When most people hear tequila, their first thought is, “it’s time to party!” But connoisseurs and shrewd alternative investors should know that tequila is one of the oldest and most revered alcoholic beverages on the planet.

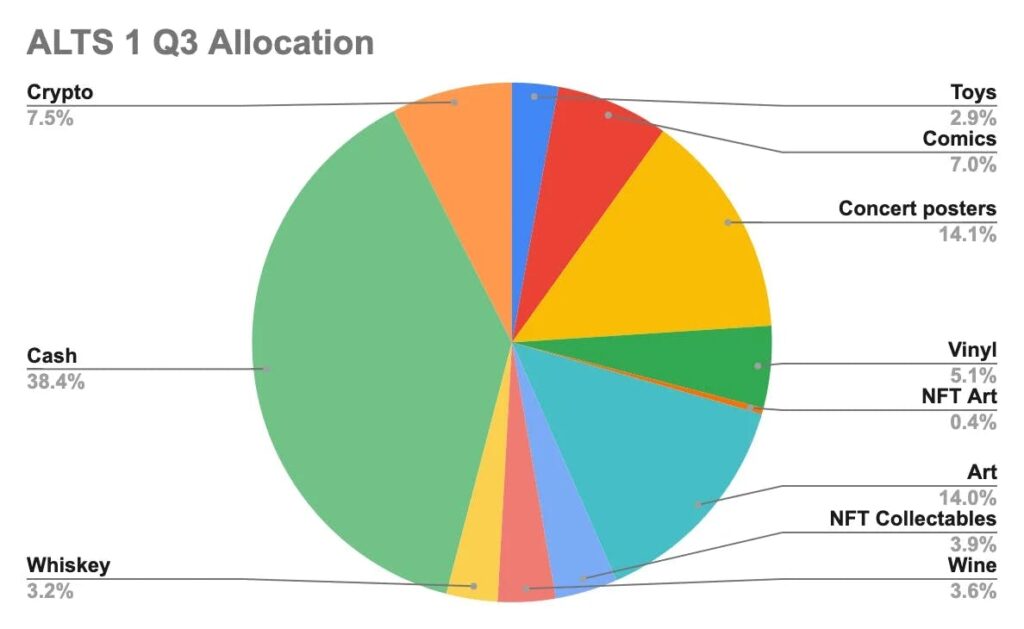

In some exciting news, we just added some tequila barrels to our ALTS 1 Fund! (That’s right — barrels, not bottles)

So, what’s the appeal of investing in tequila? And why does it actually make a good investment beyond a fun night out?

PS: Since publishing this issue, we’ve decided to take our first investor field trip to Mexico.

Come join us! 👇

Table of Contents

The history of tequila

Tequila is surprisingly ancient, with a history tracing back two thousand years. The Aztecs fermented juice from the blue agave plant as a ceremonial, religious drink to comfort the souls of those who lost someone dear to their hearts.

But tequila didn’t take off until after Cortés and the Spanish unceremoniously decimated the Aztec empire.

