Welcome to Deep Dives, where we explore interesting companies in the alt investment space.

I hope you enjoyed our last issue on A Jewish Christmas. That was the first film financing deal we have ever featured. Response was through the roof!

After publishing, Wyatt did some research and found that horror movies have the best ROI. Interesting. We’ll definitely highlight more film opportunities in the future.

Today, we’re looking at investing in whiskey casks.

There are plenty of platforms and auction houses that give investors access to rare whiskey bottles.

But investing in casks is only just starting to take off, thanks to companies like CaskX who are working hard to provide access to a fascinating space that has been long overlooked.

The reason cask investing has been overlooked is because there is a fundamental flaw in the distillery business model.

By investing in casks, you can solve this problem, dramatically improve whiskey quality, and make money.

Let’s explore why 👇

Table of Contents

Whiskey investing 101

Okay, first things first. There are really only two ways to invest in whiskey:

- Investing in bottles – This is probably what springs to mind for most people when whiskey investing is discussed. This type of investing essentially means purchasing bottles of whiskey in the hopes that their value will appreciate.

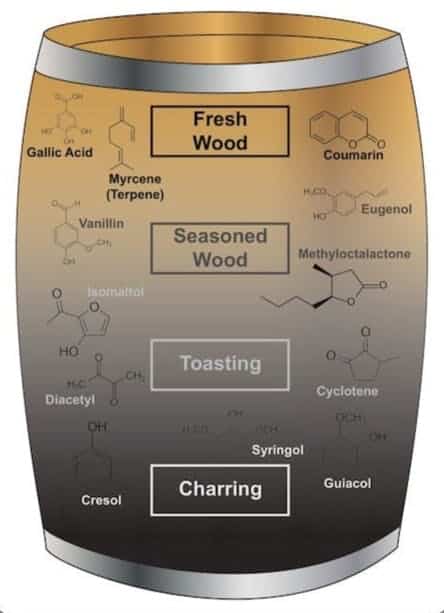

- Investing in casks – Before it can be bottled, whiskey has to be aged. In this process, whiskey sits in wooden barrels known as casks, where the wood imparts flavor on the liquid. Investing in casks means purchasing the whiskey-filled barrels outright, which can either be sold to another investor, or bottled for sale.

Investing in bottles is more speculative. It’s similar to investing in artwork or rare champagne. The primary driver of returns here is scarcity. In-demand bottles only become scarcer as they are consumed, so you want to own them.

Investing in casks, however, comes with a more “natural” form of appreciation. The quality of whiskey becomes higher as it ages in the cask, which should cause its value to increase over time.

One parallel for investing in whiskey casks is investing in timberlands. As trees grow, they become more valuable, creating a similar time-based natural appreciation that’s not commonly found with non-financial investments.

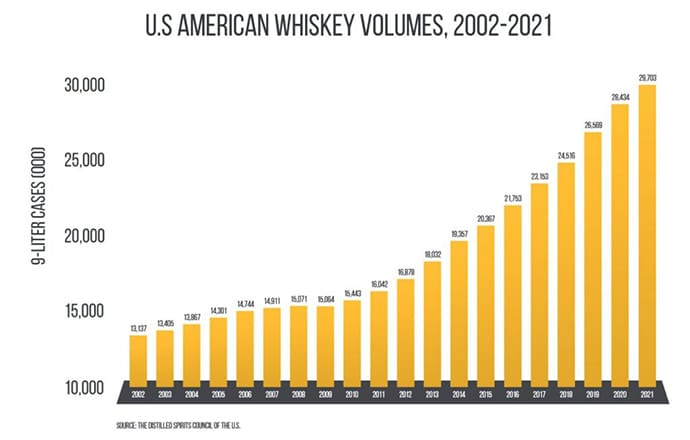

Of course, returns on both casks and bottles are influenced by market demand for whiskey.

That demand looks promising. In 2022, American whiskey sales grew 10.5%, with Irish and blended sales growth following closely behind.

Why whiskey distilleries are a tough biz

At first glance, the whiskey distillery business model might seem like the perfect setup for someone who doesn’t like to do a lot of work.

