Welcome to Wine and Whiskey Insider for May 11, 2022 – FREE Edition.

We give you the scoop on undervalued, mispriced and hidden gems in Fractional Investing.

Let’s go!

Table of Contents

Wine and Whiskey in 2022

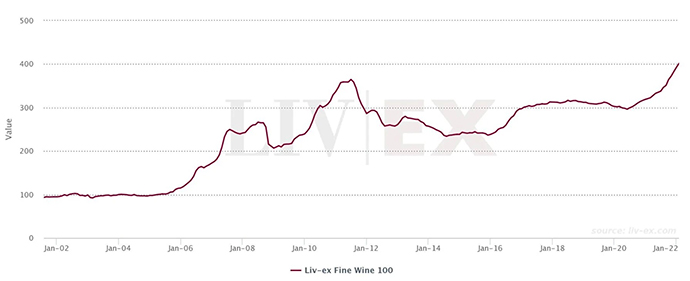

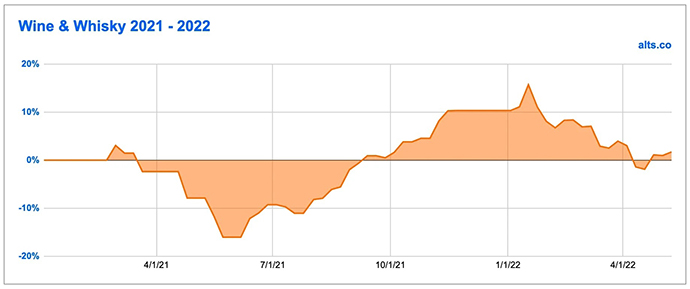

Wine on fractional marketplace Rally has rebounded, though a significant number of the assets on the platform remain undervalued by an average of 33% relative to the valuations on both Wine Searcher and Liv-Ex.

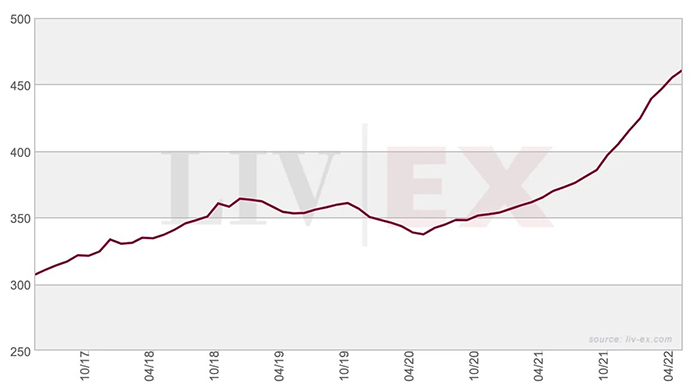

The fractional market seems to have not caught up to the real world as fine wines continue to head up and to the right in the Liv-Ex 1000. The rate of acceleration is slowing ever so slightly, but I wouldn’t be against wine just yet.

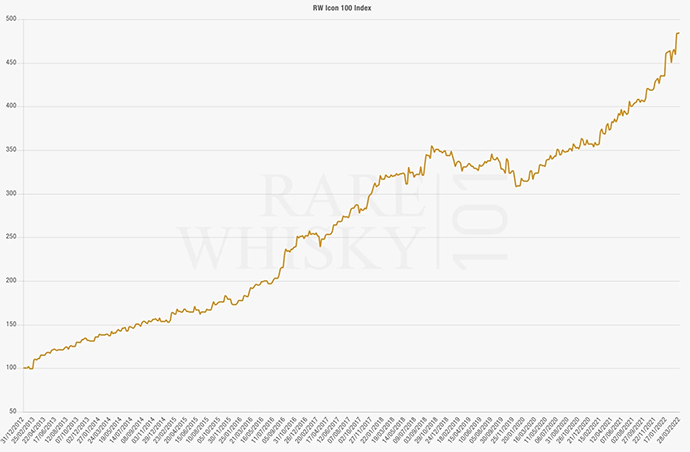

Speaking of up and to the right, whisky continues its march upward, setting another all-time high last month.

Just worth bearing in mind that while both these asset classes continue to outperform mostly everything, dips happen, and they happen relatively frequently. Declines of 20% have been common over the last fifteen years.

Last Week in Wine and Whisky

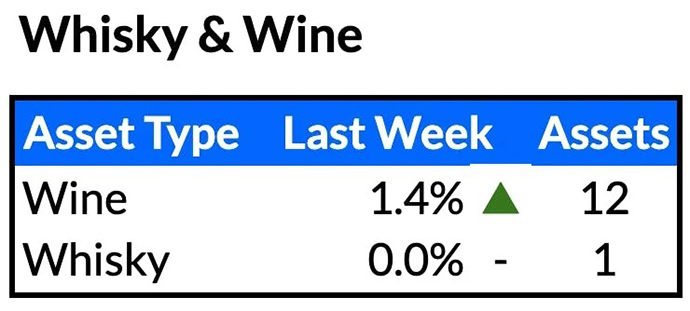

Fractional secondary markets

Pretty quiet on the wine and whisky front on Rally with only one asset moving double digits. 2006 Giacomo Conterno Monfortino (12 bottles) advanced 24% on very low volume.

