Welcome to The WC — your weekly shot of awesome.

Over the holidays, I put together a little series of posts reflecting on 2023 and looking ahead to 2024. ICYMI:

Make sure to grab your all-access pass to see the stuff our sponsors won’t let me say.

Today, we’ve got:

- A new gold rush

- The future is finally here

- How’s the American consumer doing?

- How it’s going to blow up, part 1

- How it’s going to blow up, part 2

Let’s go.

Table of Contents

A New Gold Rush

Until very recently, large hydrogen deposits were notable to academics but really no one else.

But thanks to the Paris Agreements and the aggressive sustainable energy targets therein, demand could increase perhaps 30x to 50x that by 2050.

Hydrogen isn’t uncommon. It’s by far the most common element in the universe.

But isolating it here on earth is messy and expensive, so when someone finds a deposit of pure hydrogen, it’s a big deal.

The only currently-active deposit being mined generates areound 5 Mt per year — less than 6% of global demand. A new deposit found in France has perhaps 250 Mt, which is enough for more than two years at current requirements.

But recall demand is set to increase by up to 50x over the next 2.5 decades.

The USGS estimates there are around 100,000 Mt of hydrogen deposits that are both accessible and economical to mine.

There are a few grassroots programs to find and exploit these deposits — most notably in Australia — but none of the big energy companies have got involved yet. USGS research geologist Geoffrey Ellis:

“The big oil companies, I think, are very interested, but they’re currently sitting on the sidelines, watching, taking a bit of a wait-and-see attitude. They’re letting the start-ups take the risk – at this point, this is a highly risky venture.”

So, who’s going to be the canary down the coal mine?

Cool stuff at CES

We were promised jet packs, and we got penis pills.

But finally, CES has some cool stuff that might make me finally feel like I’m living in the future.

- My own personal aircraft

- A real-time translation device that works in meetings

- Yard robots that actually work

- A machine that creates a photorealistic realtime 3D hologram of me anywhere in the world (yes like in Star Wars)

I want all of these.

A Look at the American Consumer

Tomorrow’s CPI print will get all the headlines, but I’m going to bang my drum today about the American Consumer. How she’s doing, and what her outlook is like.

As of November 2023, Americans owe $1.314 trillion in credit card debt, up 17.7% from 2022.

That’s bad, but at least it’s publicly available info. No one knows how much debt sits with Buy Now Pay Later (BNPL) companies like Affirm.

Per Affirm’s latest 10-Q, they had $4.5 billion in consumer debt on their balance sheet, averaging over $600 per consumer. Klarna and PayPal will have more.

BNPL spending hit an all-time high on Cyber Monday, “contributing $940 million in online spending, up 42.5% from a year earlier.”

Meanwhile, Affirm saw loan delinquencies increase by 30% overall from June to September 2023 and 41.5% in the 90+ past-due category.

The company reports earnings in February, which will give us more current info, but we won’t see the fallout from Cyber Monday until May.

BNPL is a drop in the bucket compared to credit cards, but poeple have started using it to buy groceries, which has to be worrying.

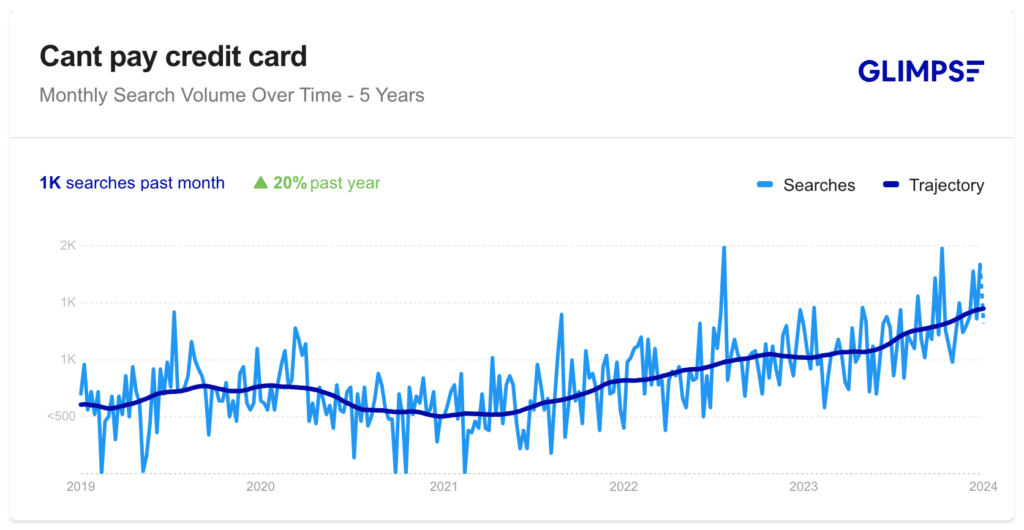

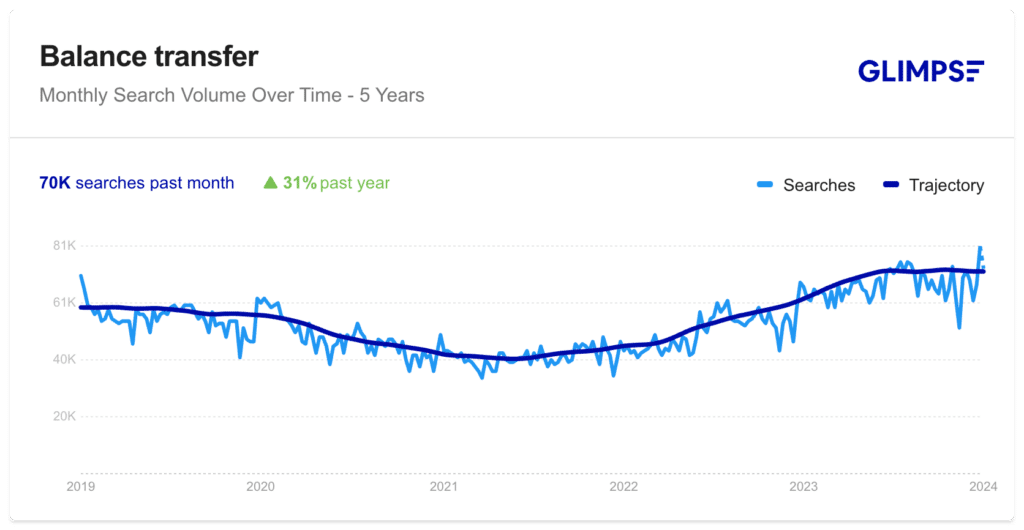

Back to credit cards. Two charts that should scare the hell out of you.

People can’t pay their credit cards, and they’re looking for a way out.

Up next, just who’s in trouble?

Where are the trouble spots? Part 1.

Yesterday I dug into the Fed’s latest survey of consumer expectations, and the detail under the surface was revealing.