Today we’ve got an issue on Sovereign Wealth Funds (SWFs). These funds are back in the spotlight this week, after the shocking announcement that the PGA Tour is merging with rival LIV Golf.

LIV Golf is backed by the Saudi Arabia Public Investment Fund — the massive, controversial entity controlled by Saudi Crown Prince Mohammed bin Salman, which has been embroiled in lawsuits and claims of sportswashing.

In this issue we explore the world’s largest Sovereign Wealth Funds — why they exist, how they operate, what they invest in, and a bunch of interesting facts.

Let’s go 👇

Table of Contents

What are Sovereign Wealth Funds?

Sovereign wealth funds (SWF) are investment funds owned and operated by a national government.

These state-sponsored institutional investors answer only to the state, and make investments according to the interests and mandate of that country.

70 countries operate over 100 sovereign wealth funds. Together, these funds oversee more than $10 trillion in assets — a staggering 11.4% of the World GDP.

SWFs allow national governments to diversify their income by investing in foreign bonds, stocks, direct investment projects (like how China builds infrastructure for Africa), hedge funds, real estate, and other alternative investments.

These funds are typically established when a country has a surplus from commodity exports (like selling oil & gas.) This is how Saudi Arabia, Norway, and China’s funds started.

But these funds are secretive and mostly unregulated. They sit at the complex intersection of finance and geopolitics, representing what is, perhaps, the peak of globalization.

Why do countries need Sovereign Wealth Funds?

It started in Kuwait.

In 1953, the wealthy emirate became the first country to establish a sovereign wealth fund. Since then, SWFs have been at the center of global curiosity and apprehension.

They exist in the gray area between profit-maximizing corporate asset management, and clandestine government agencies furthering the political agendas of their respective countries and leaders.

The reason for their existence is simple: Just like with personal finance, it makes no sense for a country to leave excess cash lying around.

As an individual, when you have a surplus left over each month, you know it’s wise to invest it into assets that provide a reasonable rate of return.

Well, countries are no different.

When a national government has a current account surplus, they typically seek to invest the extra cash in productive assets rather than just leaving it untouched in a government treasury. (Not all countries believe this. Germany famously — or infamously, depending on your point of view — has the largest surplus in the world.)

But why not spend the extra cash on public services? Why not invest in education, healthcare, defense, infrastructure, social services, arts, or the million options available?

It boils down to two things: diversification, and the time value of money.

Diversification

If there’s one thing history has taught us, you never want to rely solely on a single source of income, no matter how lucrative it might be.

This rule applies to individuals, companies, and yes, even countries. You don’t want to be a slave to a single source of revenue. The goal is to be dynamic.

There’s a reason the largest sovereign wealth funds are from the big oil-exporting countries (Kuwait, Saudi Arabia, UAE, Norway, and Qatar). Their heavy reliance on natural reserves leaves them vulnerable during periods of low oil and gas prices. For example, the oil price plunge of 2014 drove Venezuela into an economic crisis from which it never recovered.

To prevent a similar fate, countries establish these funds to diversify their revenue streams and reduce their exposure to falling oil prices.

Alternatively, East Asian countries like China, Japan, and Singapore have established sovereign wealth funds financed from currency reserves and current account surpluses to build a bigger pension pot for their rapidly aging populations.

In a way, it’s another form of defense spending — defense against an uncertain future.

Time value of money

The other reason is simple: the time value of money.

This concept should be familiar to everyone. Governments understand that the sum of money now is worth more than the same sum in the future. There’s a large opportunity cost to not investing in foreign assets that can compound faster than domestic ones can.

It may be difficult to stomach, but governments would often rather invest in lucrative assets that will serve them well in the far future, than invest in social services with more direct, tangible benefits today.

Which countries have the largest Sovereign Wealth Funds?

The top ten largest funds are from the countries you’d expect: Mainly resource-rich countries with more money than they know what to do with.