Auctions

Sotheby’s closed a huge auction last week, and it fully backed up the up-and-right trend we see above. The top 21 lots (by pre-auction estimate) beat their maximum estimate, led by three “voluptuous” 1L bottles of La Tâche 1990 Domaine de la Romanée-Conti, which sold for $212k (over $70k each).

Twelve standard bottles from the same vintage (also “voluptuous”) went for nearly 150% more than the high estimate, hammering at $150k once the smoke had cleared.

Proving there’s still some inefficiency in the high-end wine markets, two 1/2 cases sold for $68,750 and $52,500.

A jaw-dropping (and mouth-watering) case of Romanée-Conti 1988 was left on the shelf the week prior when Bonham’s featured it as the centerpiece of its Fine & Rare Wines and Spirits auction. The high estimate was £350k ($430k).

This Week in Wine and Whisky

Assets dropping on fractional marketplaces

Lafite 2010-2019 Vertical

- Market Cap: $121k

- Inferred Value: $90k

- Drop Details: 5/11/2022 on Vint

- Our view: [INSIDERS ONLY]

Deep Dive

About Chateau Lafite Rothschild

Lafite dates back nearly a thousand years, with its first mention being a (probably) plump abbot named Gombaud de Lafite.

It was arranged as a proper vineyard in the 17th century and was a favorite of French king Louis XV and American president Thomas Jefferson.

It’s now run by a sixth-generation Rothschild named Saskia.

The average age of vines used in the Grand Vin (the stuff on offer at Vint) is around 45 years old and they tend to live up to 80 years.

About the Wines

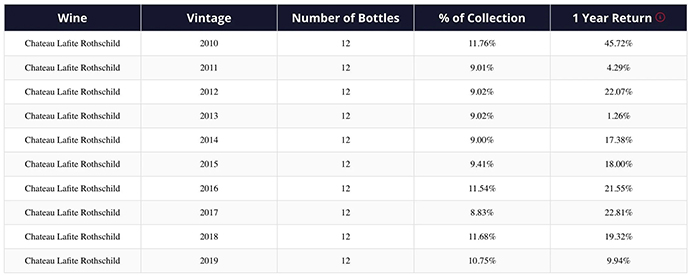

This is a vertical collection ranging from 2010 to 2019 that includes one twelve-bottle case from each year.

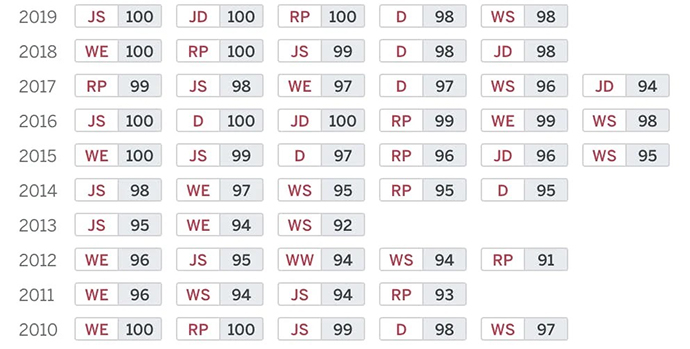

Despite a slight dip in quality from 2011 to 2013, the wines receive mostly excellent reviews.

Perhaps unsurprising that the vintages during the 2011 to 2013 lull average significantly lower returns than the rest of the set.

Price Analysis

Lafite commands a significant premium relative to the other four First Growth vineyards in Bordeaux due to its brand and the wine’s quality. It ranks second on the Liv-Ex Brand Power Index and is the top Bordeaux.

I went through wine-searcher.com to review current offers for each of the ten vintages, taking the third-lowest option (to account for availability, since you’d need to buy twelve of each), and the total value came out to just shy of $90k.

Conclusions

Wine and Spirits Auctions this Week

If you like soy sauce and getting drunk (and have a tremendous amount of disposable income), Sotheby’s has the auction for you. Their vintage Moutai auction closes this week with two cases of “Sun Flower” Kweichow Moutai estimated to fetch between £200k to £450k.

If whisky is your thing, Bonhams is running an auction on super-premium Scotch led by a bottle of Laphroaig-15 year old-1967, which is estimated to go for between €28,000 – €38,000.

If your tastes run slightly less expensive, Big Peat distillery is giving away one bottle of Islay blended malt scotch whisky in exchange for a £5 donation to the Disaster Emergency Committee’s Ukrainian Humanitarian Appeal.

That’s all for this week.

Make sure you sign up to our Discord, where issue previews and in-depth valuations get kicked around.

Cheers,

Wyatt