New here? Read up on our past NFT issues to get the most from this email.

June 4, 2022 | ± 6 minutes

CONTENTS:

- Our analysis of the NFT market for the year & for the week (SPOILER ALERT: it ain’t pretty reading)

- A heads up on cool projects we think are worth checking out

- Industry news update, including Soulbound tokens, the latest paper written by ETH co-founder, Vitalik Buterin

Let’s go!

Table of Contents

NFTs in 2022

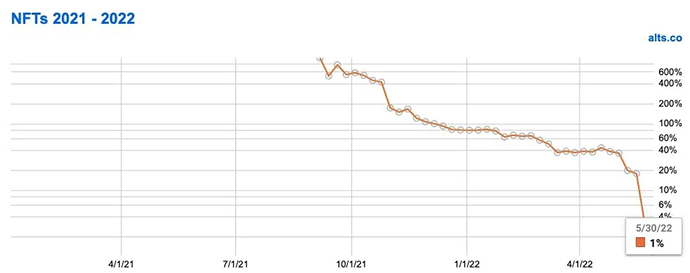

Our index shows NFTs in the fractional markets have given back all their returns since secondary trading opened in September 2021.

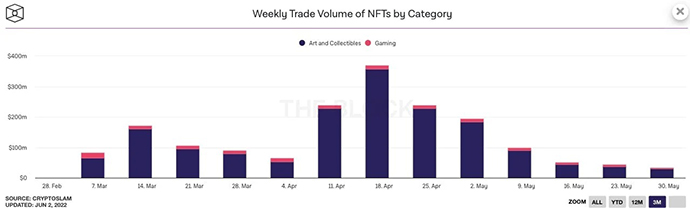

Last week marked the lowest weekly trade volume in more than a year. An NFT bear market is officially here, with fears that it could become an extended NFT Winter driving some projects out of business.

NFTs Last Week

NFTs on Fractional Marketplaces

Scanning the market, it appears that some assets have made slight recoveries, but are still significantly down from their IPO price.

Rally’s Bored Apes have mounted a comeback. The current floor price for Bored Apes is $195k. On Rally, many of the Bored Apes, paired with their Otherside Deeds, are trading well above floor price.

While investors may be looking to put their money into a well-known commodity, the prices now do not reflect the overall market value.

For example:

- “Leather Jacket” Bored Ape #9159 last traded at $8.05 per share for a market cap of $314k. Our inferred value with the Otherside Deed is $240k.

- “Sailor Hat” Bored Ape #601 last traded at $21.00 per share for a market cap of $346k. Our inferred value is $205k.

- “Astronaut” Bored Ape #7359 is trading at $14.90 per share for a market cap of $283k. Our inferred value is $205k.

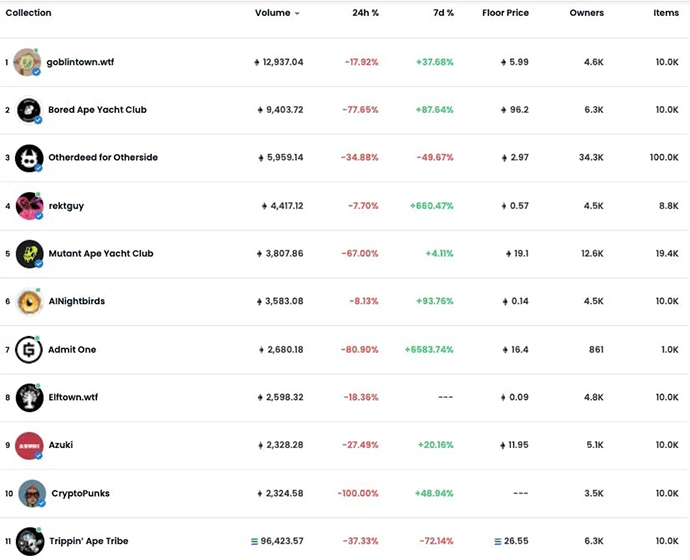

NFTs on OpenSea

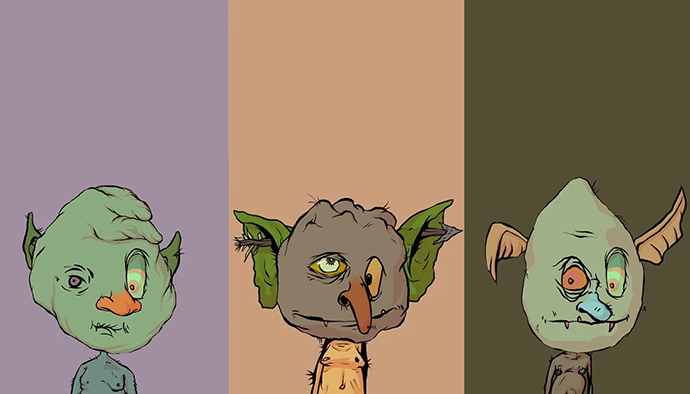

Goblintown’s advertisement is as straightforward as it gets; No roadmap. No discord. No utility. With that marketing stroke of genius, the NFT that openly admits to offering very little has become the highest-selling project this past week on OpenSea.

Goblintown is at the forefront of the latest NFT movement to offer products for free. There are many reasons why it makes sense, but the biggest reasons are:

- To attract a community hard-hit by falling prices.

- The developers getting freed up from any legal entanglements by promising nothing.

