Investing in Athletes

We’re already investing in athletes emotionally. Now you can invest financially, through something called a fan-funded Future Earnings Contract

Debt financing (also known as Private Credit) is one of the “OG” alternative investments — a $1.2 trillion alternative investment market that is top of mind for institutions around the world. Common uses include equipment financing, inventory financing, and acquisition financing.

As an investor, you can help provide secured and unsecured loans. Firms use your capital to finance equipment and pay you back with interest.

We research and write about opportunities from time to time. Follow this asset if you’re interested. We’ll send occasional updates.

We’re already investing in athletes emotionally. Now you can invest financially, through something called a fan-funded Future Earnings Contract

Milton Friedman thought humans could sell shares of themselves. But his ideas have mostly devolved into subprime lending and ISA platforms fighting for “college education deal flow.”

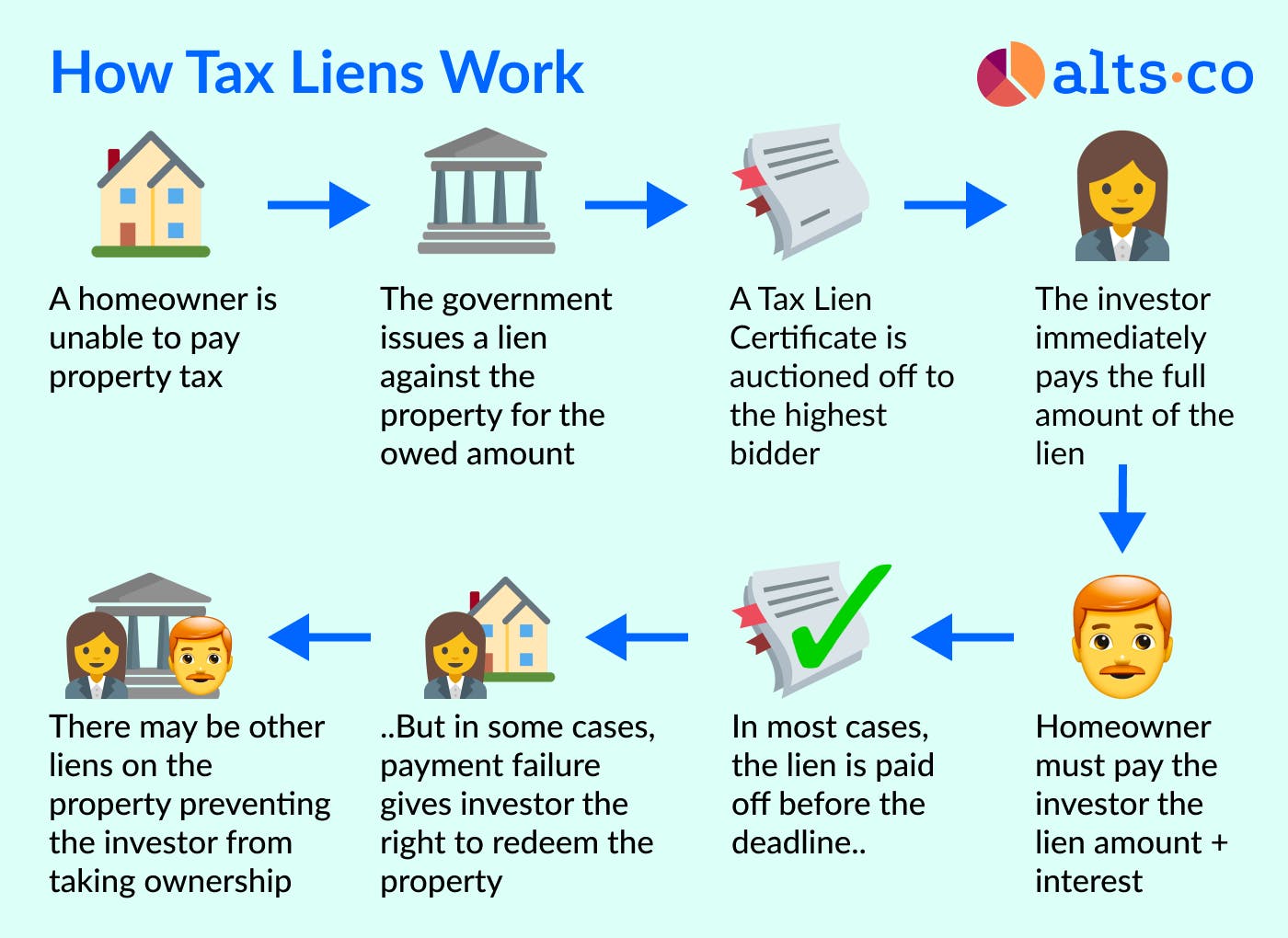

Tax liens live on the darker side of real estate. They’re not for everyone. But with interest rates, mortgages, and delinquencies rising, the time is now.

This week I have asked Den Bortnikov to provide an overview on the status of alternative finance in Ukraine.

This week we will also focus on the Status of Alternative Finance in France with Florence de Maupeou.

This week we have a detailed insight in the Status of Alternative Finance in Poland with Karol Król.

Last week I was in Milan to give a key-note lecture on European trends in alternative finance at the presentation of the latest crowd investing numbers of Italy (€153m in last 12 months). Today I will focus on some of the highlights of the conference and we take a deeper look into the status of Alternative Finance in Italy with Giancarlo Giudici.

This week I will focus on the alternative finance market in Lithuania with Vytautas Šenavičius. Lithuania is aiming to be the fintech hub in the CEE-region and has very supporting Fintech / crowdfunding / ICO regulation.

This week we focus on the status of Alternative Finance in Switzerland with Simon Amrein.

To improve the systems we have, we must understand how other systems work — especially one that dates back as far as Islamic finance.

This week we will focus on the status of Alternative Finance in Norway with Rotem Shneor.

This week we start our European review on the Status of Alternative Finance in Austria with Karoline Perchthaler.

We create indices for eclectic modern alts. We’ve got a vinyl index, a whiskey index, and more. This helps us find the best buying opportunities for our alternative investment fund

We wrap everything up with a rich qualitative analysis. You’ll understand the pros & cons of investing in all sorts of alternative asset classes.

Disclaimer: The authors of Alt Assets, Inc. are not finance or tax professionals. They are self-taught accredited investors, sharing information, research, and lessons learned. The published content is unique, based on certain assumptions and market conditions at the time of publishing and is intended to serve solely as research, not financial advice. Alts I LLC (the “Fund”) is an affiliate of Alt Assets, Inc. and the Fund has conducted a private placement offering under Rule 506(c) of Regulation D of the Securities Act of 1933, as amended. The Fund may invest in one, several or all of the alternative asset classes that Alt Assets, Inc. publishes content on its site. Any published articles on Alt Assets, Inc. that an alternative asset has a “buy”, “pass”, “overvalued” or “undervalued” designation does not factor into the asset classes that the Fund through its manager ultimately invests in, and thus, any of the Fund’s investments that have positive designations on the Alt Assets, Inc.’s site are purely coincidental as the Fund is actively managed and guided by its own investment parameters as summarized in the relevant private placement memorandum.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |