Welcome to Deep Dives, where we explore interesting companies in the alt investment space.

I hope you enjoyed last week’s issue on Sandhill Markets, and why startups are taking so much longer to go public.

Today we’re discussing one of our favorite asset classes: short-term rentals (STRs).

You may have noticed that short-term rental market has become professionalized. It’s no longer about renting a spare room and earning a few bucks on the side.

Today, it’s common for Airbnb hosts to manage multiple properties, and they need modern software to manage it all.

STRs come with their own unique challenges that aren’t addressed by old-school hospitality software. A company called Jurny recognized this, and is growing quickly.

Let’s go

Table of Contents

Did you hear? Houses are now hotels!

Covid is over, and travel is big business once again.

In the United States, people are now taking more than 2 billion trips per year, collectively spending over a trillion dollars.

But over the past decade, travel has been completely transformed by the rise of a new hospitality model: short-term rentals.

In the past, hotels were the only game in town. Hotels are consistent, reliable, and have professionally trained staff to handle any hiccups. If you’re traveling to a new city (or especially country), all of that can be reassuring.

But hotels can be expensive. After all, someone needs to pay for all those employees. For young, budget-conscious travelers willing to risk a little uncertainty, paying a premium to stay in a hotel isn’t always worth it.

Capitalizing on the opportunity, ambitious entrepreneurs developed an alternative vision. What if regular people could earn cash by renting out their place to travelers?

And thus, the short-term rental (STR) market was born. Platforms like Airbnb and Vrbo, (which today I found out is actually pronounced “verbo”) have since proved tremendously popular.

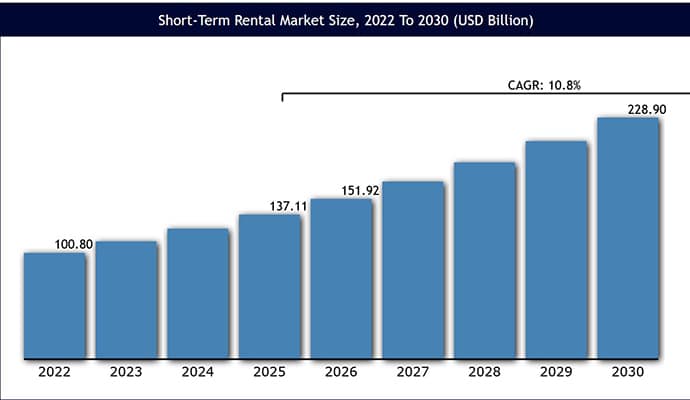

Some estimates calculate STR’s share of the overall hospitality market at around 30%, with the STR market itself set to grow by ~11% YoY.

Initially, it was pretty easy to tell the difference between a hotel and an STR. Hotels were the massive buildings with identical rooms and professional management, while STRs were the ordinary homes where you could chat directly with the host.

But over time, the line between hotels and STRs started to blur.

The Professionalization of STRs

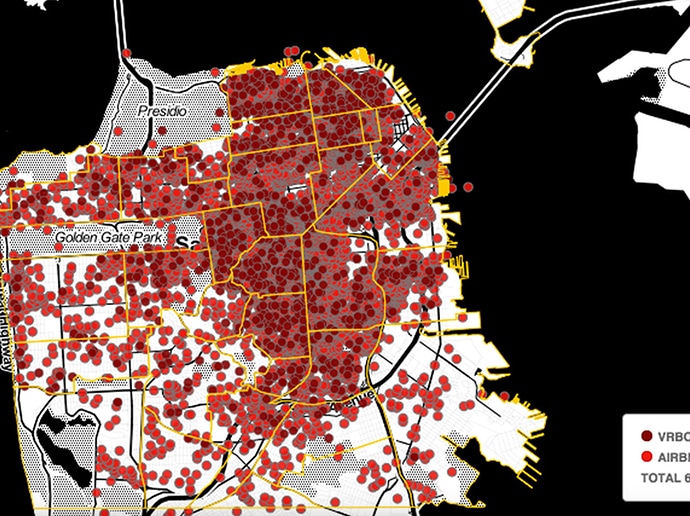

The days when Airbnbs were dominated by plucky homeowners with a spare room, making a few bucks on the side, are long gone. Slowly but surely, the market became professionalized.

