You may have noticed that investing in shares of pre-IPO startups has been on our mind lately.

There’s a good reason for it. Private startups have a potential for wealth generation that public companies simply can’t match:

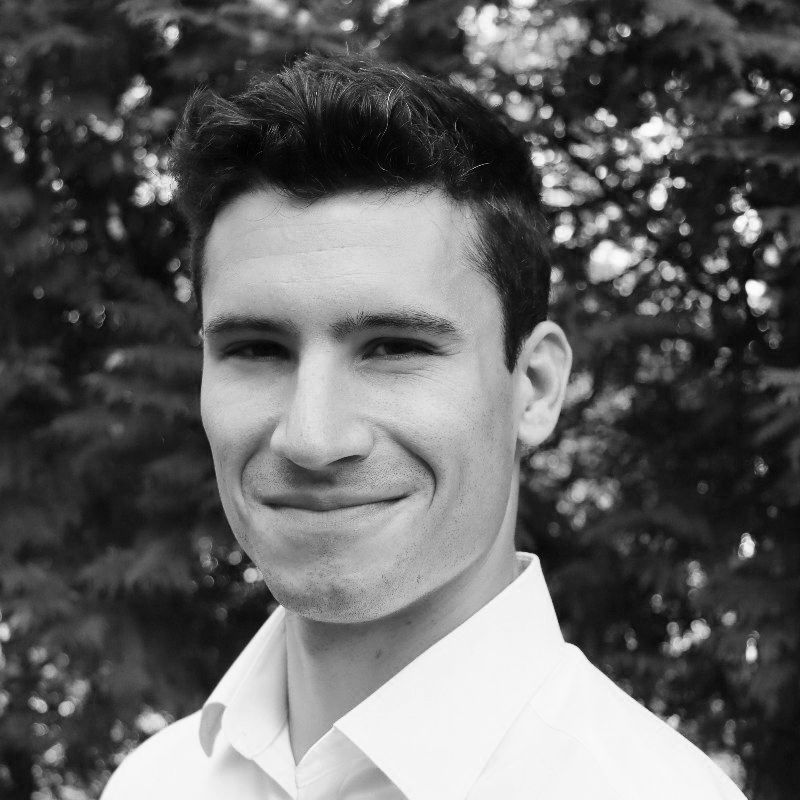

- Historically, investors who participated in a venture round of an company that IPO’d have received avg annualized returns from 50-100%.

- But for investors who purchased shares on the first public trading day, the average return shrinks to almost nothing (and often goes negative)

In years gone by, world-changing companies like SpaceX, Stripe, and OpenAI would already be public by now.

(Remember, Google’s massive IPO took place just six years after its founding, younger than all three companies listed.)

But with companies staying private for longer, everyday investors have basically lost access to venture-backed startups. Only wealthy, well-connected individuals and platforms can get access.

You could argue the best solution here its to create a publicly-traded fund for pre-IPO shares. Shares that you can buy through your brokerage account. Shares that anyone can invest in…

And there’s only one company doing this: They’re called Destiny, and they’re the subject of today’s issue.

This issue is free, and sponsored by our friends at Destiny. As always, we think you’ll find it extremely informative, and very fair.

Let’s go 👇

Table of Contents

Why private stock markets don’t cut it

Traditionally, investing in secondaries through private stock markets has been one way to bridge this gap. But there are a few reasons to think this isn’t really the best solution for investing in private companies.

On the surface, building a “stock market for secondaries” seems like an excellent way to let investors access late-stage, venture-backed companies.

But this approach doesn’t solve some of the fundamental problems with investing in private companies.

Accreditation restrictions are a huge issue

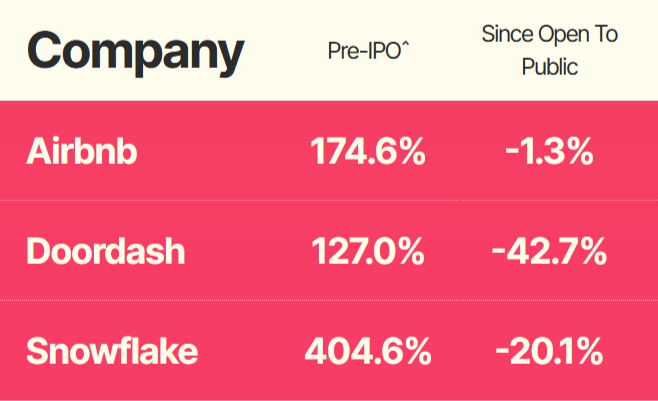

A private stock market might make it easier to trade secondaries, but these platforms can only be used by accredited investors (typically those with an income of $200k+ or net worth of $1m+)

Since qualification as an accredited investor is the fundamental legal restriction barring most people from purchasing private investments, secondaries markets can never be a universal solution.

