New here? Read up on our past NFT issues to get the most from this post.

May 20, 2022 | ± 6 minutes

CONTENTS:

- Our analysis of the NFT market for the year & for the week

- All you need to know about current drops

- A heads up on cool projects we think are worth checking out

- Industry news update

Let’s go!

Table of Contents

NFTs in 2022

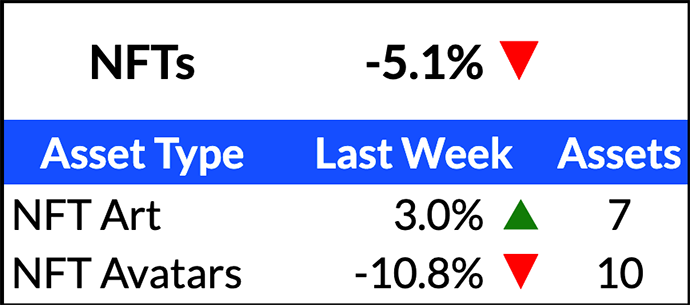

Our index shows that NFTs on the fractional marketplace are returning 20% from the initial offerings. That’s a significant drop from a week ago when the fractional markets were returning 37%, and it’s the first major move in the fractional markets since the middle of March.

Despite last week being a tumultuous one, the fractional markets did not reflect the drop in prices. This week is different. Many of the fractional offerings are inflated compared to market values. We can look at Bored Apes as an indicator.

Rally’s “Sailor Hat” Bored Ape #601 + Otherside 601 is trading at a $380k market cap. Our inferred value based on floor prices and recent comps is $205k. However, looking at the big picture, this Ape was IPO’d at $165k, so original buyers are still up on their investment.

“Leather Jacket” Bored Ape #9159 + Otherside 9159 is trading at a $283k market cap. Our inferred value is $240k. Leather Jacket’s value is being helped by a relatively valuable Otherside Deed that contains a “Koda.” “Leather Jacket” was IPO’d at $195k.

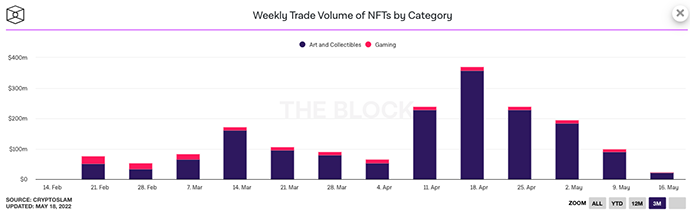

The trade volume is approaching a 3-month low. All momentum from the Otherside mint is gone, and the controversy surrounding the Azuki collection is still taking a prominent position on social media channels. However, the ‘blue chips’ are holding strong, including Azuki, which has managed to rebound from a near 7 ETH floor to now holding steady at 13 ETH.

NFT volume has dried up

— Giancarlo (@GiancarloChaux) May 18, 2022

we’re seeing $20m/day on eth compared to $128m/day average in Jan

yet many “blue chip” collections are still holding floor prices above what they were in Jan (doodles, clones, azuki, BAYC)

feels very bullish for those communities if this lasts

NFTs Last Week

NFTs on Fractional Marketplaces

NFT Art is up thanks to XCOPY’s Bottom Feeder on Otis. The asset was trading at $0.77 per share last week and went up to $0.85 with ten shares filled, then moved up to $0.94 per share with 1 share filled. The volume is still incredibly low on these assets.

The CryptoPunks are sinking in value. They are now selling for as low as $92k – $95k. About five months ago, Punks were selling on average for between $125k – $135k. They are down BIG.

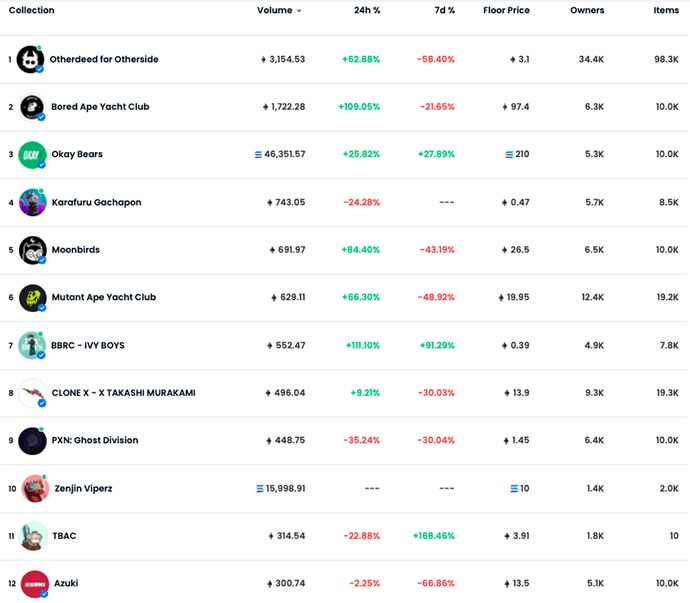

NFTs on OpenSea

The most significant part of this week’s OpenSea list is the collection that is not there. That would be the Not Okay Bears. You can’t find them on OpenSea because they’ve been delisted. But in the first three days of the collection being deployed, it had a trading volume of 3,700 ETH, more than any of the other collections on this list had in seven days.

So why did OpenSea delist Not Okay Bears? They’re essentially Ethereum rip-offs of the Solana-backed Okay Bears; which are basically rip-offs of Bored Apes, but I digress… The Not Okay Bears are left-facing, making them completely different from the right-facing Okay Bears. But OpenSea didn’t see things that way and delisted the collection, citing a violation of its terms of service.

Most Not Okay Bears holders expected the collection to be delisted at one point or another. But the project has drawn praise for donating 20% of its mint proceeds to support mental health charities and bring some fun into the space.

This has revived the issue of decentralization and the power OpenSea has to decide which collections to list and delist. That was a hot topic back when the Phunks, a left-facing version of the CryptoPunks, were also delisted from OpenSea.

In a typical NFT plot twist, it turns out the CryptoPhunks project was abandoned by one of the co-founders of Azuki.

NFTs This Week

Fractional Marketplaces

Moonbird #2754

- When: May 18 @ 12 PM ET (32% funded)

- Platform: Rally

- Market Cap: $60k

- Retained Equity: $0

- Inferred Value: $44k

- Our View: [INSIDERS ONLY]

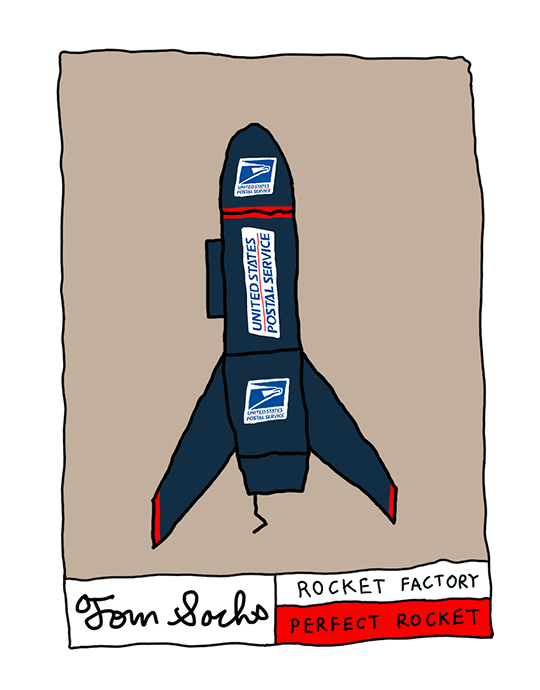

Tom Sachs Rocket Factory “Gamechanger”

- When: May 19 @ 6 PM ET

- Platform: Rally

- Market Cap: $21k

- Retained Equity: $0

- Inferred Value: $11k – $13k

- Our View: [INSIDERS ONLY]

Projects Minting

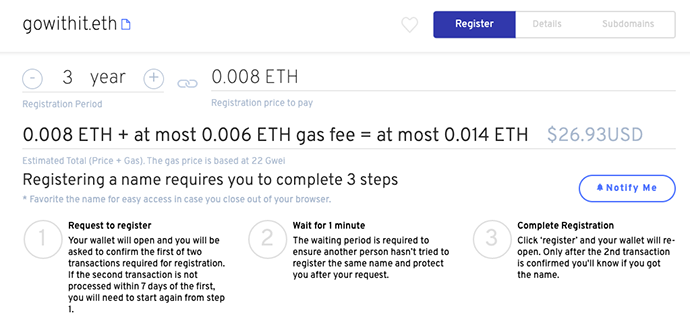

ENS Domains

Price: Varies based on registration period.

- There has been a lot of advice about investing in yourself recently. Buying rights to an Ethereum Name Service (ENS) Domain is a low-cost way to get a piece of Web3 real estate.

- You can claim your name, or something similar, to use as your Web3 identity and make easy cryptocurrency transactions.

- You can also claim “phrases” or “brand names” as small investments or a way to build on a business idea you may have.

- A lot of the best domain names are already taken, in which case you can make offers on the secondary market on OpenSea.

Here’s some extra reading on ENS domains and an explanation of the recent rise in volume mostly attributed to secondary sales of three- and four-digit ENS domains.

Industry News

- Madonna, the Material Girl, gave the world some more, uh, material to look at. She collaborated with Beeple to release a set of three NFTs depicting her giving birth to a tree, robotic centipedes, and butterflies. The NFTs used scans from her lady parts to make the art as life-like as possible. The three NFTs sold for $630k, with proceeds split between three charities.

- NFT Ethics wrote a thorough Twitter thread looking into Zagabond, an Azuki cofounder, and his ties to various people across corporate crypto. Zagabond recently attributed rugging three NFT projects as “learning experiences.” The NFT Ethics thread provides a fascinating look at some of the connections NFT founders have, especially with corporate partners, and how embedded they are in financing NFT projects and supporting an inner circle of people.

1/ We will still provide some additional information on Azuki. Zagabond himself said that he expects to be doxxed at some point and that that is fine, so we will do that. For storytelling & learning purposes of course, and to create a bridge between the physical & digital world. pic.twitter.com/ZVN2PYUJOW

— NFT Ethics (@NFTethics) May 17, 2022

That’s all for today. I hope you’ve enjoyed this week’s issue, and thanks so much for all the great feedback so far.

Is there anything in particular you’d like us to cover? Hit reply and let us know. We read every piece of mail!

Thanks,

Horacio