- Norway Government Pension Fund (Norway, $1.3 trillion) 🇳🇴

- China Investment Corporation (China, $1.3 trillion) 🇨🇳

- SAFE Investment Company (China, $1 trillion) 🇨🇳

- Abu Dhabi Investment Authority (UAE, $853 billion) 🇦🇪

- Kuwait Investment Authority (Kuwait, $750 billion) 🇰🇼

- GIC Private Limited (Singapore, $690 billion) 🇸🇬

- Public Investment Fund (Saudi Arabia, $650 billion) 🇸🇦

- Hong Kong Monetary Authority Investment Portfolio (Hong Kong, $514 billion) 🇭🇰

- Temasek Holdings (Singapore, $496 billion) 🇸🇬

- Qatar Investment Authority (Qatar, $475 billion) 🇶🇦

Let’s dial in on two of these: Norway and Saudi Arabia.

Norway 🇳🇴

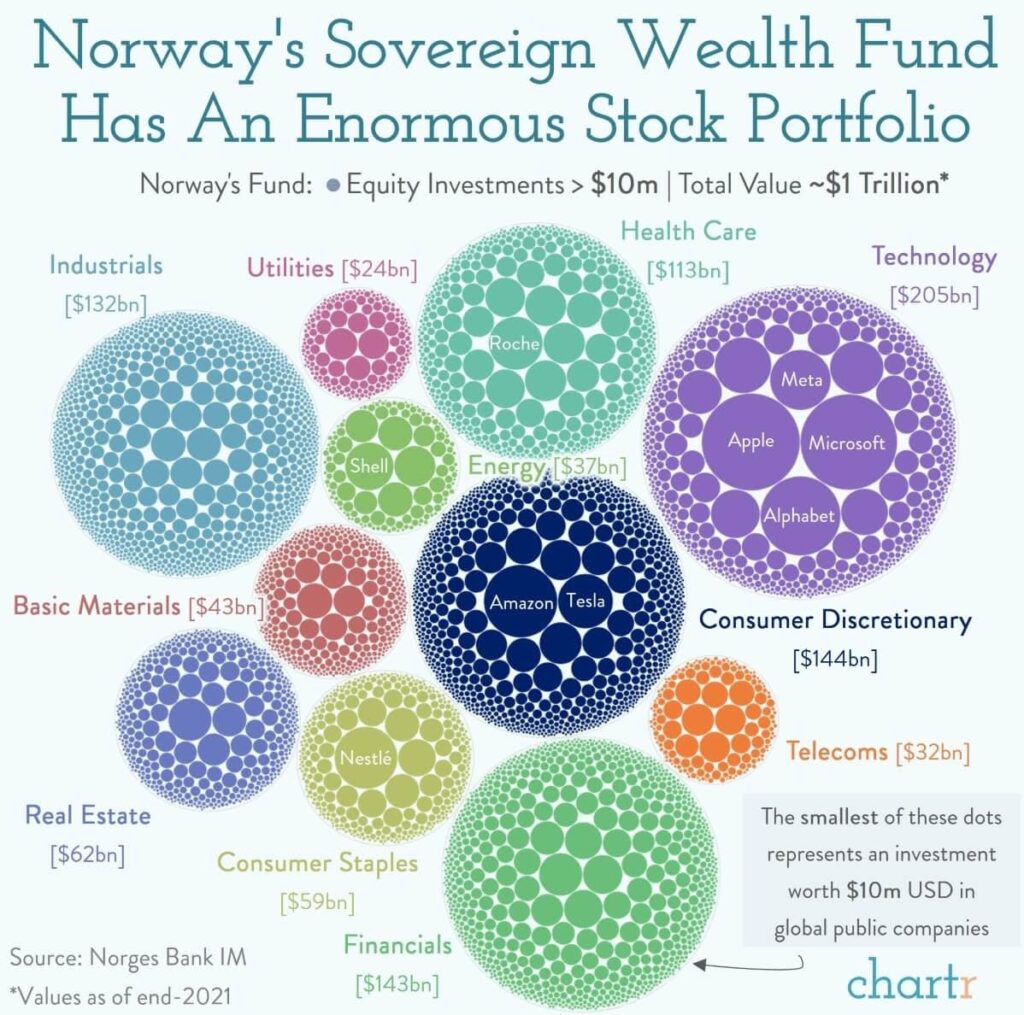

Norway’s Government Pension Fund (NGPF) is the world’s largest SWF, with over $1.3 trillion in assets. Norway is also the only country in the top 10 not located in Asia or the Middle East.