Private companies aren’t easy to vet

Vetting promising startups and deciding which ones to invest in is literally a full-time job.

Despite this, everyday investors are pretty much expected to fend for themselves in private markets — and often with almost no financial statements or company material to actually analyze. (After all, private companies don’t have the same disclosure and reporting requirements as public ones)

Diversification is very challenging

In private markets, you usually need to invest $10,000 or more.

Some platforms focusing exclusively on transactions in the range of $50,000 – $100,000+.

What’s more, some high-demand investments (like say, SpaceX) can be assigned custom minimums, often reaching up to $1 million. And brokerage commissions to close these deals can be 5% or more.

That makes assembling a suitably diverse portfolio of secondaries an expensive task. Most investors don’t do this, and end up over-concentrated in just a few companies.

Liquidity is still pretty rough

Finally, even though private markets improve liquidity for startup shares, secondary shares still don’t trade very often. This means it’s hard to track their current value, let alone cash out.

Clearly, private secondaries markets are far from perfect. Using them only makes sense for a specific kind of investor: one who is: active, rich, and ultra-hands-on.

Thankfully, in a few short months, investors are getting access to a better option — DXYZ.

D/XYZ (Destiny): A breakthrough company

DXYZ will be the first public, exchange-listed portfolio of hand-picked venture-backed private technology companies (!)

For the first time, investors can get access to the late-stage startups like SpaceX, Stripe, and OpenAI on the public markets.

D/XYZ (pronounced Destiny, the actual team behind this) is planning to list this offering on the New York Stock Exchange in March 2024 under the ticker DXYZ.

And considering that founder Sohail Prasad literally founded and led a private secondaries market (Forge), DXYZ is clearly informed by the shortcomings of that model.

Destiny’s approach

No accreditation restrictions

It’s a public product, after all.

Everyone can participate — no wealth barriers. (Huge!)

No minimums

Unlike the restrictive minimums of private secondaries markets, you can invest pretty much whatever you want in DXYZ

This is basically the only way to invest in SpaceX with your spare cash.

Plus, making automated investments through a brokerage account is way easier than through a secondaries market, allowing you to make private investing a recurring part of your strategy.

Strictly vetted companies

DXYZ has some specific eligibility criteria for companies to be included in the portfolio, including:

- Venture-backed

- At least $50 million in investment by reputable US institutions.

- Sound financial structure, including healthy liquidity and no burdensome debt.

- No unusually high executive turnover or other cultural red flags.

- And no risky foreign legal structures. (Looking at you, Chinese VIEs…)

Broad portfolio construction

Instead of needing to assemble a broad portfolio piece-by-piece, DXYZ investors can get access to a mix of venture-backed startups with just one purchase.

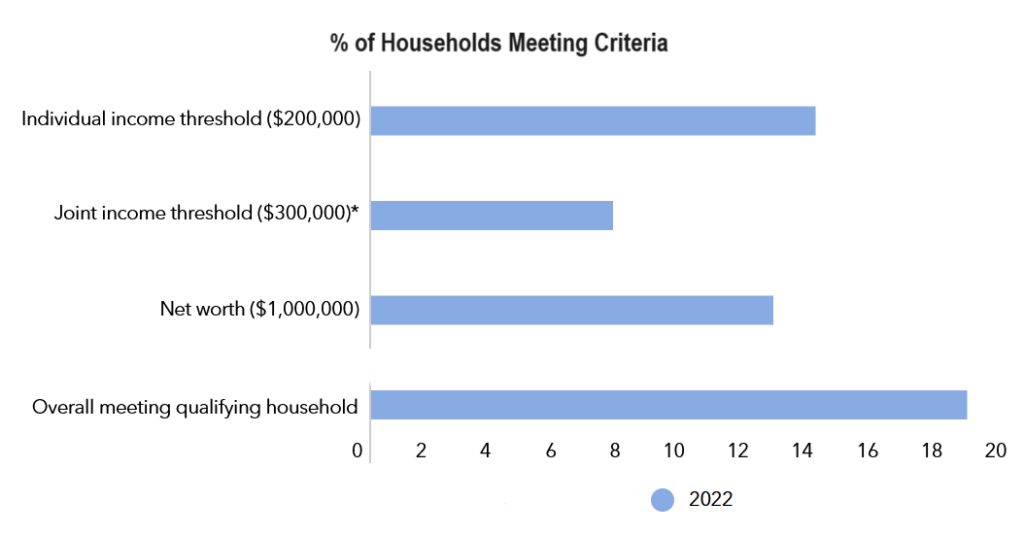

The current portfolio includes 23 late-stage companies from a range of industries (although the team eventually hopes to build that up to 100)