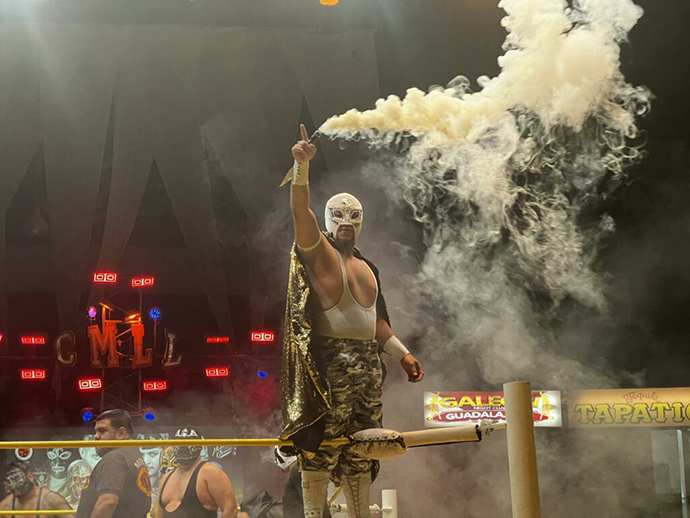

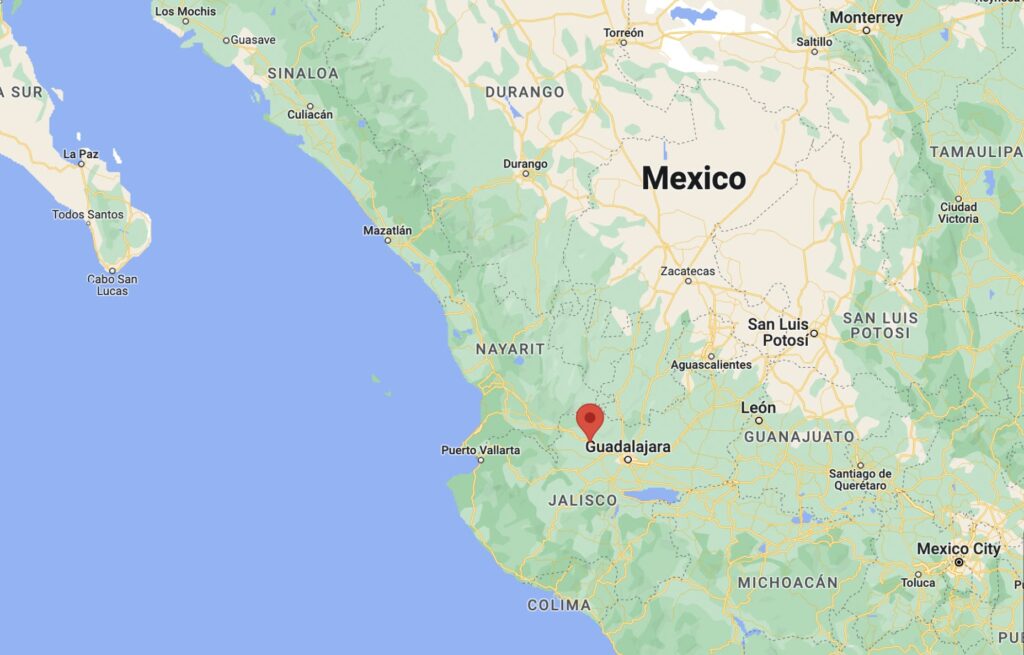

The Spaniards realized el tequila es delicioso, and created a trade route to an obscure Mexican town in the state of Jalisco.

Through the years, one name has undoubtedly stood out: Cuervo.

In 1758, Don Jose Antonio de Cuervo became the first to distill the alcohol commercially. His family founded the Taberno de Cuervo using the blue agave plant in a unique distillation process.

Fun fact: Just like sparkling wine can only be called Champagne if it comes from the Champagne region of northeast France, tequila can only be called tequila if it’s made from 100% Blue Weber Agave and produced in Jalisco, Mexico. 🇲🇽

In 1974, the Mexican government declared the term ‘tequila’ to be an intellectual property of Mexico, which meant that no other countries could produce and sell their own tequila.

Today, the most famous cocktail made with tequila is the Margarita.

The drink ushered in a new era of popularity for tequila, where to this day it remains the most popular cocktail in America.

Two parts tequila. One part lime juice. One part triple sec. Garnish with lime and salt around the rim. Voila, you have yourself a Margarita. A party in a glass.

What is tequila made of?

It all starts with the blue agave plant (agave tequiliana) — a large-leafed succulent native to Mexico that looks a bit like aloe vera or a pineapple plant, but it’s neither.

Unlike grapes, which are harvested in the fall, agaves are harvested year-round. But they take between 7 and 40 years to ripen…and die once harvested.

To make the best mejor tequila, the juice is extracted from the “piñas” (the pinecone-looking thing at the core of the plant), cooked, and fermented.

How is tequila made?

It goes something like this:

- Harvest the agave hearts (the pineapple-looking part, not the leaves)

- Cook them in a massive oven or a stone pit

- Crush the cooked hearts to extract the sugar and separate the fibers

- Fermented with yeast

- Distill the liquid twice

Is tequila the same as mezcal?

Mezcal, sometimes confused with tequila, is an umbrella term for the entire agave spirit category, while tequila is a type of mezcal.

Think of it like bourbon and whiskey, where bourbon is a type of whiskey.

Oh, and it’s mezcal that has the worm.

Why do we like the tequila market?

