Today, we’re diving into a company called Life Time Group Holdings, Inc (NYSE:LTH)

But even though the company (along with spending on gyms) has bounced back, their memberships are very expensive, and the stock is still down from the IPO.

Life Time is profitable once again. But is this “luxury fitness experience” company a worthwhile investment?

Let’s find out 👇

This issue was written by Alts contributor Jeffrey Briskin, a veteran Boston-area financial writer and marketing consultant. Jeffrey is a Life Time club member and shareholder. He’s also the author of the best-selling Biblical crime novel, Bethlehem Boys.

Note: This is a paid issue. Since you have the All-Access Pass, you get the full thing. ✅ {% else %} Note: This issue isn’t sponsored by anyone. But to read the whole thing you’ll need the All-Access Pass. 🎟️

Table of Contents

What’s Life Time Fitness all about?

I’m sitting in the café/retail store of my local Life Time fitness club in Framingham, MA at 7:30 on a Monday night, drinking a $12 smoothie.

At other tables, moms are picking away at $16 salads while their kids wolf down $20 sandwiches. A highly buffed man is paying $40 for a can of protein powder. Behind him, a sprightly senior is waiting to purchase a $35 Life Time branded T-shirt.

I’ve been here for two hours. The first hour I watched ESPN while splitting calorie-burning between a brand-new NordicTrack treadmill and an Octane Fitness recumbent elliptical. I followed that with 20 lengths in the club’s heated Olympic-sized lap pool.

After my workout, I treated myself to fifteen minutes of muscle-relaxing bliss in the large co-ed jacuzzi, followed by 10 minutes in the sauna in the men’s locker room. After cleaning up in my own private shower stall with a hotel-quality towel provided by the club, I ended my session with a post-workout treat.

Three days ago, I was on the pickleball court, matched in round-robin doubles with other players of my limited ability.

And this weekend, I’ll hit its expansive strength training circuit for a half hour before taking a free group Pilates class.

And, even as I’m trying to burn off holiday pounds in the middle of February, I’m counting the days until I can spend an hour soaking up rays in the huge outdoor pool area when it opens in May.

For all of these benefits, I pay $209 a month. It’s far more expensive than any health club I’ve ever belonged to.

And, as far as I’m concerned, membership is worth every penny.

The company survived the height of the COVID-19 pandemic, whereas many of its competitors filed for bankruptcy. That says something about its resiliency.

And the financials look pretty good right now. But to really understand the company’s potential as an investment, it’s important to understand what the Life Experience is all about.

More than a health club chain

Chanhassen, Minnesota-based Life Time Group Holdings (LTH) is a publicly traded holding company that earns most of its revenue from its network of 170 higher-end fitness centers in the US and Canada.

All clubs offer generously equipped fitness floors, group studios and luxuriously appointed locker rooms.

Many locations also offer indoor and/or outdoor pools, cafes, salons, spas, on-site childcare and special learning programs for kids. Some offer indoor and outdoor tennis courts.

For those who want to work out at home, the company also offers live streaming fitness classes and virtual personal training and nutritional consulting.

….And of course — pickleball

I know, I know… Both Stefan and Wyatt are bearish on pickleball as an investment. (And so far, they’ve been proven right)

But as a sport, it’s definitely still growing. And Life Time has embraced the pickleball phenomenon with a vengeance.

At my club, one half of its full-size basketball court was converted to four full-time pickleball courts in 2023. They’re always busy with players of all ages and levels. Private classes are held nearly every day. Multi-day tournaments are held several times a year, attracting hundreds of participants.

Membership ain’t cheap

Life Time doesn’t cater to budget-conscious consumers.

Most of its clubs are located in wealthier suburbs and major metropolitan areas, reflecting its target audience of affluent professionals and families and well-heeled retirees.

Fees tend to reflect the demographics of their region. For example, in Tulsa, Oklahoma, memberships start at $139 a month. In Walnut Creek, California they start at $299 a month.

A money-making machine

Life Time has money-making down to a science. According to its latest financial report, in 2023, total revenue rose to $2.2 billion, a 21.6% increase over 2022.

In 2023, $1.5 billion (or 72.3%) of total revenue came from membership fees, with each member generating, on average, $2,810 per year.

While access to workout facilities and most classes are included in its starting monthly fees, its higher membership tiers give you access to more “exclusive” services, such as high-powered workout and strength training classes.