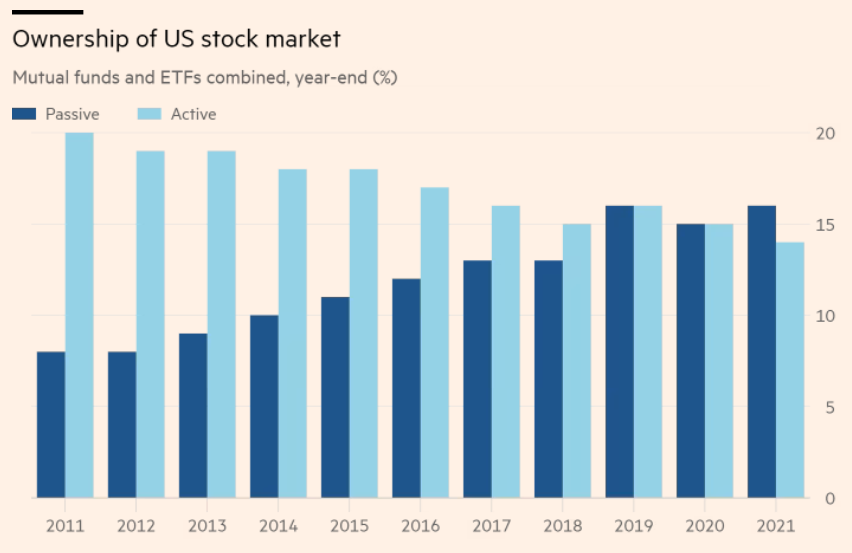

This approach is closer to the passive, index-oriented style of investing that many investors prefer, especially as active stock picking has fallen out of favor (although DXYZ isn’t actually designed to follow an underlying index).

Strong liquidity (finally!)

By virtue of listing on a centralized public market like the NYSE, DXYZ will have vastly increased liquidity when compared to the underlying companies.

Not only does this make it relatively easier to liquidate your position than in private markets, but it allows you to better track the market value of your shares over time — meaning you actually know how much your investment is worth.

Does DXYZ have competition?

Here’s the thing: the whole fund-based approach has actually been tried before, with a number of investment funds promising access to a portfolio of private companies or startups in some form.

These include The Private Shares Fund, the Fundrise Innovation Fund, and the ARK Venture Fund).

How does DXYZ stack up to these direct competitors?

DXYZ is truly public

DXYZ is the first of these fund offerings to actually be a publicly listed fund — as opposed to industry-standard interval funds, which have investment minimums and only allow quarterly, partial cash-outs (usually only 5% of your shares can be redeemed per quarter.)

The Private Shares Fund, for instance, has a $2,500 minimum investment and only offers liquidity on a quarterly basis.

In contrast, the minimum investment in DXYZ is just the cost of a single share (launching at a nominal price of $8, not including any brokerage fees) and you can sell shares daily on the exchange (assuming, of course, that there’s sufficient demand).

Having the choice to liquidate by selling shares isn’t just good for investment optionality, but also for peace of mind.

Only private & proven companies are included

Pretty much all of DXYZ’s competitors hold “private” shares in their funds. But there’s no consistency regarding what that means, nor what portion of the fund is actually private.

DXYZ is clear that their fund is only interested in the “top 100 venture-backed private technology companies” on the market.

Other funds vary, with portfolios including everything from public to private companies and early-stage to late-stage startups.

If you’re interested in either ultra-early-stage or public companies, DXYZ probably isn’t for you.

But just understand that by focusing on a curated subset of private companies, the DXYZ portfolio is far more tailored than other approaches.

DXYZ isn’t just secondaries

Lately, there’s been unprecedented market activity in capital raises for secondaries funds.

As we’ve seen, investing in individual secondaries is one way to access private startups. A secondaries fund takes this a step further, aggregating these shares into a portfolio.

That might seem similar to DXYZ, but there’s a crucial distinction here — secondaries funds restrict themselves to purchases on the secondaries market only, meaning their investment choices are inherently limited to what that market is offering.

