UPDATED SEPTEMBER 2023

Today we’re doing an issue on Vinovest: A wine and whiskey investing platform I personally use and love.

When I first got into alternative investing, these guys were one of the first companies I checked out.

Let me tell you more

Table of Contents

Summary

- Type: Managed wine and whiskey investing, with an option for full control

- Accreditation: Anyone can invest. Accreditation is not required.

- Minimum: $1,000 for wine, $1,750 for whiskey

- Horizon: 2-4 years for whiskey, 5+ years for wine

- Geos: Available everywhere except Cuba, Iran, North Korea, Syria, and Crimea.

- Other restrictions: Must be of legal drinking age in your country of residence

Why wine?

Sometimes I get asked about my path into alternative investing. What brought me here, what hooked me.

While I come from the world of website investing and micro private equity, one of the very first alternative investments I made was through Vinovest. I consider it one of the companies that got me hooked.

I love wine. Love it. I’m no sommelier, but I know what I like, and I’ve lived in high-profile wine regions throughout my life, including Santa Barbara, CA (where the famous wine road trip flick Sideways was filmed) and Adelaide, Australia, which is low-key one of the world’s best regions.

Wine sits at an interesting place in the world of alts. Depending on how you look at it, wine is either the oldest new alternative asset, or the newest old one.

It sort of bridges the gap between old and new: It has a long history as the world’s oldest alcoholic drink, and plenty of relevancy for younger generations. This is part of what makes it the perfect entry point for alternative investors.

Beginning in the 1970s, the availability of top-tier wines skyrocketed. Suddenly investors could buy vintages en primeur (by the barrel) and the market started to take off. For the wealthy, wine investing became normal, and huge collections weren’t unheard of.

But the availability those generations enjoyed is nothing like we have today.

And hallelujah, because wine is pretty much the quintessential alternative investment.

Consider:

- Despite a tough 2022, the wine industry remains strong. Last year all seven of the Liv-ex 1000’s sub-indices were up

- The slowest growth is from Bordeaux wines, but even those are still up 6.1%

- Alcohol is a “defensive” investment — meaning it typically performs well even during recessions. (Case in point: The fine wine index rose by 25% during the Global Financial Crisis)

- Wine has low-volatility – it’s comparable to bonds, which are famously low. The Liv-Ex index’s biggest drop since 2011 was just –8.0%.

- Last year’s best-performing wine appreciated 101.4%.

- Over the past 15 years, fine wine has outperformed the Global Equity Index by nearly 2%

- Since the year 2000, the number of 100-point vintages has grown significantly. A top winery producing a bad bottle is unthinkable these days.

- Climate change and supply chain issues are putting further upward pressure on prices

- Wine’s tangible, and loaded with utility. If your investment underperforms, you can get the bottles shipped straight to you and drink them. (On Vinovest, at least. Not so with most other platforms)

But the industry isn’t without its grapes…err, gripes.

Why whiskey?

Whiskey was a natural next step for Vinovest:

- Just like wine, whiskey prices are not really correlated with the traditional markets, but in addition, they are also not correlated with the wine market, as whiskey production follows a completely different logic (more on that below).

- Rare whiskey returned 418% from 2011 to 2022 according to Knight Frank, which also prompted them to call whiskey “the best collectible of the decade”.

- American Whiskey in particular has gained market share in the global whiskey market, with a compounded annual growth rate of approximately 5.3% with total export growth of over 55%.

Experts are bullish on whiskey. They expect the global market to grow from $59.8 billion to $81.21 billion in value by 2025, which translates to a 9.18% compound annual growth rate.

Vinovest decided to expand into whiskey in 2022, and after several months of careful testing with over 10,000 people on the waitlist, whiskey investing has been officially and fully live since spring 2023.

Incredibly, the very first whiskey holders already saw their first profitable exit: In November 2022, Vinovest offered high-rye bourbon casks to clients for $1,415 per barrel. Seven months later, an alcoholic beverage producer inquired about buying those same casks at a contract price of $1,850 each, resulting in a 30.7% return to investors.

The big problem with investing in wine and whiskey

True investment-grade wines are tough to come by.

