New here? Read up on our past Crypto issues to get the most from this post.

May 12th, 2022 | ± 5 minutes

CONTENTS:

- All you need to know about $UST TerraUSD & $LUNA Terra

- How the depegging of one of the fastest-growing stablecoins happened

- What are the risks of $UST not repegging & what’s our take

Let’s go!

Table of Contents

Looking at $UST and $LUNA

We’ve written multiple times about stablecoins and even had an entire article on them. The whole point is that they’re supposed to be stable, with very few fluctuations, so that you can count on their consistency.

TerraUSD ($UST) is no exception, and the goal of this stablecoin is always to be pegged to the US Dollar so that $1 UST will equate to $1 USD.

$UST TerraUSD

CoinMarketCap

$UST (at time of writing): $.7336

Market Cap (at time of writing): $12.87B

Twitter: https://twitter.com/terra_money

Discord: https://discord.gg/terra-money

$LUNA Terra

CoinMarketCap

$UST (at time of writing): $15.60

Market Cap (at time of writing): $5.9B

Twitter: https://twitter.com/terra_money (same as $UST’s)

Discord: https://discord.gg/terra-money (same as $UST’s)

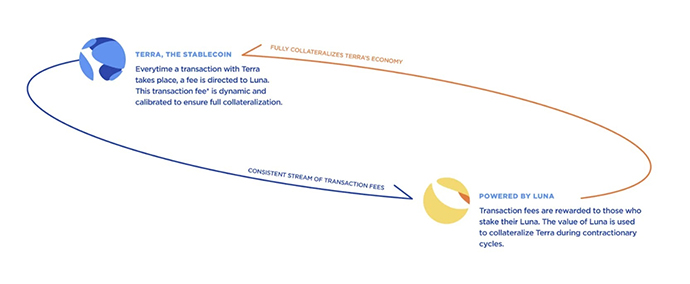

How it works

TerraUSD ($UST) is a decentralized stablecoin on Ethereum that attempts to maintain a value of US$1.00.

Unlike centralized stablecoins, UST isn’t backed by US dollars in a bank account. Instead, in order to mint 1 $UST, US$1.00 worth of TerraUSD’s reserve asset (LUNA) must be burned.

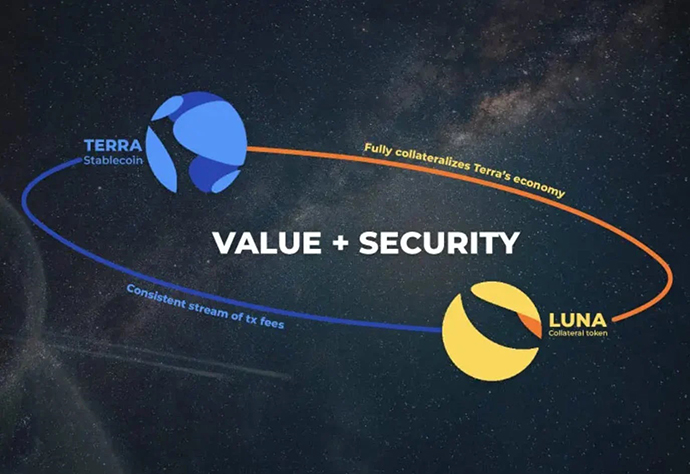

So, in a nutshell, the collateral token LUNA is responsible for the stability of Terra stablecoins and vice-versa.

It’s also critical to know that $UST and $LUNA are both projects of Terraform Labs, headquartered in Korea, but it’s the job of Luna Foundation Guard (LFG) to keep the stablecoin pegged to $1.00.

Depegs do happen, but there was only one brief instance of a 5% fluctuation for the past year, and while this isn’t ideal, it wasn’t a big problem.

Here is $UST to $USD in the past year from CoinMarketCap.

Due to the mechanics of $LUNA and $UST, they have an incestuous relationship – one cannot succeed without the other. We won’t dive too deep into the mechanics of it, but essentially, here is how $UST is stabilized:

- When $UST goes above $1.00 USD, more $UST can be created by burning $1.00 USD worth of $LUNA token for each new $UST.

- When $UST goes below one dollar, $UST can be burned for $LUNA token.

In short, the goal for $UST is to be pegged to $1.00. The more $UST that is in circulation the higher the value of $LUNA goes. This is because having more $UST in circulation shows that investors have confidence in $UST and the entire Terra ecosystem.

Again, the exact mechanics are complicated to explain and understand, but if you’re interested in learning more, we encourage you to read the whitepaper.

How the depegging happened

- On May 7th, over $500M in different cryptocurrencies was withdrawn from Anchor, leaving just $300M of liquidity to support $14B in $UST, which had been deposited in Anchor.

- $UST holders withdrew $3.8B $UST from Anchor, which caused $LUNA to drop 10%

- More holders withdrew $UST, and one individual off nine figures of $UST on Binance.

- Terra tries to restore balance, but this drives down the value of $UST further.

- On May 8th, $UST is replenished by holders and those still confident in $UST. LFG lends out $1.5B in $BTC to keep $UST pegged

- On May 9th, $UST goes as low as $0.65, showing a major loss of confidence. Terra then deploys all of its $BTC reserve, but the $UST price stays down.

This sent the crypto world into chaos. Mashable.com used a good comparison that might help understand the scale:

Imagine the USD losing purchasing power in a matter of hours or minutes. The bagel that cost $3 this morning is $4 in the afternoon, and the amount of dollars in your bank account hasn’t grown to match this discrepancy … Anyone who counted on UST being valued at $1, e.g. someone lending UST on a decentralized finance protocol, is in trouble.

What if $UST doesn’t repeg?

TerraUSD has a market capitalization of roughly $16.7 billion (the number should be over $18 billion, but the anomaly is due to the UST currently being valued below $1). It’s one of the biggest stablecoin projects in crypto, so, naturally, when its value plummets, everyone is affected.

Many argue that the crash of $UST and $LUNA might be responsible for bringing down the whole market:

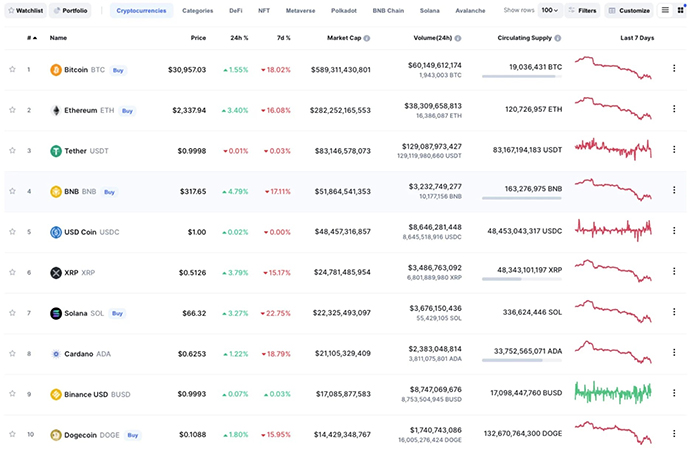

Stablecoins are critical to the cryptocurrency world, allowing people to swap $BTC and other coins for stablecoins without cashing them in for fiat, potentially avoiding taxes and government tracking. So if a currency as popular and widely used as $UST fails to repeg, this will certainly affect other stablecoins and defi negatively.

3 of the top 10 coins by market cap are stablecoins:

It appears Terra is working on a deal to raise cash from institutional investors to help restabilize the peg sooner. It doesn’t seem like $UST will be able to repeat without additional help, and LFG might be looking to raise capital to return its peg.

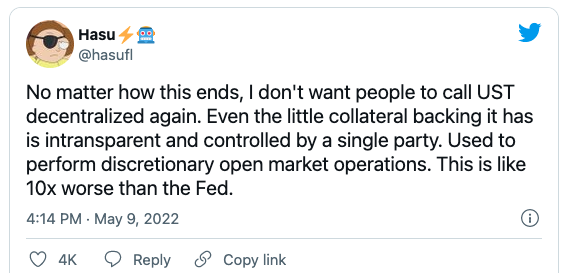

The fact that LFT, a single entity, is responsible for returning $UST to its peg, gives an argument for the fact that $UST is not actually decentralized:

Wrapping up

While it’s too early to tell with certainty what the future holds, the crypto world at the moment is in a precarious position that could have a tremendous short-medium term negative impact. While cryptocurrency prices could certainly go lower, we think the bottom might be here, presenting one of the best buying opportunities in a year:

That’s it for this week’s Crypto Insider. Did you find it useful?

If you have any questions or would like to discuss anything about this issue (or about crypto in general), please don’t hesitate to head over to my Twitter, where I can respond to all of your questions, comments and suggestions. Just @ me – seo_colinlma, and click Follow if you like what you see.

Thanks, Colin