While DXYZ does gather some underlying shares through the secondaries market, it also accrues positions through other sources, including primary venture rounds, forward contracts, and special purpose vehicles.

This flexibility allows DXYZ to pursue the best overall investment terms, regardless of source.

Fees are lower than industry standards

Once listed, DXYZ will have a management fee roughly equal to an annualized rate of 2.5% of the fund’s assets (there are some technicalities to how that’s calculated and paid, see here for more detail).

That might sound high relative to traditional exchange-listed products, but it’s actually quite a bit lower than the industry standard for funds that hold private investments.

Hedge funds, for instance, usually operate with the infamous 2 and 20 fee structure – meaning a 2% management fee and 20% cut of performance.

(Our ALTS 1 Fund is lower still — it’s a 1 and 20 model. But in recent years, some venture capital firms have even pursued a 3 and 30 model. Ouch!)

But DXYZ doesn’t charge a performance fee at all, in line with their mission to put growth back in the hands of investors.

Moreover, their management fee is lower than many competitors, including ARK Venture’s 2.75% fee.

Now, despite these advantages, the DXYZ model is not flawless – if you’re launching something new, you’re bound to run into some challenges.

DXYZ is still a closed-end fund

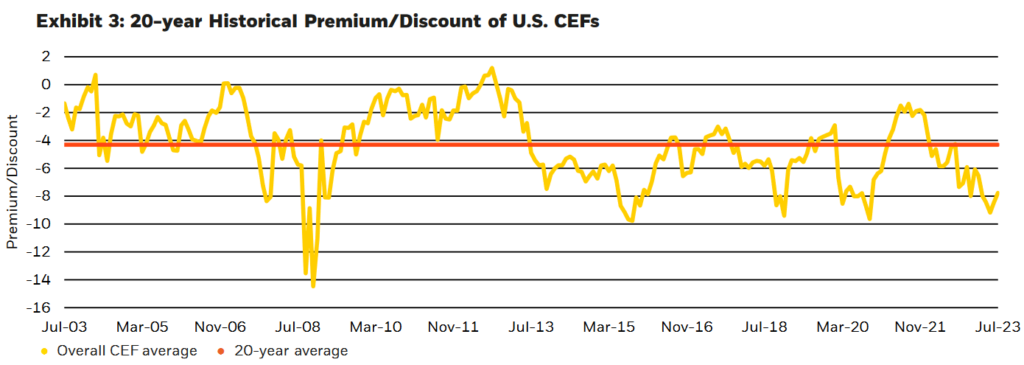

DXYZ might not be an interval fund, but it doesn’t work exactly like a standard ETF either.

In particular, DXYZ is a closed-end fund, not an open-end one.

What’s the difference?

The details of what that means are a bit technical, but here’s what it boils down to: the trading price of closed-end funds like DXYZ can occasionally deviate from the asset value of the underlying portfolio based on supply and demand dynamics, resulting in a premium or a discount.

But this might not be a challenge that lasts forever.

The team could potentially explore a potential share repurchase program, which could involve trading on the open market to keep the price in line with the underlying portfolio value.

Moreover, the underlying portfolio value is transparently determined by an independent valuation committee and filed in an official SEC report.

DXYZ has greater overhead

Finally, DXYZ simply has greater costs than their competitors.

The fact is, DXYZ is doing something with no precedent in the financial industry – and that means higher operational, regulatory, and legal overhead than pursuing a well-trodden path.

Those higher costs are indicative of the challenges the team had bringing DXYZ to market – but also the opportunities that this new structure creates.

How did they bring DXYZ to life?

Before founding D/XYZ, Sohail Prasad spent six years founding and running Forge, a global secondaries marketplace.

But Sohail’s inspiration to move beyond secondaries actually came from a surprising place: a conversation with his dad at Sohail’s childhood home in Texas.

When his dad asked him which startup’s shares he should invest in, Sohail realized that the answer was probably none of them.

After all, investing in startups through secondaries came with high minimums, concentrated risks, and poor liquidity – not exactly ideal for the average investor.

That’s when Sohail realized that a diversified, public, and low-cost way to invest in startups needed to happen – whether or not he would be the one to do it.

Why didn’t a big bank build this?

Even though Sohail had identified the problem, the solution was basically brand-new, requiring the use of existing regulation in a novel way.

That meant this wasn’t something that could be built within Forge, which had its own regulatory and operational limits to consider.

But despite Sohail advocating for its creation, major partners weren’t interested in building a publicly-listed portfolio of private firms, due to a combination of profit motivation and institutional inertia.