- A passive revenue stream from secondary sales.

A week ago, the Goblintown floor price shot up from a literal price of $0 to 1.6 ETH. Today, it stands at nearly 6 ETH. The project has a total sales volume of $37 million, with the creators taking almost $3 million in secondary sales.

No one is sure who is behind the project, but there are suspicions that some well-funded investors back it. A week ago, the community hoped to get more answers about the project on a Twitter Space hosted by Goblintown.

Instead, the community got 3 hours of grown men communicating in Goblin language. If you haven’t already watched this video, please do. It’s awesome.

Bruhhhh 💀☠️ this space is too much Lmao #goblintown (volume up) pic.twitter.com/Pqhy8EQEfd

— The Bitcoin Express (@The_BTC_Express) May 26, 2022

Of course, there are plenty of skeptics. How far can a project with no value ride the initial euphoria of creating a new community? Whether it’s Constitution DAO, Wall Street Bets, or any number of previous NFT projects, we’ve seen that only a handful of projects make it.

NFTs This Week

Fractional Marketplaces

There are no offerings on the fractional markets this week.

Projects to Follow

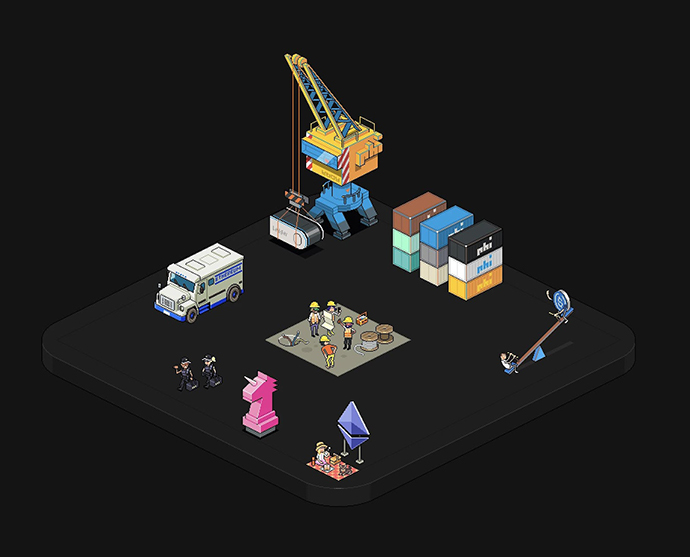

PHI

Minting: TBC, currently in development

- Two weeks ago we highlighted ENS Domains.

- PHI is working on creating Phi Land – a metaverse generated from ENS Domains. So as an example, alts.eth would have its own land in Phi Land.

- Users can build on their land using NFTs that represent their Web3 identity

- For instance, holding more than 1 ETH or participating in community voting would generate a pixelated icon that would appear on their land

- This allows users to build on their metaverse when other metaverse options like The Sandbox or Decentraland can be cost prohibitive.

- For more information, read their medium article here.

Industry News

Three juicy tidbits for you this week.

Soulbound Tokens

Vitalik Buterin co-published a paper about Soulbound Tokens in May. The report envisioned a new form of digital wallets, named Souls, that could carry “soulbound tokens” that could represent professional credentials, affiliations, or attendance at an event.

Each soul would carry the needed provenance that would legitimize any given soulbound token. For instance, as the paper explains, a university could hand out degrees in the form of tokens from its soul. The more degrees that a university hands out in the form of a soulbound token, the more people know that the degree comes from a specific university, therefore legitimizing the token.

The paper goes on to advocate the potential for disrupting lending. Certain loan tokens would be non-transferable, meaning that they would not leave a Soul until a loan is paid off. If someone opens a new Soul to avoid paying the loan, they would have to build up their Soul with new tokens to rebuild their reputation.

Why is this important?

Buterin states that the beginnings of Web3 have been marred by “hyper-financialization,” and a new path forward could be a way to make for a more “transformative, pluralistic future.” Sounds dreamy.

Seth Green Update

Were you losing sleep over Seth Green’s stolen Fred Simian? Worry not, we have good news.

Green alluded to making a deal with DarkWing to get Fred back in that same thread.

Green also stated that he’s working with Yuga Labs and an international art theft and cybercrime team to track down the thief responsible for the phishing scam.

OpenSea Insider Trading Scandal

In case you missed yesterday’s Crypto Insider, Nathaniel Chastain, a former head of product at OpenSea, was charged with insider trading by the U.S. Attorney’s Office for the Southern District of New York. Chastain would be privy to the artists featured on the front page of OpenSea.

Before the art would appear on the front page, Chastain would buy their NFTs at a lower price than when the artist would get a bump from the exposure of being a featured artist.

Chastain reportedly made $40k from insider trading and is now facing up to 40 years in prison. His prosecution is the first time anybody has been arrested for insider trading with NFTs. Secondly, this could lead to a broader legal definition that could label NFTs as Securities.

Chastain was wrong and took advantage of his position to make a profit. But 40 years in prison? The charges seem a bit heavy-handed. In 2008, when the financial crisis nearly wiped out the global financial system as we know it, the Justice Department sent just one Wall Street executive to jail.

Something doesn’t seem right.

I hope you enjoyed this week’s issue. We take all feedback into consideration, so please feel free to reach out with tips, comments, or suggestions on what you’d like to hear about next.

Until next week!

Horacio