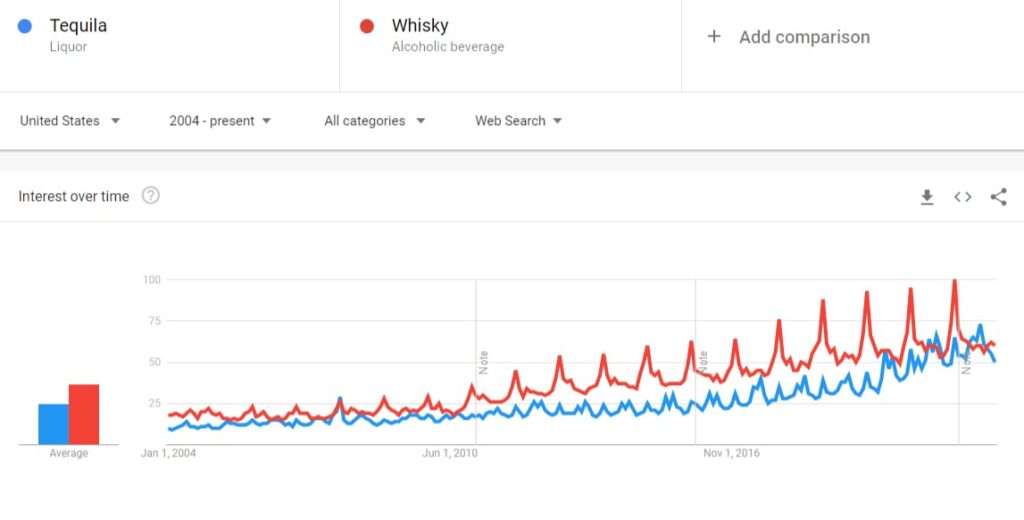

Vintage wine is the premier alcohol investment, and has been for hundreds of years. Over the past half-decade, whiskey has shown its strength. But you know what?

We think tequila could be the next whiskey.

Search activity for tequila has recently overtaken whiskey – if only briefly. And America’s appetite for tequila is growing steadily:

Spirits, in general, have been on the upswing for a decade. 2021 was the 12th consecutive year in which spirits have taken away market share from beer in the US.

To be fair, tequila is still a relatively niche market, But it also makes it an enticing opportunity. Tequila has long been underrepresented for no real reason.

And over the past few years, tequila has really started to make its presence felt in America:

- Tequila is one of America’s most imported spirits: 288 million liters imported in 2021

- These imports have increased every year since 2014

- Luxury spirits are in vogue. Last year, sales grew 43%

- 18% of all spirit sales in the US are tequila. This is third after whiskey (26%) and vodka (25%)

In 2021, the top five spirits by revenue growth were:

- Tequila/Mezcal (30.1%)

- Cordials (15.2%)

- Brandy & Cognac (13.1%)

- American Whiskey (6.7%)

- Vodka (4.9%)

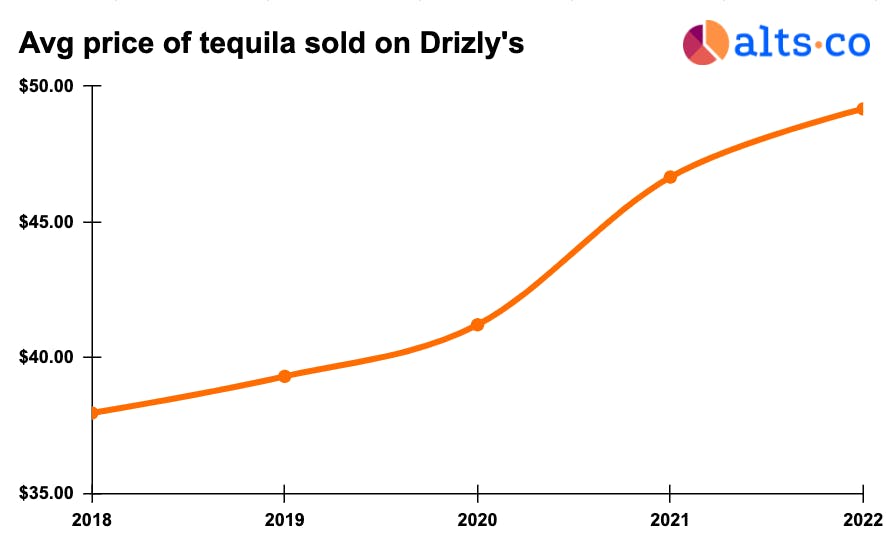

But what’s most interesting to us is the spirit’s price changes. Just like with vinyl records and vintage concert posters, we track this stuff closely.