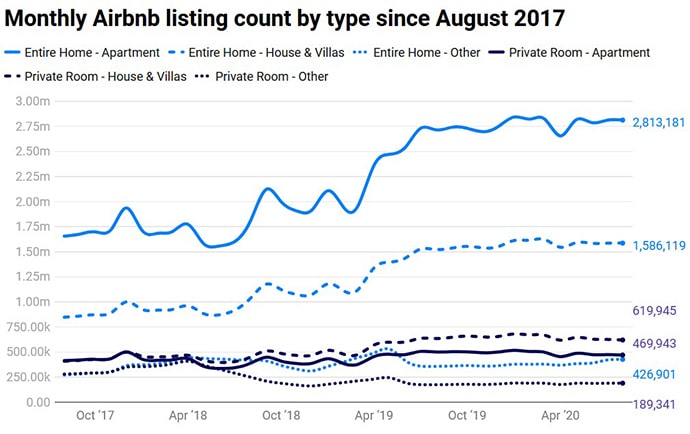

On Airbnb, listings from owners with multiple properties on the platform is rising. And listings for entire homes or apartments have boomed, while listings for individual rooms have stagnated.

It’s no surprise hosts are expanding. After all, the returns on STR investing are attractive, averaging between 8-20%.

And there are economies of scale at play. You can get a better deal hiring a cleaning company to turn over three properties than just one.

In addition to these professional hosts, another reason that it’s becoming harder to tell the difference between hotels and STRs is because hotels themselves are entering the STR space.

Hotel groups have begun to recognize that STRs offer value that traditional hotels just can’t replicate. In one study, 53% of travelers said they preferred Airbnbs due to access to household amenities, while 39% said Airbnbs were a better way to experience local culture.

To get in on the action, hotels are creating their own STR solutions.

- Sage Hospitality Group, for instance, created the Catbird Hotel in Denver, where rooms include full kitchens and in-unit washer and dryers.

- Marriott, meanwhile, launched a serviced apartments division, inspired by “the blending of work and leisure travel and the desire among younger travelers for wider accommodations options.”

But as the competition between professional STR hosts and hotels heats up, the inadequacies of STR management solutions are becoming apparent.

This is what companies like Jurny are trying to solve.

The problems with managing vacation rentals

Take it from me: Managing multiple vacation rentals is a pain in the butt. (Yes, it’s a nice problem to have. But it’s still a problem.)

Thanks to STRs, the hospitality industry has experienced fundamental change in a very short timespan. The result is that a lot of the industry’s infrastructure just hasn’t had time to catch up.

It’s as if a small town turned into a big city overnight, but the city hasn’t had a chance to upgrade the power grid.

This really stands out with rental management software. There are plenty of property management systems out there, but a lot of them are still designed for the way hospitality used to work.

But Jurny is different. They’re focused on building tech that’s designed for how hospitality works today. And the industry desperately needs new solutions.

There are three big challenges property owners and managers face when it comes to existing software.

1) Legacy software isn’t designed for modern STRs

Most of the solutions on the market are designed exclusively for hotels and, if they’re “tailored for STRs,” they’re still fragmented and dependent on unreliable third-party plugins.

Take the ultra-important check-in process, for example.

At a hotel, that’s pretty simple:

- Show up at a front desk

- Receive your key

- Walk straight to your room

But with an STR, there’s usually no one on-site to manage the process, meaning a pre-arranged digital code or keyless entry needs to be established for guests.

In addition, there’s basically no margin for error if a room or house hasn’t been properly prepared. If you show up to your hotel room and it’s not clean, you can just request a new room.

But if something goes wrong with an Airbnb, it can be a disaster. It’s critical for guests to be able get in touch with hosts, and quickly.

Emailing Airbnb support doesn’t cut it. This puts huge pressure on hosts to always be available, even in the middle of the night. For this, that hosts need to have support staff on standby, and need software for organizing support staff.

2) Finding a practical, inexpensive solution

The hospitality software pro hosts use today are expensive and complicated.

Price can be a real turnoff for STR hosts who manage just a dozen properties or so. These “middle-market” hosts can’t always afford to pay the premium prices associated with traditional hospitality management software like Guesty, which comes with onboarding fees, booking fees, and regular monthly fees just for using the platform.