Just distill some fresh spirits into a big wooden cask, wait around for a decade, and then charge people a ton to open it up. How tough could it be?

Well, this seemingly simple business model hides some serious underlying complexity. Despite its outward appearance, the distillery business isn’t easy.

The main issue is the large time gap between when new inventory is created, and when that inventory is monetized. After all, there are few other businesses where newly manufactured product needs to literally sit in a cool warehouse for years before it can be sold.

This creates a cash flow mismatch that has been a perennial issue for the industry. Think about it: While their newly distilled batch is aging, a distillery still has bills to pay!

What’s worse, this aging process can’t really be avoided.

Aside from market preferences for aged whiskey, there are often legally enforceable restrictions on how long a spirit must sit in the cask before it can even be called whiskey. (For instance, in the UK, spirits must be aged at least three years before being sold as whiskey.)

Consumers don’t think about this stuff while they’re enjoying a Scotch or smooth Bourbon.

But this dynamic has resulted in two trends that directly impact the quality of whiskey:

1. New distilleries have trouble getting started.

Since older, established distilleries have a sizable backlog of inventory, they can continuously monetize that inventory to continue their operations.

New distilleries on the other hand, have to wait years before they can recoup any startup costs.

While this lack of startup competition is great for “traditional” distilleries, it has also led to a dearth of new approaches and experimentation that could lead to even more delicious whiskies.

2. Distilleries have to bottle prematurely

Distilleries that have large impending expenses may have no other choice but to prematurely bottle and sell whiskey in order to keep the lights on.

In an ideal world, distilleries could let their whiskey age to perfection — the longer it sits in a cask, the more they can sell it for. But business reality forces them to sell their stock today to generate cashflow.

These problems both stem from the same constraint – the fact distilleries need to bottle their casks in order to generate cash flow. But this constraint can be bypassed entirely by taking a different approach…

Solution: Distilleries can sell casks directly to investors.

By transferring ownership of the casks to investors with a longer time horizon, distilleries can monetize their inventory immediately without disrupting the aging process.

Everyone wins:

- Distilleries get the cashflow they desperately need

- Investors get an asset that has a history of strong, uncorrelated returns

- Whiskey lovers enjoy an increased supply of fine, aged whiskey.

Despite this being a perfect solution, investors have historically had difficulty accessing the space.

But one company is determined to change that – CaskX.

What is CaskX?

CaskX is leading the market in providing access to aging whiskey investments.

Think of them like a whiskey cask broker that connects distilleries (who want to sell casks) to investors (who want to buy them).

As you can probably guess, the market for whiskey casks can be opaque and difficult to navigate. CaskX’s main value is in providing information and connections that facilitate deals.

But this just a fraction of the amount needed to satisfy raw whiskey demand in America, who consumed 936 million bottles last year.

Bottom line: Supply is limited, and there’s plenty of demand to go around.

Storage

Now, one of the challenges with tangible asset purchases is storage. (After all, investing in oil would be a lot more difficult if you had to store it at your house.)

CaskX solves the storage problem by including a 8-year storage plan for investors. Casks are stored at government-regulated warehouses.

- In the US, barrels are stored at federally licensed distilleries.

- Meanwhile, in Scotland, they’re stored in warehouses protected by His Majesty’s Revenue and Customs (HMRC).

Selling the casks

When it comes time to liquidate the investment (hah, easiest pun ever) sellers have a range of options:

- Selling to independent bottlers

- Selling to other distilleries

- Selling to corporate buyers, all of whom seek to bottle whiskey under their own labels.

Alternatively, investors can pass the cask along to another investor, under whose ownership the whiskey will continue to mature.

You can even bottle the barrel yourself under your very own label.

Distillery suppliers benefit too

In their Investment Guide, CaskX highlights a number of reasons investors should consider purchasing casks.