Here’s some of what we’ve found:

This is even more pronounced for premium tequila, seeing growth of 75% over the past year:

The market is on its way up, and tequila has proven to be a recession-proof asset class.

How do we know this will stick? We don’t. But look, if there’s one thing people do when they’re sad and have no money, it’s drink.

At the very least, tequila is a great hedge against inflation with almost no correlation to the stock market.

Two parts club soda. One part tequila. One part grapefruit juice. A tablespoon of lime juice + salt for garnish. And now you enjoy your Paloma (dove).

What makes tequila valuable?

Ingredients

You probably remember the nasty cheap tequila at student parties. These tequilas are known as mixto and must only be made up of 51% agave sugars.

The other 49% can be from any other type of sugar — whatever is cheapest (usually palm sugar). Oh, and not to mention they’re rife with preservatives, colorings, and other crap that contributes to the classic “tequila hangover.”

If you’ve never tried pure tequila, you may wonder, “why the hell would people hype this up?”

Well, remember the cheap stuff is barely half tequila. Primo stuff is made from 100% agave sugars.

Production method

Handmade tequilas (from harvesting agave to corking bottles) are usually more valuable than machine-produced.

Look for tequila that uses the tahona method. This means the distillery crushes the agave piña with a large stone wheel. This method is labor-intensive and slow but provides stronger flavor.

Batch numbers

Smaller batch runs are also sought-after because, in theory, there’s more attention to detail and a lesser chance of the flavor being compromised.

Barrel type and how many times it has been distilled (by law, it must be at least twice) also factor in.

For example, Patrón’s ultra-premium bottle, en Lalique Serie 2, is worth $7,000.

