This week, we’re back to normally scheduled programming.

Today, we’ve got:

Table of Contents

Tequila is incredibly popular.

Two weeks ago, I highlighted the economics of the tequila industry and some of the opportunities there.

Check out the Q&A session we ran with Miguel, our tequila broker in Jalisco.

The degree of positive feedback we received was … unexpected. There’s been so much demand from our community that we’re spinning up an SPV to invest in aging tequila barrels.

Run through Altea, our private member community, we’ve blown past the initial $260k target (50 barrels) and are currently looking at over $450k.

The good news is that we can stretch the SPV as far as demand supports and the barrels actually get slightly cheaper at 100 casks.

If you’re an accredited investor and would like to express interest, let me know. I’m hoping to cap this next week.

Oh, based on what we learned about the economics of agave farmland, we’re also considering acquiring ten hectares of prime land just outside the Tequila city limits.

Let me know if you’re interested in that as well. It’s still very early days, and the opportunity may not materialize.

Should it proceed, Altea members get first dibs, but accredited non-members can get on the waitlist.

Africa’s football stars are making the transition from rich to wealthy.

Everyone’s getting into sports investing at the minute:

Goldman Sachs has institutionalised it

So has JPMorgan

Our own community, Altea, has presented members with the opportunity to invest directly in three professional football (soccer) teams and has a rugby investment in the works.

So it’s no surprise that the players themselves want in on the action. You’ve probably already heard about Tom Brady, LeBron James, and Serena Williams’s endeavors.

But a growing number of African footballers are getting in on the action, too:

- Didier Drogba: The Ivorian striker has been involved in the business of football through his association with the United Soccer League (USL) team Phoenix Rising FC. In 2017, he joined the club in the unique position of player/co-owner, playing a pivotal role in its development and success on the field.

- Sadio Mane: The former Bayern Munich and Liverpool star, who grew up in the small village of Bambali in southern Senegal, has invested in the football business by acquiring a majority stake in French fourth-tier side Bourges Foot 18.

- Wilfried Zaha: In June 2022, Zaha, along with British rapper and singer Stormzy, invested in the ninth-tier English soccer side Croydon Athletic. Zaha, born in the Ivory Coast but raised in Croydon from the age of four, aims to uncover and develop young talent through this investment. Furthermore, in September 2022, Zaha and his brother Carin acquired the Ivorian fourth-tier club Espoir Club D’Abengourou, hoping to lead it to the country’s top flight.

It’s welcome news. Over 40% of English Premier League players are bankrupt within a few years of retirement. A combination of bad planning, bad advice, and unsustainable lifestyles contributes to this.

George Best, the legendary Northern Irish footballer, probably summed the problem up best.

“I spent a lot of money on booze, birds, and fast cars. The rest I just squandered.”

But Shaq has a better philosophy.

A few companies deal with this problem, but I think there’s a huge opportunity to work with players while active to set them up for a better future.

If you’re a current or former pro who knows about this (or someone who works with them), I’d love to hear more.