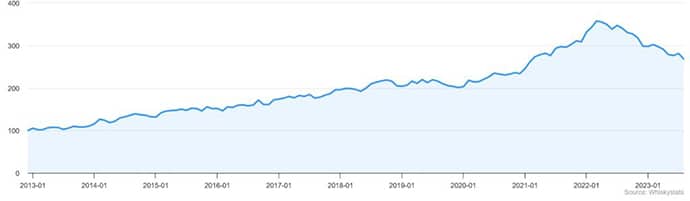

Historical data on this burgeoning asset class is somewhat scarce, but since 2013, prices for major whiskey categories have grown by about 10% per year. In addition, whiskey tends to have low correlation to broader markets, making it a strong candidate for portfolio diversification.

But CaskX isn’t just serving investors – they’re also partnering closely with distilleries to solve some of the problems we discussed previously.

In the words of Chris Miller, co-founder of an emerging distiller in Kentucky:

CaskX has played a pivotal role in helping Kentucky Artisan Distillery continue to expand. The partnership allows us to generate instant cash flow to fund operations and capital improvements without waiting years for the bourbon to reach maturity.

Clearly, CaskX is providing a tremendous amount of value to buyers, suppliers, and, indirectly, whiskey fans as a whole. Part of the reason they’re operating so effectively comes down to the impressive credentials of the team behind it.

CaskX investment options

CaskX offers two unique opportunities for those with a passion for whiskey and who understand the value of a whiskey investment .

For both, the firm says that it will help source and design a profile of casks that suits an investor’s risk and reward preferences. When it comes time to monetize the investment, the CaskX team will use their connections to distribute the casks at the highest possible price.

Note that you’ll have to be an accredited investor to take advantage of these opportunities. Moreover, CaskX has minimum investment limits, which depend on the age of the barrels purchased.

Bourbon barrel investment

Bourbon is a type of American whiskey (the ‘e’ is used for drinks sourced in Ireland and the United States) that has seen a tremendous increase in popularity in recent years. Over the last decade, annual output has climbed 116%, even as average cask prices have risen more than 13% a year.

The expected performance of a Bourbon cask will depend on the age at initial purchase. A new make Bourbon cask (with an age between one and four years) has an estimated appreciation between 10-16% per year.

In comparison, a cask with an age of more than 15 years has an estimated appreciation between 6-12% per year. This is lower, yes, but when it comes time to exit, it’s easier to sell older barrels.

Scotch Single Malt Cask investment

Scotch is the name for Scottish whisky (the ‘e’ is dropped for drinks sourced from Scotland, Canada, and Japan). The term ‘single malt’ refers to a whisky made exclusively from malted barley at a single distillery.

Traditionally, single malt Scotch is considered the king of whisky. This popularity has proved robust, especially as the world gets richer and global demand for luxury goods surges. Returns for Scotch whisky casks are strong, with average growth exceeding 12% per year.

Like bourbon casks, the expected performance of a scotch cask will depend on the age at purchase. In general, anticipated returns are slightly lower – for a new make cask, they sit at between 8-14% per year. Scotch casks also have slightly higher price volatility than bourbon casks.

With that being said, there’s simply no debating the brand value of Scotch whisky. While bourbon has been growing in popularity, one thing is for sure – Scotch is here to stay.

Pappy bottle giveaway

Pappy Van Winkle bourbons are produced in extremely limited quantities.

The brand deliberately restricts the number of bottles released each year, making them highly sought after by collectors and bourbon enthusiasts.

CaskX is looking to hear from Alts readers about their thoughts on whiskey cask investing.

As a special thank you, everyone who completes a brief survey will be entered to win a bottle of Pappy Van Winkle 20 Year Old.

Valued at over $3,000, this is one of the crown jewels of the bourbon world. For the lucky winner it’ll be the chance to experience a bourbon that is in a league of its own. Click here to enter to win now.

The CaskX team

Since the whiskey investment market is somewhat young, it would be challenging to find a team that has decades of such specific experience. But CaskX has the next best thing, with a group of people that combine their significant experience in tangible investments with a passion for whiskey.

Jeremy Kasler — Founder & CEO

Jeremy is an entrepreneur with more than 20 years of experience in specialty finance and alternative asset investments. Prior to founding CaskX in 2019, Jeremy was the founder and CEO of a leading investment broker for Chinese contemporary art.