It was established in 1990 to invest the surplus revenues of the Norwegian oil & gas sector. Today, more than half of the fund’s net value comes from the return on its investments, rather than deposits into the fund. This gargantuan, oil-fueled (pun intended) fund is worth about $250,000 for each Norwegian resident. But the money can only be used in retirement.

The fund takes pride in responsible investments and chooses not to invest in companies that “violate fundamental ethical norms or impose substantial costs on society.”

Norway recently announced that it would require all companies it invests in to reach net-zero emissions by 2050.

As our friends at Chartr put it:

The irony that a fund built on oil and gas revenue is now pushing for net-zero is hard to ignore. However, as one of the world’s largest investing entities, the Norwegian fund can exert genuine pressure on major companies to clean up their act — or see their shares dumped.

Saudi Arabia 🇸🇦

Saudi Arabia’s Public Investment Fund (PIF) is worth $650 billion.

It may not be the biggest, but it creates more headline news than any other SWF by far.

Their investments are all over the place; increasingly defined by enormous, high-profile bets across sports, entertainment, technology, urban planning, and culture.

As Wyatt wrote about earlier this week, they’re getting their hands into a lot more than just LIV Golf:

- Back in 2016, they infamously invested $3.5 billion into Uber

- Last year, they took a controlling stake in Magic Leap

- They control Newcastle United in the English Premier League

- They poured a billion dollars into Fanatics

- They’ve acquired the four most dominant clubs in the Saudi Pro League. (Collectively, these four teams have won 23 out of the past 25 years)

- Real Madrid star Karim Benzema just signed for reigning Saudi Pro League champions Al Ittihad. And seven more stars are on the Kingdom’s radar this summer.

In addition to luring top athletes and increasing market share, many call this an attempt at sportswashing; a way for Saudi Arabia to improve their public perception and bury their human rights record in the sand.

Wyatt continues:

In addition to locking in high-profile spokesmen ahead of the 2030 World Cup bid, the ambition here feels bigger than domestic dominance. Because regardless of how many aging stars Saudi Arabia can lure to the SPL, no one’s going to watch the matches. Unless… UEFA (Europe’s governing body for football) holds the world’s biggest international football competition — The Champion’s League. So if I’m Saudi Arabia, maybe now I can convince UEFA to let me join? Nearby Israel, Turkey, and Cyprus are all members. Why not me? That would give the four privatized clubs — and the stars the PIF is luring in — a massive global stage. All in service of the Kingdom’s larger ambition for legitimacy.

How do SWFs work?

The way a SWF invests depends on its purpose.

There are three categories: Stabilization funds, Pension funds, and Strategic Development funds.

Stabilization funds

The most common type of SWF, stabilization funds are built by national governments trying to prevent a fate such as Venezuela’s.

In other words, these funds are designed to shield the country against unforeseen economic shocks, such as a sudden fall in the price of oil and gas, international sanctions, or internal political turmoil.

For instance, Russia’s massive $175 billion stabilization fund, known as the National Wealth Fund, has been used to cover the budget deficit and keep the economy afloat amidst Western sanctions and the rising costs of the ongoing war in Ukraine.

As of October 2022, the Russian government drew more than $16 billion from the fund to finance its budget deficit, in addition to the $22.7 billion set aside to replace foreign planes with domestic models. (Sanctions have made it hard for Russia to acquire the spare parts needed to repair foreign aircraft)

Pension funds

Many Asian countries like Japan, China, and South Korea struggle with a shrinking workforce, falling birth rates, and a large elderly population. So, they’ve set up pension funds to cater to the needs of those who’ve either already aged out of the workforce or will do so shortly.

After retirement, they’ll need money, healthcare facilities, and other government assistance. Without a sovereign wealth fund to bear some of the financial burden, these expenses will take a massive toll on the government’s budget in the coming years.

Most East Asian pension reserve funds are non-commodity-based, and were largely built from trade surpluses. Japan’s sovereign wealth fund, in particular, is the world’s largest retirement savings pool.

Strategic Development Funds

Governments set up strategic development funds to achieve lofty national development goals (like building huge transportation or energy infrastructure projects).

The goal is to make job-creating investments within a country. Instead of investing in foreign assets, strategic development funds invest at least half their funds into domestic firms and industries.

The UAE’s Mubadala Investment Company, or MIC is a great example. It invests heavily in key sectors like renewables and aerospace, which greatly impact on the country’s strategic and development goals.

Khaldoon Al Mubarak, the CEO and Managing Director of MIC, invests in projects that align with the UAE’s strategic priorities. For instance, MIC has even invested $50 million+ in renowned Israeli cyber weapons developer NSO group.

Failures and corruption

Most people would agree that if you can make a reliable return on government cash reserves, then investing at least part of it is a good idea. After all, you want your country’s cash put to work for you. And if the government can earn a significant portion of its revenue from international investments, there’s far less need to raise taxes.

The question at the heart of all SWF discussions is: Can citizens really trust their government to manage investments made on their behalf?

In the case of Venezuela, their fund never even got off the ground.

Venezuela 🇻🇪

One of the reasons for Venezuela’s current troubles is that, after discovering vast oil reserves within their country, the Venezuelans never created a sovereign wealth fund like other rich petrostates. The reason why is simple: the government was perceived as being too corrupt to do so.

Citizens felt the risk was too great that the funds would simply be used to further enrich and solidify the ruling elite’s power. Not only did Venezuelan politicians not have the trust of the average citizen, they didn’t even trust each other enough to allow the creation of a multi-billion-dollar fund that would be controlled by whoever was in power at any given time.

As a result, Venezuela’s oil revenue was channeled directly into government spending, leaving the country massively vulnerable to oil price fluctuations which eventually led to its downfall.

Turkey 🇹🇷

President Erdogan of Turkey (now called Türkiye) took control of the country’s Sovereign Wealth Fund in September of 2018 and, despite the use of major public assets in its transactions, promptly exempted it from public auditing.

There is now extremely little transparency and accountability into where the money flows. This is precisely the type of thing Venezuelans were afraid of.