Age

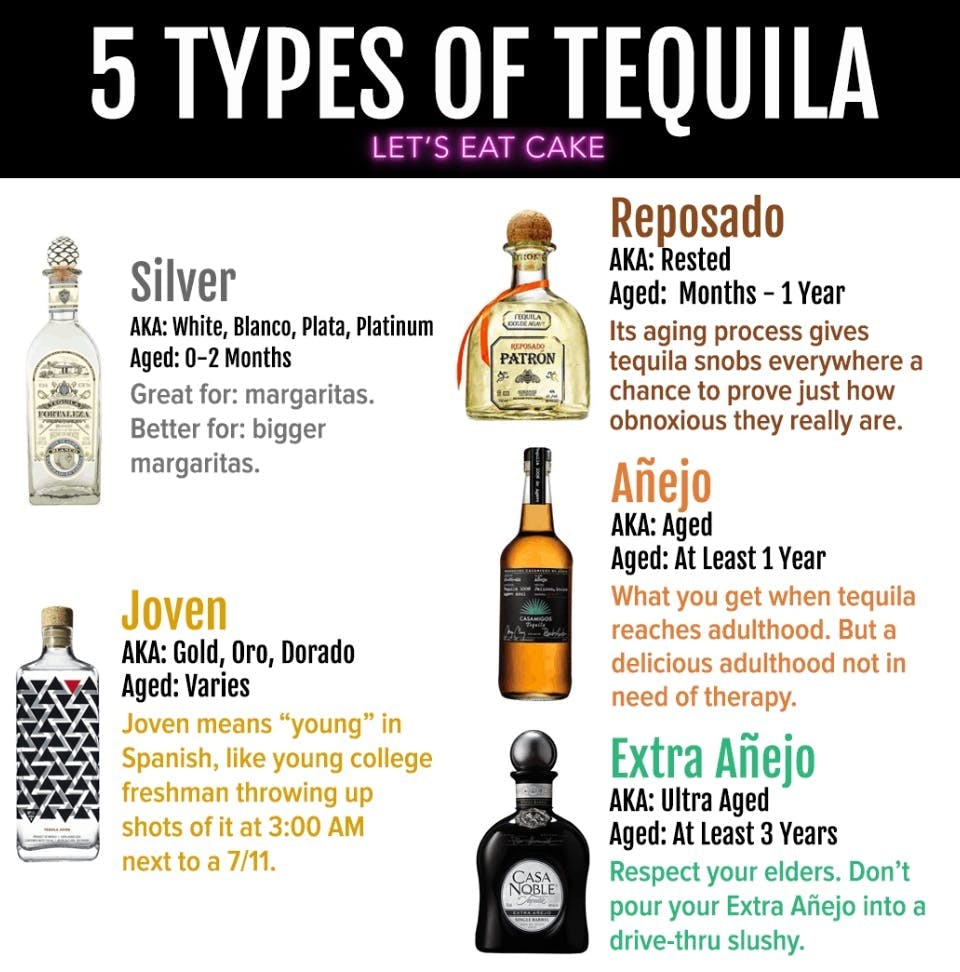

Like with most booze, older = better.

Tequila ages like a fine, uhh, wine. Unlike wine or whiskey though, you don’t need to age tequila for very long to bring out the flavor.

Añejo tequila (“old” in Spanish) is aged between 1-3 years. These tequilas are more valuable than Silver, Gold, and Reposado (“rested”) tequila.

Extra Añejo tequila is what we’ve invested in for ALTS 1. This is tequila that’s aged for 3+ years. These tequilas (like en Lalique Serie 2) are some of the rarest and most expensive kinds.

This style of aging has only officially been around since 2005. But in that time, it has produced some of the world’s most luxurious bottles of liquor.

Country of origin

Remember that tequila is the intellectual property of Mexico. So tequila that isn’t produced in Mexico simply isn’t tequila.

Last year, Vinepair reported that producers are attempting to give similar names to alcohol made using an identical process but made outside of Mexico (e.g., “Temequila”, made in Temecula, California), but all that does is increase the risk of cease-and-desist orders and potential lawsuits.

Appearance

Judge a book by its cover: bottle appearance matters.

Not to be shallow, but a good-looking bottle goes a long way to making alcohol more valuable. We’ll see that in action below.

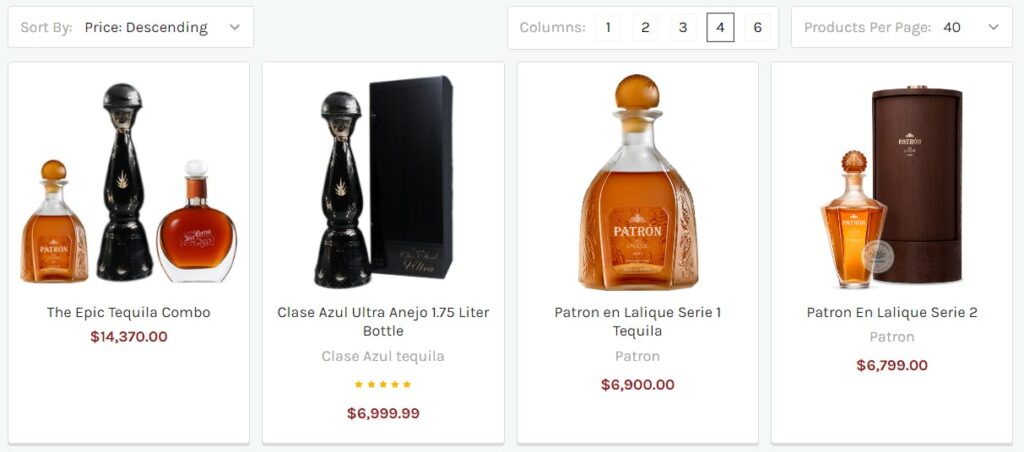

What are the most expensive bottles of tequila?

The most expensive bottle of tequila is a few grand, right?

No way amigo. The Tequila Ley .925 Diamante goes for $3.5 million.

But it’s not just what’s inside the bottle that makes this tequila so special. Rather, it’s the bottle itself.

The bottle contains an insane 8 pounds of platinum and 4,100 perfectly-fitted diamonds. It took 10 months to create, and the bottle weighs nearly 18 pounds.

Of course, the tequila inside is nothing to sneeze at. The Ley .925 tequila has been barrel-aged for seven years, and, like all good tequilas, it’s 100% blue agave.