In addition, platforms like Hostaway don’t offer an all-in-one solution that time-strapped hosts need. It’s basically a fragmented marketplace, with competing vendors all vying to serve hosts in areas like booking, cleaning, and accounting.

3) The old technology is falling behind

Finally, current software solutions were built a decade ago, and don’t really utilize the latest technological advances. (The biggest being AI)

There’s a lot of buzz around AI these days, I know. But the fact is it really can make a world of difference for hosts in terms of setting prices and responding to guest inquiries.

Moreover, as properties become “smart,” software should be able to connect with the hardware inside a home to do things like set the temperature or ensure the front door is locked.

Finally, managing online booking and support staff scheduling isn’t enough. Software solutions should integrate with the other technology hosts are using to make their properties more efficient and effective.

What is Jurny?

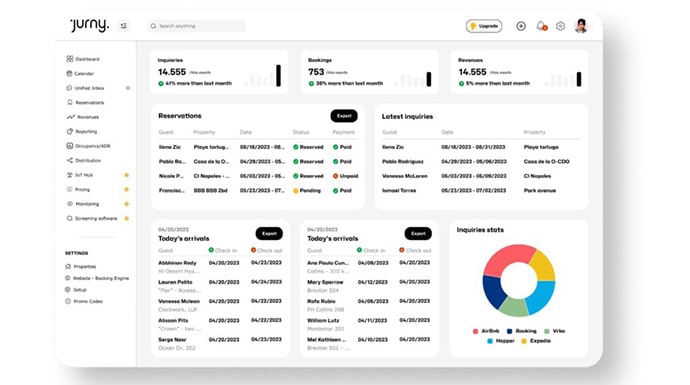

Jurny is a hospitality tech startup that’s focused on delivering the first truly effective software for modern property managers.

It’s not just for Airbnb’ers. Jurny caters to both short-term rental hosts and boutique hotels — two groups that have struggled to find good hospitality software.

The firm was founded by CEO Luca Zambello, who has direct experience with the inadequacies of current property management technology. Before founding Jurny, Luca and his team managed more than 300 rental units across 5 major US cities.

Identifying the opportunity for a better technology solution, Luca developed the vision for an affordable, efficient property management system that used the latest technology to save hosts time and money.

Now, Jurny has raised over $8 million to build that vision, with their total valuation recently climbing to $20m.

AI: Hype or reality?

Let’s be honest — there are a lot of startups doing “AI” these days, which usually means little more than a thin layer over ChatGPT.

And there’s a sense in which Jurny is following that same approach. Their AI assistant (called “Nia“) runs on GPT-4, OpenAI’s latest model.

But Jurny is trying to apply the technology to specialized hospitality use cases. Nia is trained to reply to common questions, helping free hosts from the burden of always needing to be available to respond to guest inquiries. According to Jurny, those using Nia have seen an 80% increase in response time.

In addition, Nia can monitor guest reviews from a variety of websites, even responding in brand voice and helping hosts collect insight from reviews with sentiment analysis.

In the future, the Jurny team wants to take Nia a step further by having it automatically confirm and update reservations, and speak to guests in their native language. Pretty cool.

Jurny OS

Jurny also integrates dynamic pricing software powered by Wheelhouse, which lets hosts automatically maximize revenue by analyzing millions of data points. It’s part of what they call Jurny OS.

Remember above how we mentioned Hostaway was a fragmented marketplace?

Jurny is the opposite.

The true value for hosts lies is in the end-to-end property management system, meaning guests get to use it too.

- When guests arrive, they use the Jurny app to check-in, connect to Wi-Fi, and access a 24/7 virtual concierge. Hosts can add locks, thermostats, and other smart home devices to Jurny’s “Internet of Things” dashboard.

- When guests leave, Jurny offers cleaning management through Turno, through which hosts can find cleaning companies, schedule cleanings and track the status of staff in real time.

Building all this hasn’t come cheap. Jurny raised substantial capital to bring this to life. But people seem to be drawn to the platform, with 1,000+ hosts using it every day.

Investment opportunity

If you’re a rental host looking to iron out inefficiencies and boost your profits, Jurny’s platform might be the solution for you.