While your local wine shop may stock a few top-shelf or even ultra-top shelf vintages, chances are investment-grade stuff isn’t something they carry. And one reason for that is storage.

This isn’t like collecting trading cards. To store fine wine properly, you need large, climate-controlled spaces designed to keep wine at the optimal temperature & humidity. You need a proper environment where wine can age gracefully and mature.

Basically, you need a cellar.

The world’s best wines have long been exclusive to the ultra-wealthy, because they can a) buy it outright, and b) store it in expansive, decadent wine cellars.

But not everyone has this.

Speaking of whiskey, it matures in large casks in warehouses, and you simply can’t store them on your own. Yes, you could buy whiskey that’s already bottled and store it at home to re-sell sometime in the future (if you can resist a temptation to sample it!) but since it’s no longer aging, bottled whiskey’s potential return is limited.

That’s where Vinovest comes in.

What is Vinovest?

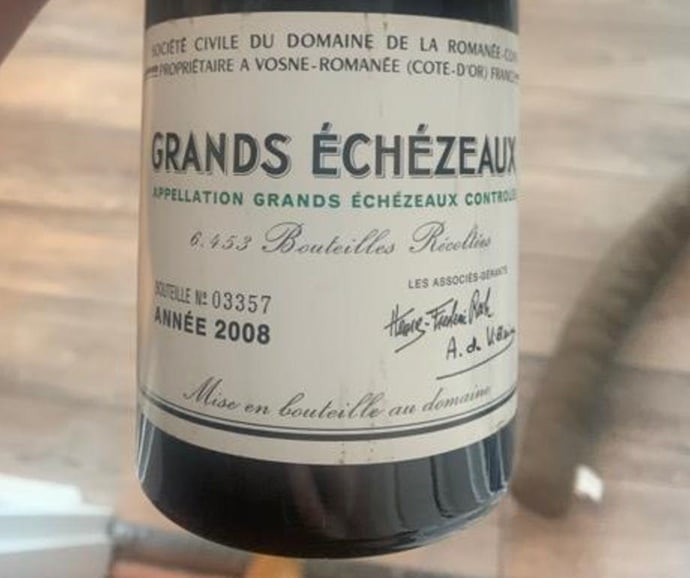

Vinovest is a platform dedicated to democratizing wine and whiskey investment. They let you invest in ultra-high quality vintage wines and fine whiskeys through an app. You can buy & sell cases of investment-grade wine and casks of whiskey like you’re investing in gold.

Vinovest offers vintage wines from the world’s best regions. Bordeaux. Burgundy. Champagne. All the familiar names.

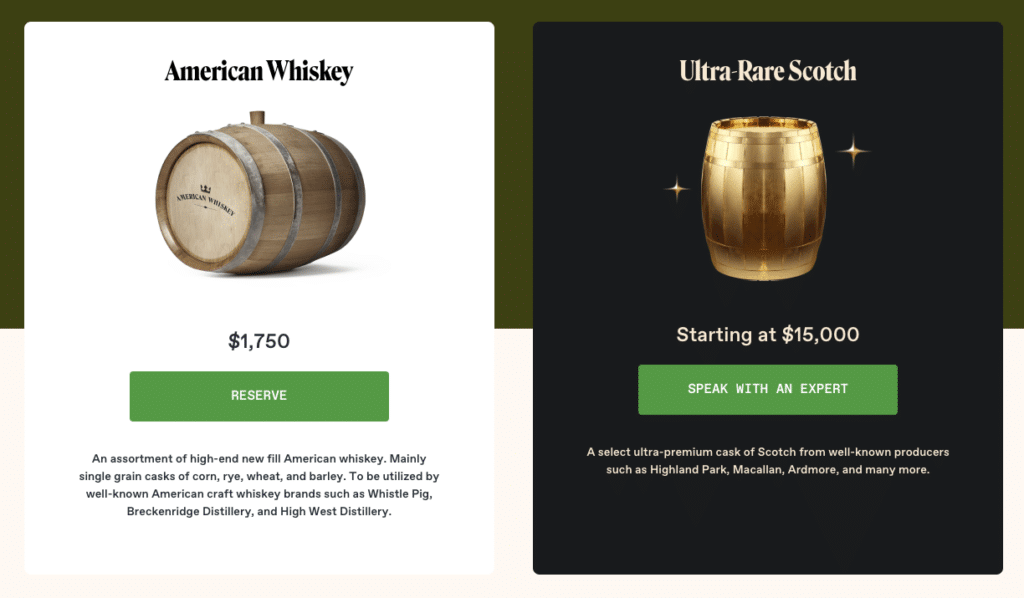

On the whiskey side, they offer American whiskey or ultra-rate Scotch.