In conversation with Alts, Sohail said:

While at Forge, we fully expected someone to build this product. We waited in vain for half a decade. Peers with the pedigree to access top late-stage companies decided to instead raise their own venture capital funds or set up SPVs — relative to DXYZ, both paths subject a party to less stringent reporting requirements and offer the upside of carried interest (i.e. profit-sharing fee) of 20% or greater.

– Sohail Prasad, founder of Forge and DXYZ

In fact, the closest Sohail ever got to realizing his new vision within Forge was a partnership with leading French bank BNP Paribas to list structured notes tied to the performance of private startups.

If you want something done right…

Eventually, Sohail realized that if no one else was going to build this, he’d need to do it himself.

In 2020, Sohail took a step back from Forge (which eventually went public in a $2 billion SPAC deal) to launch D/XYZ.

On the back of a $100 million fundraising round to assemble the initial portfolio, the team got to work engaging with regulators and lawyers to create a new structure out of existing components.

DXYZ shares some characteristics of a lot of standard offerings, including:

- A secondaries fund

- An exchange traded fund

- A venture capital fund

- And a REIT (in the way that an illiquid portfolio is transformed into a liquid investment)

But despite sharing traits with all these offerings, DXYZ is an entirely new thing.

And here’s the exciting part – now that the team has built DXYZ, they can iterate on the process to create new types of exchange-listed portfolios of private shares, beyond the current fund’s focus on a broad range of venture-backed private tech companies.

As the DXYZ story shows, establishing the precedent can sometimes be the hardest part.

What does the future hold for pre-IPO investing?

DXYZ clearly offers a fresh approach to the world of investing in pre-IPO shares, expanding beyond traditional interval funds and secondaries markets.

Here’s where we think this asset class is headed in the future:

Increasingly index-based, passive, & lower-fee.

The pre-IPO equity market still operates mostly on active management, rather than the passive management predominantly seen in public equity markets.

But it’s not obvious this should be the case.

After all, late-stage venture-backed companies of today aren’t much different from traditional public companies — so shouldn’t the investment strategy be the same?

DXYZ isn’t quite a passive, index-based solution – but it is close to one, and we expect to see more in the future.

Competing indexes & vetting

The pre-IPO market does pose some unique challenges when it comes to the creation of indexes.

It’s harder to vet companies for inclusion in an index when there’s not easy access to corporate information.

Plus, valuations are murky and highly contingent, often resulting from a mix of previous funding rounds and proprietary models.

There are already multiple competing indexes in this space, including the Forge Private Market Index and OpenVC’s Unicorn Index – expect to see a lot more as companies compete to convince investors that their index has the best inclusion standards and structure.

Private companies will engage more

Currently, private firms are usually hesitant to allow random investors to purchase their shares – which is why they frequently exercise their “right of first refusal” on the secondaries market.

But we expect this to slowly change.

This hesitancy is largely about keeping capitalization tables simple, and it’s much easier to keep track of a single large fund than a million individual investors.

Further, offering liquidity for employee shares will be a competitive advantage for startups in an environment with fewer traditional exits.

Questions from Alts Community Members

Some community members had a few questions, which Robert Blecher from Destiny did a great job answering. Copying & pasting here for transparency.

If 2% fees are charged now, that suggests one could invest now. Is that true? If so, how?

Robert: We did a private capital raise of ~$100M in 2021-2022 but, between the filing our registration statement (which took place in May 2022) and the effectuation of the listing, can’t take on any new capital.

The prospectus shows fees charged on a $1000 investment being $50 for year 1, $150 for 3-years, etc. That would suggest a 5% fee. Can you clarify?

Robert: Sure, that’s primarily driven by legal and audit fees incurred by the fund in 2023. This is a first-of-its kind product, so there were a number of matters lacking precedent with respect to both audit testing procedures and the SEC registration process. The Tech100’s registration statement has been deemed effective, so the latter is less applicable to 2024.

Disclosures from Alts

- This issue was sponsored by Destiny

- The ALTS 1 Fund holds no interest in any companies mentioned in this issue.

- This issue contains no affiliate links

This issue is a sponsored deep dive, meaning Alts has been paid to write an independent analysis of Destiny and their associated markets. Destiny has agreed to offer an unconstrained look at its business, offerings, and operations. Destiny is also a sponsor of Alts, but our research is neutral and unbiased. This should not be considered financial, legal, tax, or investment advice, but rather an independent analysis to help readers make their own investment decisions. All opinions expressed here are ours, and ours alone. We hope you find it informative and fair.