And if you’re looking to invest, Jurny recently opened up their latest VC-backed funding round to the public via Wefunder.

Jurny has already raised more than $2.5 million in about a month from their crowdfunding initiative.

The minimum investment is $250, and you’ll receive a convertible note in Jurny. (In simple terms, this is a type of loan designed to convert into equity shares. Read more about convertible notes here.)

Ultimately, Jurny plans to convert these notes into stock, but the price at which that happens might differ. The notes come with a valuation cap of $20 million, which ensures you still get a good deal if Jurny’s valuation skyrockets.

If things don’t go according to plan and Jurny doesn’t convert these notes, investors still have some protection. The notes would then mature in a year and half with a 5% annual interest rate.

The convertible note structure might seem complicated, but it’s actually fairly common in startup structures. Still, make sure you review the offering documents to understand the deal – you can find them on the SEC’s website here.

Challenges

In 2021, Jurny had a net loss of more than $2.8 million. In 2022, despite growing revenue, that figure increased to more than $4 million.

Despite the challenging headline numbers, Jurny has made significant progress towards profitability. According to Luca, recurring expenses are now less than half of last year’s, which were higher than usual due to heavy platform development costs. Jurny projects additional cost savings of around 30% by the end of this year.

With more than $2.2 million in contracted ARR, and infrastructure in place that’s set to scale past $10 million in ARR without needing additional costs, Jurny is optimistic about reaching profitability around Q1 2024.

These figures should help give investors confidence that profitability is on the horizon. In fact, growth does look strong – Jurny registered 5x customer growth in the last 9 months.

However, Jurny does have accounting considerations to address. While their liabilities exceed their assets by more than $3.5 million, it’s important to note that some of these liabilities are convertible notes, which should eventually turn into equity rather than requiring a cash outlay.

Again, Jurny’s growth has been strong, and the opportunity set is massive. It’s not uncommon for successful startups to have early struggles in terms of both their income statement and balance sheet, especially in the current environment. But investors should be aware of these figures before committing money to the round.

Opportunities

If Jurny can overcome these challenges and reach a point of sustainability, there are some great potential avenues for the firm moving forward.

Right now, Luca says that the eventual goal is to go public via an IPO.

However, I think they could get bought by a big ecosystem player well before then. Think about it — if you’re a company like Airbnb, Vrbo, Expedia, or a major hotel group, you have two options for getting out of the stone age: building, or buying.

These companies could see Jurny as a valuable acquisition.

Whichever avenue Jurny pursues, they’ll need the capital to get there, and these options could be hugely lucrative to investors who get in at an early stage.

Closing thoughts

Jurny is targeting a huge opportunity here. Inefficiencies in hospitality management are $1 trillion per year problem.

As an Airbnb host, I know firsthand that these problems are real, and that Jurny has huge potential. This is a massive market whose basic infrastructure has yet to catch up with reality.

As Wyatt is fond of saying, “Stay away from AI startups that are just ChatGPT skins!”

Jurny appears to be more than that. I don’t personally use it to manage my Airbnbs, but I’m also not in their target market. If I owned a dozen more units, it would be a godsend.

I do think there’s a good chance this company gets acquired. Whether they get acquired for more than the $20 million market cap is debatable.

But their software is creating lots of value. And valuations live downstream from value.

Want to connect with Jurny? They’re a very responsive team. Email us and I’ll make a personal introduction.

Further reading

- Read Jurny’s audited financial statements

- Luca did an in-depth Q&A with our friends at The Offer Sheet

- Why vacation rentals are probably my single favorite alternative investment

- Alts Academy: How to invest in short-term rentals

- We’ve previously done reviews on STR platforms, including investment.com and Wander

Disclosures

- This was a paid deep dive by Jurny

- Our ALTS 1 Fund has not invested in Jurny

- I have not personally invested in Junry

- This issue does not contain affiliate links

This issue is a sponsored deep dive, meaning Alts has been paid to write an independent analysis of Jurny. Jurny has agreed to offer an unconstrained look at its business & operations. Jurny is also a sponsor of Alts, but our research is neutral and unbiased. This should not be considered financial, legal, tax, or investment advice, but rather an independent analysis to help readers make their own investment decisions. All opinions expressed here are ours, and ours alone. We hope you find it informative and fair.