The company was founded in 2019 and launched in March 2020. That’s right — the very same month things went haywire (ironically that’s when I first discovered them).

But Vinovest has been looking good ever since.

- $100M+ invested in wine and whiskey

- 12,000+ investors from 44 different countries

- Vinovest manages 1.7 million bottles on behalf of their customers

Founder’s story

Vinovest’s backstory is particularly interesting.

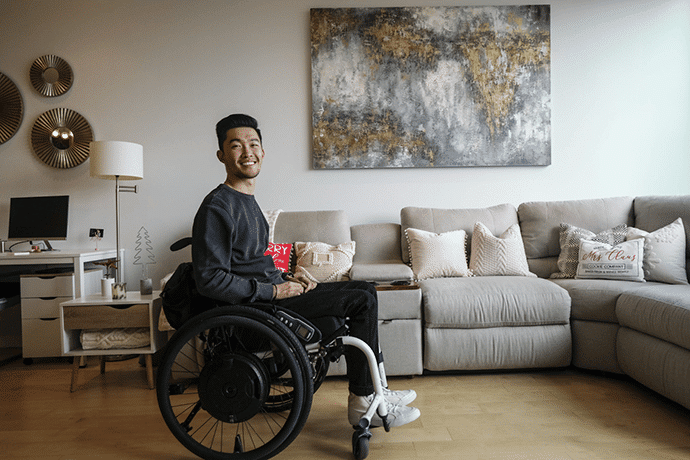

CEO and co-founder Anthony Zhang had already sold two businesses. His first claim to fame appearing when he pitched Shark Tank host Mark Cuban a food delivery business called EnvoyNow.

Watch here:

Cuban turned the team down.

But Cuban was ultimately proven a bit wrong when Zhang sold EnvoyNow for over 2x its valuation.

But as impressive as that is, there’s something even more remarkable about Anthony. While he was running EnvoyNow at college, he suffered an accident while diving into a campus pool.

When he woke up, he realized that he couldn’t move – he’d broken his neck. Five weeks later, he was out of the Intensive Care Unit, but the real challenge was yet to begin.

Zhang had to re-learn how to walk. How to breathe without a ventilator. How to eat. How to hold things.

Suddenly startups, investors and EnvoyNow were obsolete. Anthony was in full-on survival mode.

But you can’t keep a fighter down for long. Zhang recovered his entrepreneurial spirit, and had a new focus on accessibility.

He spent time working with Blockfolio, which opened his eyes to the power of alternative investments, and the barriers that hampered their accessibility.

Finally he partnered up with co-founder Brent Akamine, and the team created Vinovest – a platform where anybody can buy exclusive, investment-grade wine.

How does Vinovest work?