Clase Azul is one of the most-revered tequila distillers in the world. Bottles routinely sell for up to $5,000. They’re renowned for their ornate decanters and tequila with intense, yet intricate tasting notes.

Clase Azul’s crème de la crème was its 15th-anniversary tequila. Only 15 were released to the public, and each bottle was uniquely designed by a different Mexican artist.

The drink was actually a blend of 11-year tequila mixed with 15-year tequila in a Spanish sherry barrel.

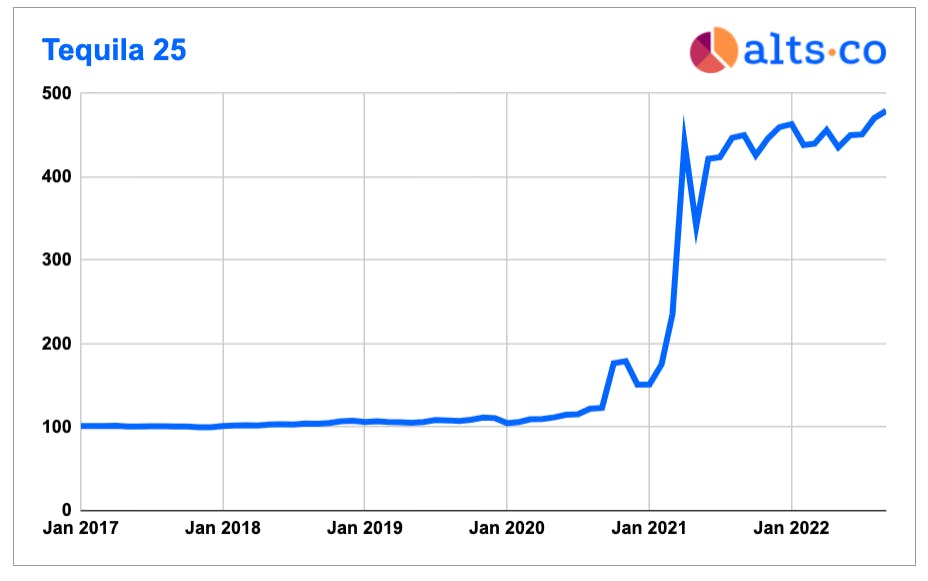

This year, Clase Azul came out with a new tequila to commemorate its 25th anniversary. Each bottle was priced at $500 and is already worth over $2,000: a 4x increase in just a few months.

How to invest in tequila

There are only two ways to directly invest in tequila:

- Bottles

- Barrels

Bottles

So, your local bottle shop probably won’t have the rare, vintage stuff. But it’s not too hard to find reputable online dealers specializing in rare tequilas.

A decent starting point is the well-named RareTequilas.com. These guys stock all sorts of cool bottles, from affordable, sippers under $50, to $600 bottles of Gran Patron Burdeos.

For those with a bit more cash to burn, try Old Town Tequila or Caskers.

Both of these guys stock the good stuff we’ve talked about – Clase Azul Ultra Anejo and Patron en Lalique (each goes for about $7,000)

Barrels

But the truth is there just aren’t that many high-priced bottles of tequila commercially available to the public.

When even “premium” tequilas are under $100, getting a big return means storing hundreds of bottles.

To make a real return, you’ve gotta buy big ($20k+), and you can’t pay retail. That’s where companies like House of Rare come in. This team operates a tequila cellar four meters underground in Tequila, Mexico, where they age their ultra-premium tequila for 3+ years.

House of Rare solves the storage issue. You invest in the barrels, and in return they store and age them on your behalf. After 3 years, they’ll propose an exit strategy (export the barrels, sell them back to producers, or bottle them into tequila) and return the profits back to you.

House of Rare also adds a dash of blockchain to the process. HOR distributes NFTs representing ownership to all investors. As tequila ages, the drink slowly changes.

As the barrels age, the NFT price increases. These NFTs can be traded in real-time on the House of Rare’s secondary market. Think of it like “tequila staking.”

This is how we purchased our barrels of tequila for ALTS 1. And the team is starting to put on events. As investors, we can visit their operation down in Tequila, see the barrels, and meet the team.

Indirect tequila investments

If you don’t trust yourself around a delicious bottle (or barrel) of tequila, there are other ways to get involved in the market without drinking your investments.