Jon Reade — Managing Director

Jon has significant experience in the tangible asset investment sector. For more than half a decade, he has combined his passion for whiskey and finance to identify cask investment opportunities that can help diversify investor portfolios.

Sara Havens – Director of Whiskey

Sara is a writer and whiskey enthusiast whose work has been featured in top industry publications. Recently, Sara was one of the ten finalists in the World’s Top Whiskey Taster competition.

Q&A

How did your company start out? Why was the company founded?

Jeremy Kasler embarked on his journey in the realm of fine arts before venturing into the world of whiskey. In 2019 CaskX was founded at the crossroads of passion and finance.

Following extensive years dedicated to identifying tangible assets, Jeremy and the team had discovered that one could invest in full whiskey barrels. CaskX was created to combine spirits and finance in a creative new way.

With the whiskey industry continuing to boom, CaskX created a passageway for distilleries to sustain a steady influx of capital, ensuring the uninterrupted progression of their production. Investing in whiskey barrels lets you capitalize on the aging process that enhances the value and rarity of the spirit over time, and presents a unique and potentially lucrative investment opportunity.

What is the problem you’re solving? Who is your target audience?

CaskX connects investors with whiskey barrel investment opportunities from distilleries around the world.

The platform acts as an intermediary, streamlining the interaction between investors and distilleries in a manner that is both straightforward and fully compliant with all legal requirements. This allows investors to diversify their portfolios with tangible assets while also benefiting from the potential appreciation of aged whiskey over time.

What is the biggest value you provide for your customers?

Diversification. Whiskey casks are a tangible asset which requires time to reach peak flavor profile, and maximum value. They provide a layer of protection against inflationary pressures.

What do you offer that nobody else does? What are a few things that differentiate you from your competitors?

Three key factors: direct relationships with distilleries, unwavering transparency, and a resolute financial focus.

At CaskX, transparency is a core value embedded throughout the investment process. We uphold a commitment to complete openness, providing investors with a comprehensive view at every step. Clients are provided with an online portal that serves as a centralized data repository for essential documents, ownership certificates, thorough inspection reports, and even the capability to monitor holdings and initiate sales at desired exit points.

What are your future goals and plans?

CaskX is driven to continue innovating within the whiskey investment space by using technology to simplify the experience; connecting the investment assets at the warehouse with the investor at their home or office.The entire goal is to protect investors and this starts by offering unparalleled transparency.

In addition, CaskX plans to leverage investor cask holdings to release a lineup of single cask bottles. Doing so will provide another monetization strategy for investors while helping to bring some of the finest whiskey to enthusiasts, filling the void that currently exists due to a lack of supply of well-aged expressions.

Closing thoughts

Investing in whiskey bottles is already a terrific alternative investment. But aging casks present an even more unique opportunity.

Imagine you locked away a bar of silver today, and opened up the vault in 10 years. A decade later, you’d have the same bar of silver, right?

But if you purchase cask of whiskey and leave it in the rickhouse for 10 years, when you return it’ll be a completely different product. It’d be like the bar of silver turning into a bar of gold.

And this doesn’t just help your bottom line; it’s tremendously helpful for distilleries as well. As delicious as whiskey is, the cashflow constraints are very real. When you invest, you win, they win, everyone wins.

Whiskey casks are a source of wealth preservation uncorrelated with the rest of the economy, and a tangible asset that appreciates in both taste and value.

If you’d like to get in contact with the CaskX team, reply to this email and I’ll make a personal introduction. 🥃

Disclosures

- This was a paid deep dive by CaskX

- Our ALTS 1 Fund has whiskey holdings, but has not yet invested in any casks through CaskX

- I have not yet personally invested in CaskX

- This issue contains no affiliate links.

This issue is a sponsored deep dive, meaning Alts has been paid to write an independent analysis of CaskX. CaskX has agreed to offer an unconstrained look at its business & operations. CaskX is also a sponsor of Alts, but our research is neutral and unbiased. This should not be considered financial, legal, tax, or investment advice, but rather an independent analysis to help readers make their own investment decisions. All opinions expressed here are ours, and ours alone. We hope you find it informative and fair.