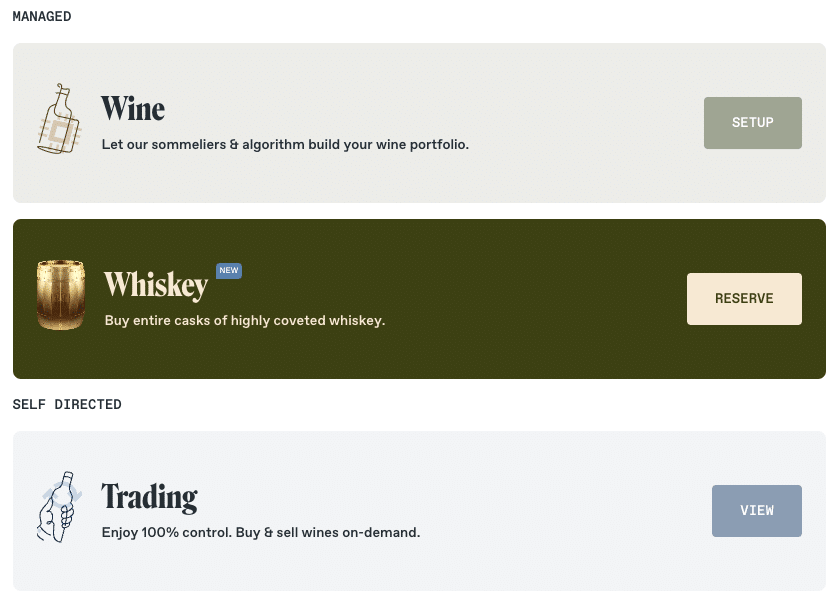

What I like most about Vinovest is it gives you a choice: Managed Portfolio, or Full Control.

Managed Wine Portfolio

Not sure what’s best for you? Not a problem.

New accounts create an investor profile by answering simple questions. What’s your preferred hold time? How much are you willing to spend? etc.

Based on your answers, either Vinovest’s AI or their sommeliers get to work. The goal is to build a portfolio perfectly suited to your investment goals.

The managed offering means the team takes care of everything on your behalf. You can’t just pick and choose specific bottles to your heart’s content.

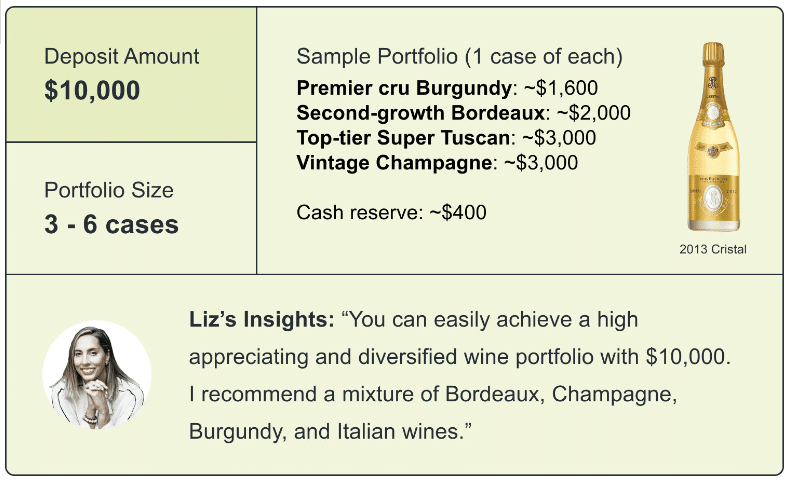

Investment minimum is very reasonable, at just $1,000 for the Starter tier. Besides, Vinovest has strict criteria for fine wine. If the minimum were lower, the wine wouldn’t be investment-worthy. $1,000 gives you the flexibility to start your investing journey with 1 to 2 cases of wine. The annual fee drops each tier up you go (there are other perks as well)

From there, it’ll take Vinovest a few weeks to actually purchase and store your wine (at a massive discount from retail price).

To be clear: The Vinovest team will purchase actual, full cases of wine for you.

For the starter tier, this is done algorithmically. (Think of it like “Wealthfront for wine”.) For the Grand Cru tier, you’ll be assigned an actual sommelier to manage your portfolio.

This isn’t like fractional investing, where you buy slices of a bottle (or rather, a collection of bottles) which you never see. These are actual bottles, sitting in a cellar, and sitting in your account. If you wish, you can have them shipped directly to you to enjoy.

If you decide to keep them in your account (which of course is better from an investment standpoint) then you’ll start to see real-time price activity after just a few hours.