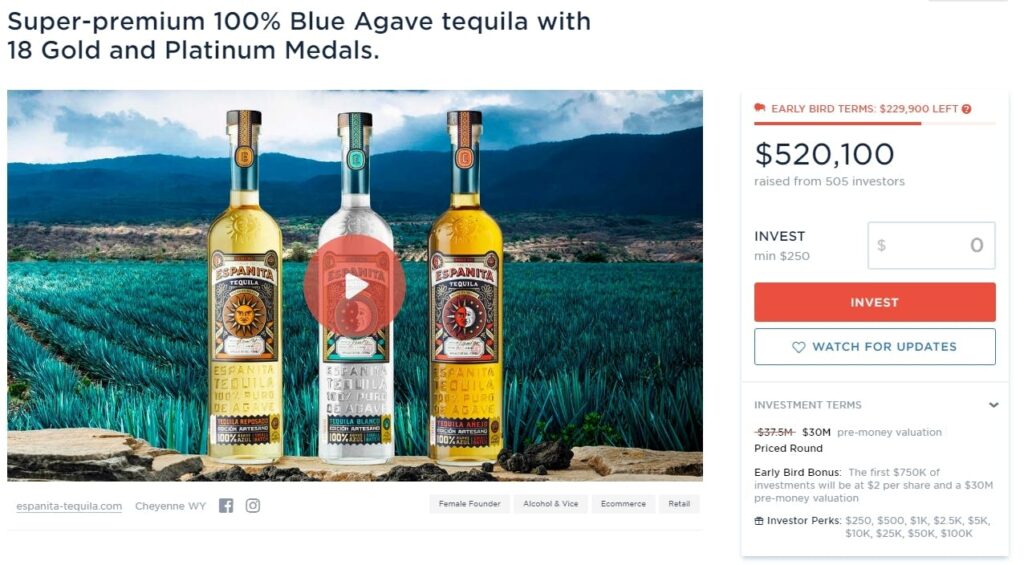

You have to be on the lookout, but startup platforms like Republic and StartEngine occasionally host tequila distilleries raising capital.

For example, Espanita, a tequila distillery producing Super-premium, 100% Blue Agave tequila, is raising $750,000 right now on WeFunder.

(Note: This is just an example, we haven’t done due diligence on this specific raise, and it may not be the best avenue to gain indirect exposure to the tequila market. But on the plus side, these guys are endorsed by Pitbull!)

This one’s for the rowdy. Equal parts vodka, gin, tequila, rum, triple sec and lime juice. Chuck in as much cola and ice as you please. And there you have it, a particularly strong Long Island Iced Tea.

Closing thoughts

Wine and spirits have had a fantastic 2022. Wine has been an excellent alternative investment for ages. And whiskey is a solid runner-up in the liquor department.

But we feel tequila could be the next whiskey. Mexico’s trademarked blue agave liquor is already making an outsized impact. It has similar appreciation characteristics as whiskey, but without the extra-long maturation periods. It holds the third-largest share of the spirits category, and it’s only just begun to flex its muscles.

Big alcohol companies are starting to take notice. Last month, The Boston Beer Company (makers of Sam Adams) introduced its first tequila-based beverage — Loma Vista Tequila Soda. This pre-mixed drink is made with blanco tequila (no surprise there), carbonated water, and lime juice.

Over the next decade, tequila is expected to grow at a decent CAGR of 6.6%. It’s certainly not the world’s fastest-growing asset class. But we feel it always has a place in our bellies, and now it’s got a place in our ALTS 1 portfolio.

The delta between good and bad wine isn’t huge. But the delta between good and bad tequila is enormous. Combine that with tequila’s growth in the US and it’s a no-brainer. Especially as our tastes go upmarket.

One last recipe before we say goodbye:

Two parts OJ. One part tequila. ¼ parts grenadine. Mix it all together, plop a cherry on top and enjoy the sunrise – tequila style.

Hasta luego amigos 🍹

Disclosures

- Our ALTS 1 Fund has made an investment through House of Rare for 6 barrels of Extra Anejo Tequila.

- None of the authors have any direct financial interests in any companies mentioned.

- This issue contains affiliate links. If you purchase something through these links we may collect a share of sales or other compensation.