Additional sources of on-site revenue

In our recent issue on the economics of high-speed rail, we talked about the importance of revenue diversification (and how Japan does this very well)

In 2023, the remaining $597 million (27.7% of revenue) came from what they cal in-center revenue. This includes:

- Food and drinks

- Apparel sales in its always-busy cafeterias/retail stores

- Spa and beauty salon sessions

- And its very popular drop-off childcare and kids’ activity centers (← Super cool, more companies should do this)

And, like most clubs, Life Time has revenue-sharing arrangements with freelance personal trainers, yoga, pilates and swimming instructors and pickleball and squash coaches who often charge between $50-$100 per hour for private sessions.

Revenue beyond its core industry

Beyond its core health club business, the company also owns a number of high-profile road and bicycle races, including:

- The Life Time Miami Marathon

- The Life Time Sea Otter Classic

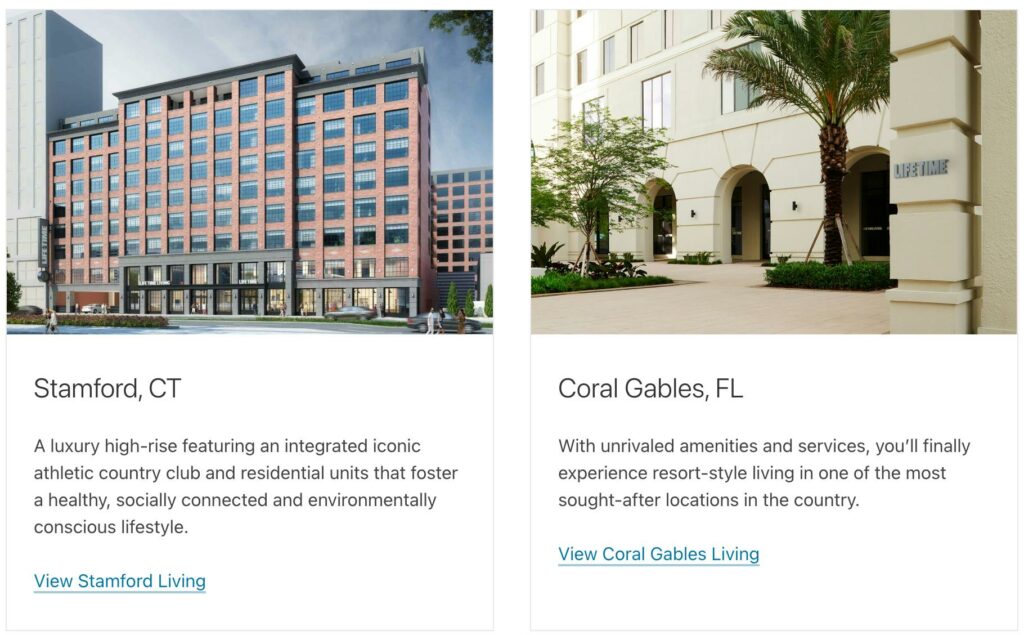

And in recent years, the company has diversified into residential real estate management, developing and leasing luxury apartment complexes abutting its fitness centers in:

- Burllington, MA

- Stamford, CT

- Coral Gables, FL

- Green Valley, NV

Finally, after noticing many members working remotely in club lobbies and common areas, Life Time has built co-working spaces at nine of their locations.

How Life Time operates

This isn’t Life Time’s first rodeo.

Life Time was founded by CEO Bahram Akradi in 1992. The company launched its first IPO in 2004, but in 2015 was acquired by private equity firms TPG Capital and Leonard Green & Partners in a leveraged buyout.

In 2021, the company braved the headwinds of the Covid pandemic and went public again under the name Life Time Holdings (LTH).

Aggressive, top down management

In spite of its many locations, Life Time employs an aggressive management style.

Whereas many other fitness chains are franchises owned by families or groups of investors whose commitment to quality can vary from location to location, Life Time is a corporate-owned and operated health club chain.

As an example, I was once a Planet Fitness member. My local club was clean and well maintained. But my experience at a center in another state was completely different. Nearly half of the treadmills and ellipticals were out of order, the locker room was filthy, and employees were surly and unhelpful.

High standards, cutthroat culture

With the prices it charges, Life Time cannot afford to let its standards slip.

According to a Life Time executive I interviewed (who wishes to remain anonymous)…