Managed Whiskey Portfolio

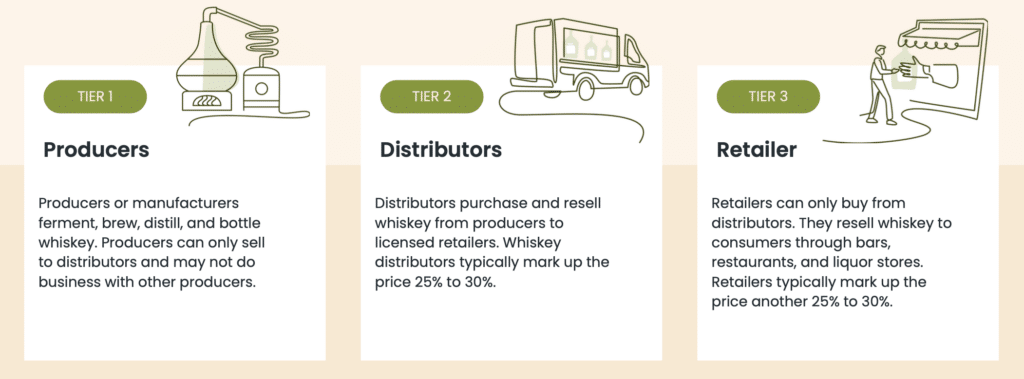

The whiskey you buy at the liquor store is overpriced.

To understand why and how Vinovest cuts out the middleman, we need to step back and look at the American whiskey industry as a whole.

If whiskey is such a safe bet, why don’t distillers just sit on their casks? Waiting years to sell a product is a tough way to run a business. That’s why distillers sell their casks immediately and free up working capital. Often, the distiller will buy back their whiskey when it’s mature so that they can bottle and sell it.

Vinovest allows you to buy, sell, and store your unique casks of American whiskey before it matures and is due to be bottled, locking in the best returns.

Minimum investment is $1,750, which is reasonable for a whole barrel of whiskey; besides, storage and insurance are covered too.

Vinovest also offers casks of ultra-rate Scotch, starting at $15,000.

Depending on your cask, after 2-4 years of holding it is time to sell, and Vinovest team will take care of that process on your behalf.

Management fees are similar to Managed Wine Portfolio, and if you decide to invest in both assets, your total deposits are added up to determine your tier, meaning you get more diversification and lower fees at the same time.

As with wine, you own your whiskey casks, and if you decide not to sell them for profit when the time comes, you can opt into bottling your whiskey for your own consumption.

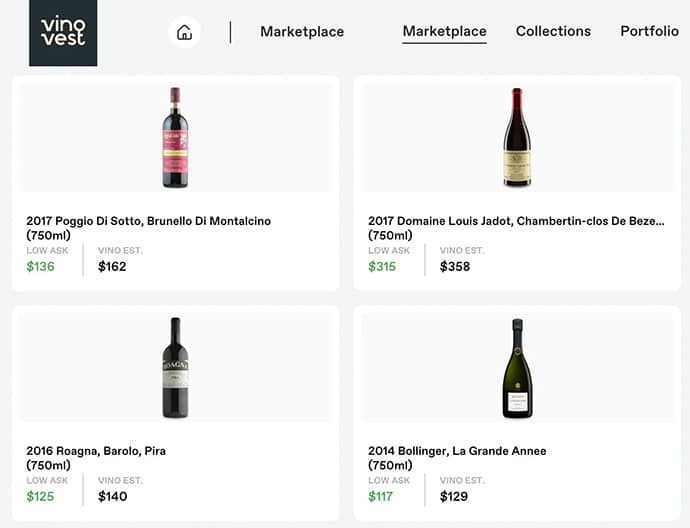

Marketplace

If you want to stay hands-off, no problem. But what if you’re an experienced wine investor?

If you’d like to take matters into your own hands, you’re in luck: Vinovest is one of the few fund-based alternative asset platforms that offers a third-party marketplace.

Here, in addition to your managed portfolio, you can buy and sell individual bottles whenever you want. No minimum balances, no waiting periods, no hold times. Just buy individual bottles of wine like they’re stocks.

Investment details

Returns

Everyone’s portfolio is unique and risk + reward are created according to your preferences and deposit amount.

Depending on your preferred time horizon and budget Vinovest algorithm and wine and whiskey experts will build a portfolio for you. Historically, wine returned about 8% to 10% annually, and whiskey 12-15%, so portfolios will attempt to target such results. Obviously, as with any investment, past performance is not a guarantee of future returns.

Fees

The base fee for a Vinovest account is 2.5% anually, which is a bit higher compared to other Robo-advisor companies, like Fundrise (1%) and SoFi (0%).

