Last week was a big one for Altea, our private community for alternative investors. Our second Art deal is closing and Altea’s first tequila deal is going to the lawyers. Plus two new deals for our members.

I’ve also started a running list of books I read and recommend based on my WC research. Suggestions are welcome.

Today, we’ve got:

Table of Contents

California Forever is Never

In January, I said the California Forever project is a bad idea.

It turns out that a wide majority of California locals across all political and demographic spectra agree.

California Forever appears headed for big defeat .

But the billionaires behind the “tech utopia” pulled off a true miracle in 2024: uniting Democrats and Republicans.

I got a deeper look at one of the most disastrous polls ever seen👇#networkstatehttps://t.co/SrLGyBPU87— gil duran (@gilduran76) April 15, 2024

You’ll recall the California Forever project, which involves a group of tech billionaires buying up land in California to create their own city.

The plan includes residential homes, a solar farm, public parks, and the renovation of significant infrastructure like Highway 12 and the North Bay Aqueduct. Architectural designs suggest a city with a level of walkability comparable to New York City and Paris, featuring Mediterranean architecture and streetcar infrastructure.

But locals aren’t buying what Andreeson and Co are selling.

A poll conducted by the nationally recognized group FM3 found that Solano County voters are overwhelmingly opposed to California Forever’s proposal to build a new city of 400,000 residents in a remote part of Eastern Solano County. When it comes to the proposed “East Solano Homes, Jobs, and Clean Energy Initiative” for the November election, 70% of poll participants say they would vote no if elections were held today.

The stroppy billionaires are taking things well, though.

😂 news alert: push poll paid for by the Greenbelt Alliance, an outsider group from San Francisco and Oakland whose policies have directly contributed to the housing and jobs crises that our initiative will help solve, reaches the exact conclusion Greenbelt paid them to…

— California Forever (@CAForever) April 8, 2024

If you’re interested in this stuff and how these things usually work out, check out Adventure Capitalism. Raymond Craib studied a number of these efforts over time and cataloged their successes and failures alongside the impact on local populations.

I still think this has the seed of a good idea. They’re just going about it the wrong way.

Fundraising is hopelessly outdated

This may not be news to readers who have raised funds and SPVs before, but the entire system is bonkers.

I’ve had a crash course in this, raising SPVs for members of Altea, our new private community, and I cannot believe how things work. We’re talking like pre-fax technology here, folks.

I could bore you for hours, but the two most egregious examples so far.

Over the last few weeks, we’ve done annual accounts for our Alts 1 fund. It’s not a big fund. We don’t have a million investors. It’s very very simple.

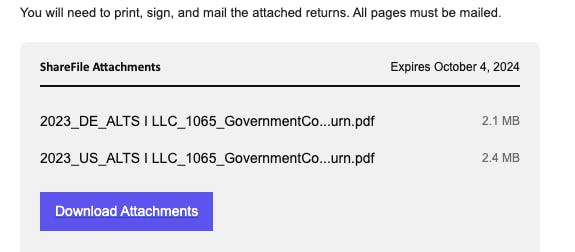

Two weeks ago, I got this note from our accounting firm’s systems manager.

The two documents are a combined 1,400 pages long. That’s not a typo.

In the year of our lord 2024, the great state of Deleware wants me to print out 1,400 pages of paper, sign two of them, and mail hard copies to their office.

I live in Spain, which is beside the point. This would be ridiculous if I lived next door to the filing office.

There is no online option. There is no fax option.

This is insane.

On or around the same day, our lawyer explained why blue sky filings are so expensive for each one of our SPVs.

Oh, it’s because every one of America’s blessed United States has its own rules and filing fees.

The costs vary widely but average around $400 per state.

In addition to being a logistical nightmare, it is a significant hurdle when trying to make deals pencil.

Alaska, for example, charges $600 per year. 2% management fees on a $10k investment pay the issuer (that’s us) $200. So, the smart thing to do would be to say no to investors from Alaska who can’t invest at least $30k.

We had to decline an investor from Tennessee who wanted to contribute $2,500 because the state charges $500 for blue sky filings.

I’m all for states’ rights and the Tenth Amendment, but you guys need to get your act together.

You can buy used Iranian missiles

Some of the 300 missiles Iran shot at Israel the other day landed in Jordan after they were intercepted.

Some enterprising locals gathered them up and listed the wreckage on OpenSooq, which is like a local Craigslist equivalent.

Al Arabiya reported on Sunday that the shrapnel was being advertised, with pieces described as “Used Iranian ballistic missile in good condition for sale,” and “One-time use ballistic missile for sale at an attractive price.”

The sellers had provided specifications and images of the missiles, describing them as “excellent type,” and mentioned their involvement in an “accident” resulting in “severe damage to the body.”

As far as I can tell, the missiles aren’t on the site anymore, but it’s unclear whether that’s because they’ve been bought or taken down by admins.

Investing in war memorabilia is nothing new, but I’ve never seen anything pop up on a resale site this quickly.

Time to go long on milk futures

Before today, I didn’t know milk futures were a thing. I guess there’s a futures market for most stuff (agaves excluded).

If the reporting I’m seeing is right, though, milk futures are about to become much more important.