Malaysia 🇲🇾

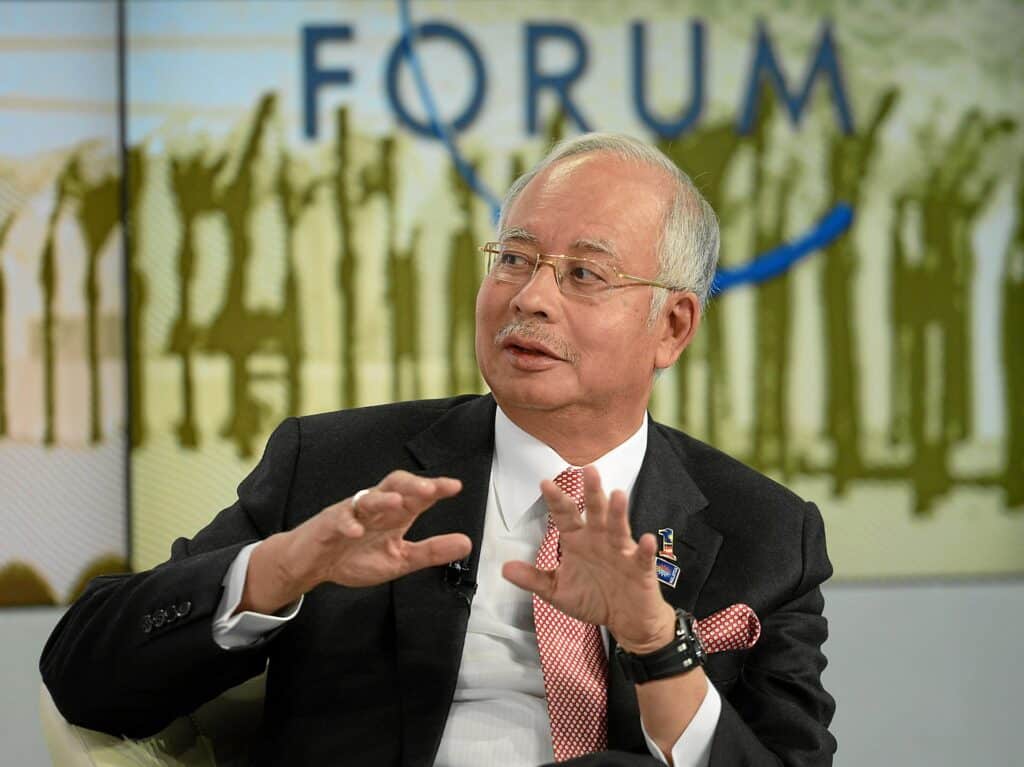

Corruption in Malaysia led to their sovereign wealth fund — the 1Malaysia Development Berhad (1MDB) being systematically embezzled by prominent politicians and bankers for years.

The scandal finally came to light in 2016, when former Prime Minister Najib Razak was accused of channeling $700 million from the Malaysian sovereign wealth fund into his personal bank accounts.

He was convicted and sentenced to 12 years in prison: Malaysia’s first PM to ever be convicted and jailed for corruption.

Closing thoughts

Sovereign wealth funds don’t get discussed as much as they should. Which is interesting, because a) they now account for 11%+ of global GDP, and b) the funds themselves invest in all sorts of things outside the mainstream: startups, real estate, sports teams, sports leagues, and even entire cities.

Ever heard of “The Line” in Saudi Arabia? Take a wild guess who’s funding it!

However you feel about Saudi Arabia’s PIF, one thing’s for sure: It’s putting Sovereign wealth funds on the front & center stage of international investing.

Countries can manage excess cash the same way a well-run company does; diversifying revenue sources and making smart long-term investments to provide an effective buffer against the vagaries of economic booms and busts, while also promoting the growth of domestic industries.

Some believe that their SWFs give rulers an outsized influence on international politics and economic cycles. A lot of criticism is levied towards SWFs because of their low levels of transparency and regulation.

Ultimately, whether or not a sovereign wealth fund is successful depends largely on how much trust the average citizen has in the government.

Countries that do it wrong will go the way of Malaysia or even Venezuela, watching their nation’s wealth systematically siphoned off by a handful of self-serving elites.

But Norway and Japan have shown that SWFs can be a very good thing. At their best, sovereign wealth funds can have a positive impact not only on the origin country, but on the world as a whole. 🌏

Further reading

- 🇺🇸 You may be wondering about America. Incredibly (or perhaps not, depending on your point of view) The United States does not have a Sovereign Wealth Fund.

- However, it has a few state-owned funds, including the Alaska Permanent Fund, which we’ve written about in detail.

- MoneyMaze has had a few Sovereign Wealth Fund managers on their podcast recently: 🇫🇷 Nicolas Dufourcq, who is the GM of the French Sovereign Wealth Fund, and 🇦🇺 Ben Samild, who is the Deputy CIO of Australia’s.

- 🇳🇴 I enjoyed this discussion: Norwegian Sovereign Wealth Fund CIO Nicolai Tangen interviews Stan Druckenmiller

- The Santiago Principles were established by the International Forum of Sovereign Wealth Funds. They’ve helped refute some of the fears regarding the growing geopolitical clout of SWFs. The principles were designed to ensure that the world’s largest SWFs are governed with transparency, accountability, and fiscal prudence.

- 🇬🇧 Britain’s leading asset managers created a $63b Future Growth Fund to invest in high-growth technology and biotech firms. The goal is to stem the flow of technology firms that snub London for New York

- 🇧🇷 Brazil’s ex-Economy Minister Paulo Guedes is launching the Green Brazil fund. He aims to attract domestic and international investments in Brazil’s energy transition, natural resource preservation and industries tied to renewable energy.

- 🇮🇹 Italy is planning a state-backed fund to promote AI startups (Yes, the same Italy that banned ChatGPT)

Disclosures

- We have no investments in any companies or entities mentioned in this issue. There are no affiliate links in this issue.

- Wyatt and I have not yet convinced the Saudis to invest in our ALTS 1 Fund.