But we have to remember that Vinovest’s model means you actually own your wine cases and whiskey casks. So you’re paying a premium for the company to securely store, authenticate, insure, and manage them. By that logic, the fee is very reasonable. (And remember, the fee drops with each tier).

The fees aren’t as low as Winecap’s, but when compared to a direct competitor like Cult Wines (2.95%), Vinovest comes out ahead.

How Vinovest stacks up

Liquidity

Fair, considering wine and whiskey are long-term assets.

Whiskey is a shorter duration alternative investment with average hold times of 2-4 years, and often the distiller will buy back the casks for bottling, so the exit is very straightforward.

Wine requires longer hold times of 5-10 years to mature, and when your wine is reaching its ideal maturity window (which you can find in your wine detail page), Vinovest team will reach out to potential buyers to find the best selling price. However, should you decide to liquidate your wine portfolio earlier, there are no lockups, and you can list your wine through the Vinovest Marketplace at any time.

Flexibility

Very good.

I love the fact that you can get robo-advised or DIY (depending on your budget). You can choose whiskey if you want shorter hold times, or wine if you’re interested in longer-term assets. And the marketplace is an added bonus.

Minimum investment

Good.

Other wine investment platforms go lower (like Vint). But wine and whiskey are serious, long-term investments, and $1000 or $1,750 respectively are very reasonable starting points.

Performance

Solid.

Especially considering the broader economic downturn. 2022’s performance was 3.93%. And it’s worthwhile mentioning that a cumulative return across their managed wines since 2020 is 11.8% (2020 was 22.1% and 2021 was 8.6%).

And their performance in 2022 across top-performing regions is especially impressive:

- Burgundy (up 26.7%)

- Champagne (up 18.7%)

- Italy (up 9.2%)

Team

Top-notch leadership.

Anthony has integrity and a great history. And the team hires well – we’ve become close with some of the terrific folks they’ve hired.

Interesting: NBA star CJ McCollum even sits on the advisory council!

Usability

Very good.

The mobile app, available for both iOS and Android, is clean, modern, and has an average star rating of 4.4+ from hundreds of reviews.

Both desktop and mobile app can be a bit janky at times (for example some actions with your portfolio, like reviewing documents, can only be done on desktop.)

Correlation

Not bad.

The dirty secret is that wine investing is more correlated to equities than conventional wisdom purports. (But it has still outperformed!)

Fees + transparency

A tad high.

The transparency is fine, but you can find wine investment funds with lower fees.

That said, the fees are not unreasonable for what they cover, including physical storage, authentication, and insurance

Company risk

Low.

Every time you add wine and whiskey to your portfolio, they provide you with ownership certificates. These legal documents prove that you are the sole owner of the cases and casks.

This means you retain ownership of your wine and whiskey even if Vinovest goes out of business.

Miscellaneous

Some nice touches.

Vinovest has developed a name for itself within the wine industry. This gives them access to exclusive deals, vineyard events, private sales and the fanciest of fancy tastings. Vinovest gives investors access to these “rarified circles” and events.

They are now following the same blueprint with whiskey investing, striking supply deals with distilleries and providing users with unique allocations, insights into ongoing distillery operations and live contract pricing, which all ultimately lead to exit flexibility.

Finally, I must say that Vinovest has been very helpful to us here at Alts. Team members have gone above and beyond to help our growing company; joining webinars, providing quotes, and a whole lot more.

Further reading

- Check out Vinovest

- Listen to our Podcast with CEO Anthony Zhang

Disclosures

- Our ALTS 1 Fund has a 15.43% allocation to fine wine and whiskey through Vinovest

- I have a small personal holding of Bordeaux wine through Vinovest

This issue is a sponsored deep-dive, meaning Alts has been paid to write an independent analysis of Vinovest. Vinovest has agreed to offer an unconstrained look at their business & operations. Vinovest is a sponsor of Alts, but our research is neutral and unbiased. This should not be considered financial, legal, tax, or investment advice, but rather an independent analysis to help readers make their own investment decisions. All opinions expressed here are ours, and ours alone. We hope you find it informative and fair.