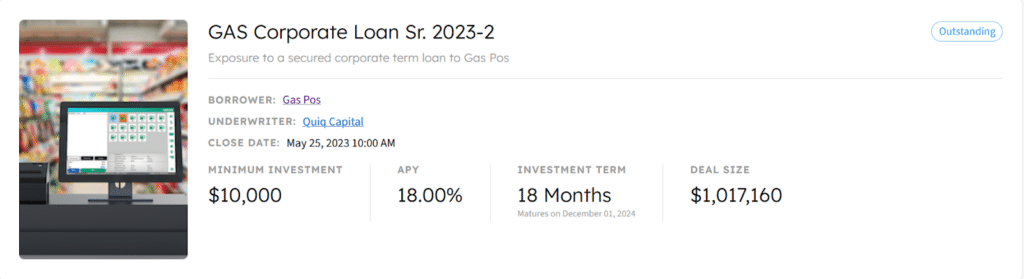

For example, take Gas Pos, a startup that offers point-of-sale technology to gas stations and truck stops across the US.

Earlier this year, Gas Pos raised money to bridge a gap between fundraising rounds.

For average investors, picking and choosing the startups that can repay their debt isn’t the easiest task, which might discourage some from exploring venture lending.

But don’t let this be a dealbreaker. Investors can participate in opportunities through a professional investment manager, and outsource the due diligence.

This is what passive private credit investing is all about.

Passive investing in private credit

Traditionally, private credit has been for active investors, who sourced their own. deals, and did their own due diligence.

Depending on your experience and level of confidence, doing due diligence yourself either sounds highly attractive, or a total headache/barrier to investing.

Active private credit investing certainly has its benefits. Investors can tailor their risk exposure precisely based on their comfort level and don’t have to participate in deals based on the say-so of some investment manager.

But as we saw in the venture lending category, there are valid reasons to leverage the resources and expertise of investment professionals. The introduction of limited partner funds has made that possible in the private credit space, delivering a viable option for investors who prefer passive structures.

What’s a limited partner fund?

In a limited partner fund, investors pool their capital into a fund, where they serve as limited partners (LPs). A professional manager invests those funds, serving as the general partner (GP).

For LPs, this is a completely passive experience. The responsibility for finding attractive opportunities in line with the stated investment strategy is entirely on GPs. Different funds have different distribution strategies, but investors generally receive income at regular intervals.

Investing in private credit as an LP is similar to investing as an individual, but there is one key difference. LP investing turns private credit from a fixed-income investment to a variable-income investment.

- As an individual investor, your returns are dictated by the interest rate on the deals you choose. These deals generally have a set maturity date. This makes returns fixed (unless of course, there is a default)

- But as an LP, your returns are dictated by the income the fund generates from the underlying loans. This income will vary based on the performance of the loans. You can estimate the anticipated return, but it’s no longer fixed.

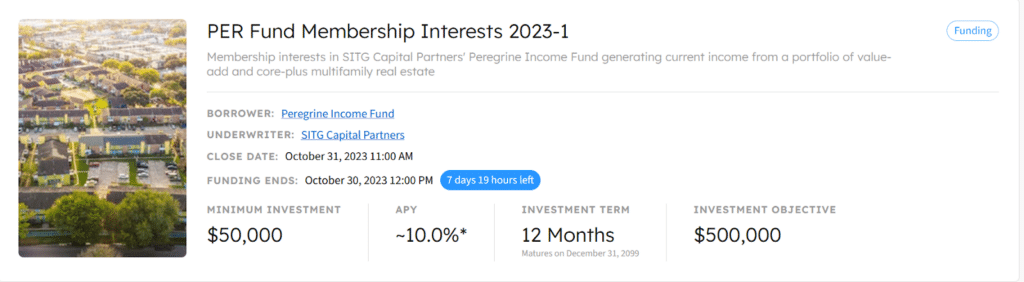

An example of a variable-income investment is the Peregrine Income Fund. It operates in the multifamily real estate space, and has an anticipated APY of 10%.

Another key difference is fees.

Private credit deals usually have no fees. Yes, facilitators and underwriters may take a cut, but borrowers pay for that, not investors like you.

In contrast, LP funds typically come with a fee, like the 1.25% management fee charged by Peregrine Income Fund. A 1.25% fee is normal, but investors should remember that these fees eat into their returns when weighing opportunities.

Finally, fund minimums might be a significant barrier for average investors to participate in private credit as an LP. Minimums generally range between $50k-$100k, which could represent a sizable chunk of many investors’ portfolios.

But here’s the good news – if high minimums make LP investing look unappealing, there are other ways to passively participate in private credit.

In particular, Percent offers something called Blended Notes, which could be a more accessible option.

What are blended notes?

Historically, private credit has been the space of institutional players and wealthy investors who had good connections and got the best opportunities. Percent is a private credit investment platform focused on opening the space to any accredited investor who wants to participate.

Recently, Percent has launched some new products. Their Blended Note offering especially stands out as a way to invest passively in private credit with far lower fees and minimums than a traditional LP fund.

Investment minimums are just $5k, and have a 1% management fee. This is a bit higher than what you’d find in other asset classes, but it’s lower than the private credit industry average.

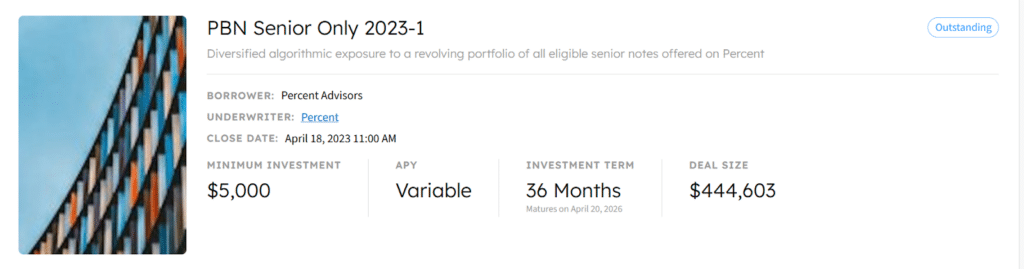

The Blended Notes work by assembling a diversified, revolving portfolio of private credit deals on Percent’s platform into a unified investment offering. Each Note comes tailored with a specific investment strategy.

For instance, this offering from earlier this year only allocates to notes with a senior priority repayment.

Percent also offers private credit opportunities in all the categories we discussed today. The numbers speak for themselves: As of this September, Percent has funded more than $800m in deals with an average APY of 18.76% and a default rate of just 1.86%.

If you’re accredited, create an account at Percent and see what they currently have on offer. As an Alts.co reader, you get a bonus of up to $500 with your first investment.

Further reading

- KKR’s Sheldon sees private credit becoming an “evergreen allocation“

- Venture debt will be big for startups in 2023 (and could break the bad habits of the boom years)

- An interesting study of two paths when building a portfolio of private credit. Two models: One’s a cautious charmer with real estate and infrastructure debt, and the other’s more daring with middle-market direct loans.

- T. Rowe Price Group and Oak Hill Advisors are launching a new private credit fund which already has $1.5b of investible capital

Disclosures

- This issue was sponsored by Percent

- Our ALTS 1 Fund has not done any private credit or debt financing deals with Percent

- The authors of this article does not have any personal holdings with Percent

- This issue contains no affiliate links

This issue is a sponsored deep dive, meaning Alts has been paid to write an independent analysis of Percent. Percent has agreed to offer an unconstrained look at its business, offerings, and operations. Percent is also a sponsor of Alts, but our research is neutral and unbiased. This should not be considered financial, legal, tax, or investment advice, but rather an independent analysis to help readers make their own investment decisions. All opinions expressed here are ours, and ours alone. We hope you find it informative and fair.