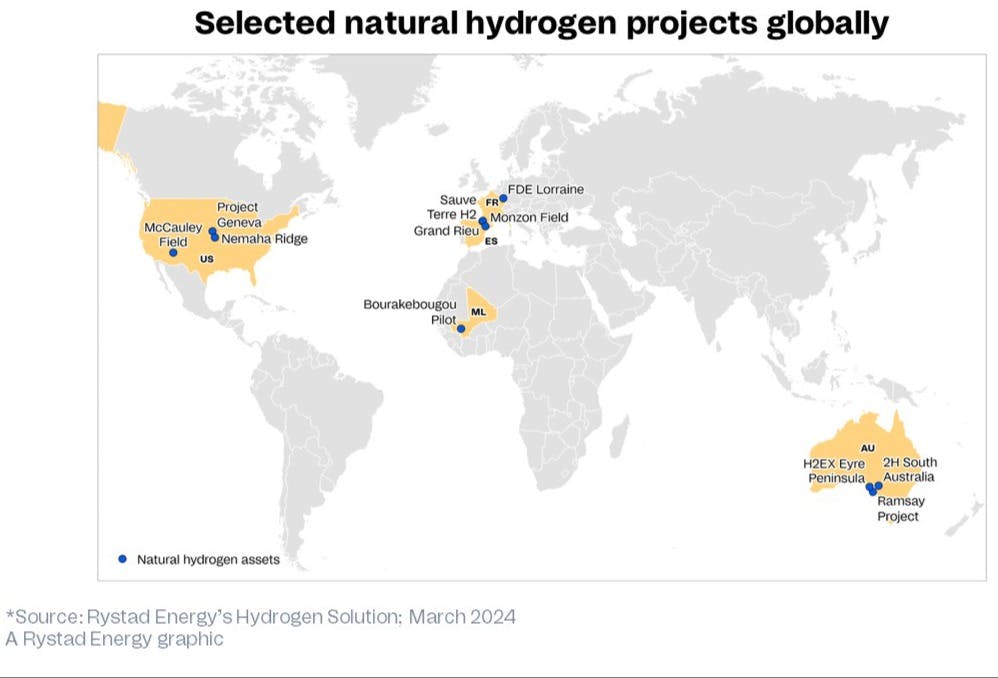

The Hydrogen gold rush continues apace

Demand for Geologic Hydrogen is set to increase by 50x over the next 25 years.

Geologic Hydrogen is natural hydrogen found beneath the earth’s surface. It’s superior to manufactured hydrogen because the artificial process is messy and defeats the point of the clean energy hydrogen is meant to power. It’s also cheaper to mine than it is to produce.

When we last looked into this (just two months ago), only one active deposit was being mined. It produces around 5 Mt yearly, less than 6% of current global demand.

But new research shows a global gold rush is on, and it’s picking up steam.

“Rystad Energy research shows that at the end of last year, 40 companies were searching for natural hydrogen deposits, up from just 10 in 2020. Currently, exploratory efforts are underway in Australia, the US, Spain, France, Albania, Colombia, South Korea and Canada.”

The investment landscape within the hydrogen sector is becoming increasingly dynamic, with several key players and funds emerging as noteworthy contributors to this trend.

Plug Power stands out in the hydrogen fuel cell technology sector by offering a comprehensive approach to the hydrogen fuel supply chain, from production to delivery.

Nel Hydrogen positions itself as a dedicated global enterprise in the hydrogen domain, providing state-of-the-art solutions for the production, storage, and distribution of hydrogen derived from renewable sources.

Bloom Energy is gaining traction as a frontrunner in the industry, thanks to its expertise in solid oxide fuel cells for electricity production. Moreover, the company’s technology is versatile, capable of being adapted for the production of green hydrogen.

Clean Power Hydrogen (LSE:CPH2), a UK-based entity, is focused on enhancing the commercial viability of its innovative membrane-free electrolyser technology. This technology stands out for its capability to produce not only very high purity hydrogen but also medical-grade oxygen, marking a significant advancement in the field.

In addition to individual companies, investment vehicles such as L&G Hydrogen Economy ETF (HTWG)and VanEck Hydrogen Economy ETF (HDGB) offer prospective investors exposure to a curated selection of companies involved in various aspects of the hydrogen economy, thereby diversifying investment risks and opportunities.

If you want to go straight to the source, the FiveT Group has formed a JV with Ardian, an investment house, to invest directly and specifically in companies riding the clean hydrogen wave.

Want to dress like Hef (or Marylin)? Now’s your chance.

Starting tomorrow, Julien’s Auctions is selling off loads of iconic pieces from Hugh Hefner’s mansion alongside several of Marylin Monroe’s gowns.

A great many of the items are NSFW, so beware when clicking through.

A few favorites: