Welcome to Deep Dives, where we explore interesting companies and strategies in the alt investment space.

Last Sunday, we explored 1031 exchanges: The biggest little secret in real estate.

Today we’re continuing our journey into real estate tax incentives, with a look at Delaware Statutory Trusts.

To be clear, the DST is not a tax shelter or a loophole. It’s just hidden part of American real estate law that more people should know about.

DSTs are one of the only passive real estate investment eligible for 1031 exchanges. And when combined with the 1031 exchange, it offers big advantages which can lead to significant tax savings.

Confused? Don’t worry, we’ll explain how it all works.

Note: This issue is sponsored by BV Capital. As always, we think you’ll find it informative and fair.

Let’s go 👇

Table of Contents

Using tax loopholes to boost returns

This week we’re talking about how to take advantage of America’s two big tax loopholes: 1031 Exchanges and Delaware Statutory Trusts.

BV Capital uses these to boost returns.

BV Capital is a private equity company offering direct access to alternative real estate investments, including 1031 exchange opportunities and private deals for accredited investors, financial advisors, RIA’s & family offices.

BV has some new projects coming soon:

- A vacation home community on West Galveston Island, TX

- A multi-family apartment building in Arlington, TX

- Ground up construction mixed-use development in Corpus Christi, TX

See all BV Capital Offerings →

Real estate has complicated taxes (and insurance)

People have been putting their money in real estate for as long as investing has existed (seriously – some of the earliest asset allocation advice in history advises real estate exposure).

But investing, there’s no such thing as a free lunch. Yes, the appreciation and yield are nice. But real estate investors put with some massive headaches.

Taxes

Real estate is tangible. It touches the material world in a way that stocks and bonds don’t.

For example, a bond is just a legal claim to receive cash flows. Whereas real estate signifies ownership of actual, physical property.

This dual nature of real estate, occupying both the real world and the financial world, results in complicated tax treatment.

- Real estate is often subject to property tax, a form of wealth tax that’s uncommon in other forms of investing.

- You also have income tax, but real estate has some surprising deduction opportunities.

- Unlike financial assets, real assets deteriorate over time. This means real estate is subject to depreciation, often resulting in even more tax benefits.

There’s a lot going on here, and it’s confusing to investors who aren’t sure if their tax bill is going to end up higher or lower than it would had they invested in other asset classes.

Insurance

If you invest in stocks or bonds, you never need to think about insurance.

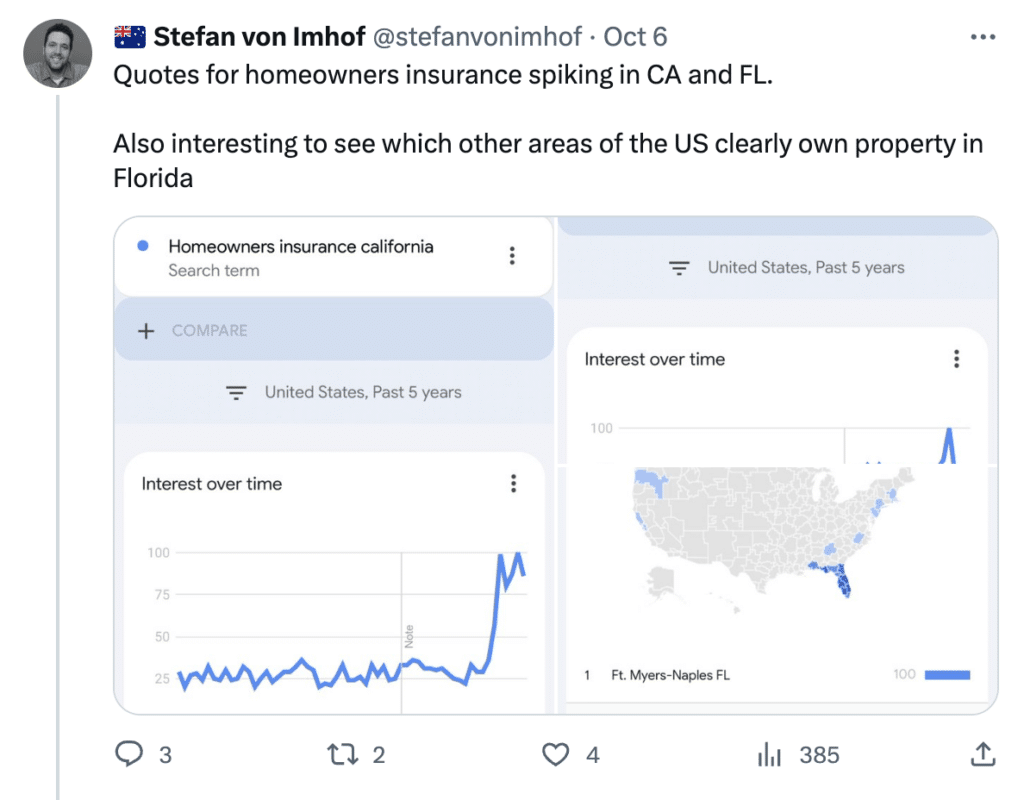

Real estate investors also need to navigate insurance issues, which have gotten very complicated.

- You need to insure the property itself

- You may need to get additional liability insurance for stuff like floods or earthquakes that may not fall under a standard policy.

- Meanwhile, climate change has made extreme weather events more likely, resulting in rising insurance rates (check out Wyatt’s terrific piece on climate change and real estate).

This is changing fast. Homeowners in Florida are already starting to pay more than triple the price they were just a few years ago.

Add issues like zoning and housing regulations into the mix, and suddenly real estate investing becomes far less desireable.

But here’s the thing: real estate’s dual nature also means governments essentially need developers to invest in real estate. After all, fresh capital going into this asset class means new properties get built, which helps ease the housing shortage plaguing cities around the world.

To help ease tax concerns and incentivize investment in real estate, governments offer investors some special tax benefits. In America, one of the most popular real estate tax benefits is the 1031 exchange.

1031 exchanges are great…

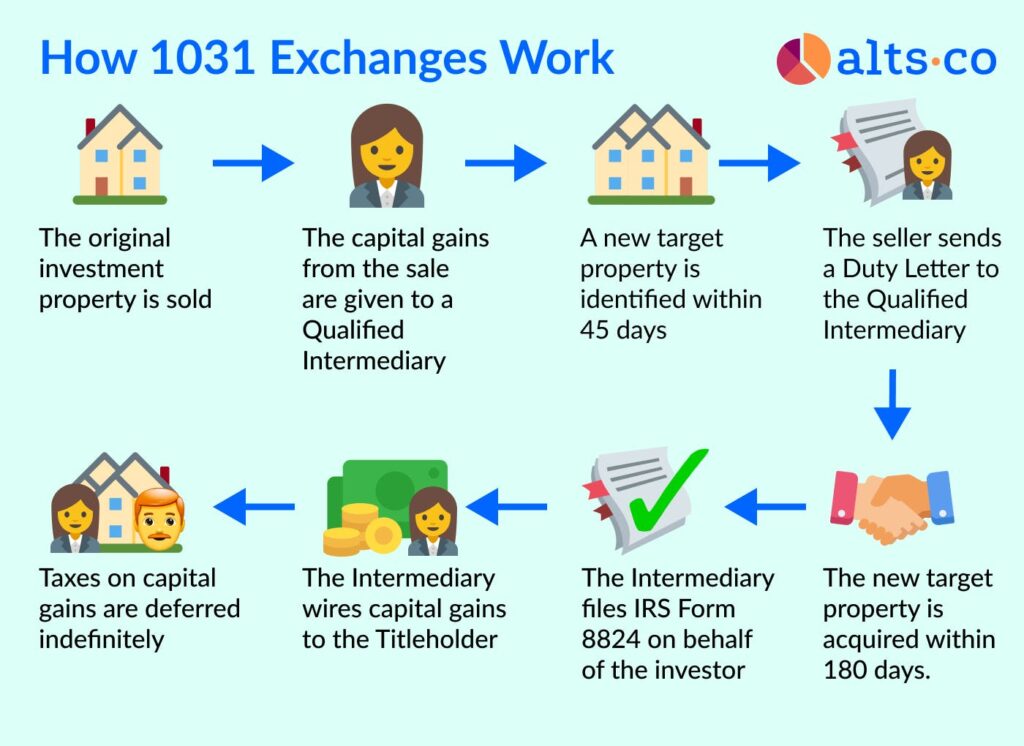

The 1031 exchange is a special tax break you get when you “swap” one investment property for another. It’s a legal tax loophole that lets you avoid paying capital gains tax (potentially forever)

If you want to read about it, check out last week’s Sunday Edition.

If you’re short on time, here’s the TL;DR

1031s seem too good to be true, but they’re a bit tricky to pull off successfully.

And taking advantage of the 1031 exchange law means you can’t use one of the most important tools in real estate investing: passive investment vehicles.

…but passive real estate isn’t eligible for 1031s

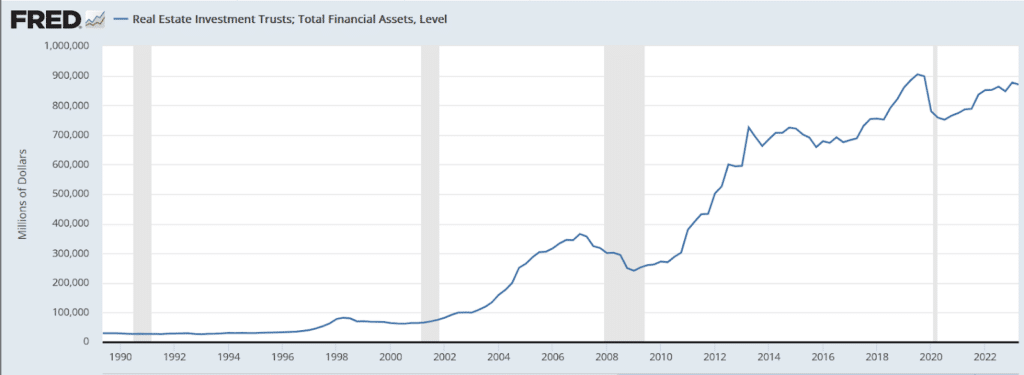

REITs (Real Estate Investment Trusts) are baskets of properties that trade just like stocks. They’re given tax advantages because by law, they have to distribute 90% of their income back to shareholders.

We talked about this last week in our issue on land REITs.

And REITs aren’t the only passive investment structures. We also have:

- Real estate syndicates

- Real estate crowdfunding

- Real estate limited partnership funds (aka real estate private equity)

But here’s the problem with passive: none of these options are 1031 exchange eligible!

So, does pursuing passive real estate investing mean sacrificing the benefits of 1031 exchanges? Can investors only solve one problem (taxes) at the expense of the other (passive investing)?

Not quite. There’s one structure that allows the best of both worlds — the Delaware Statutory Trust.

What is a Delaware Statutory Trust?

The Delaware Statutory Trust (or DST) is a very specific passive real estate vehicle.

Despite the name, a DST isn’t just for Delaware — you can own property in any state. (BV Capital, for instance, which offers DST investments, operates mainly in Texas.)

Rather, the “Delaware” in DST is a byproduct of the state’s famous role in determining American business law.

Anyways, like other passive real estate options, DSTs are a mechanism for investors to pool their funds together to be managed by someone else. They come with all the traditional passive investing benefits (greater diversification, lower minimums, and access to institutional real estate opportunities)

In a nutshell:

DSTs are one of the only passive real estate investment eligible for 1031 exchanges.

This is a big deal. It means an investor can 1031 exchange their property not for another property, but for shares in a DST.

How do DSTs work?

The mechanics of how the DST process works gets complicated, which is why lawyers and investment pros are hired to run the process.

But for a high-level overview, it helps to see how they differ from REITs.

With a REIT…

- You set up a company (a trust)

- You raise funds by selling shares of the company to investors

- You use the money to acquire real estate

With a DST…

- You make the initial purchase of real estate with your own money (you don’t raise funds)

- You transfer ownership of those assets to a trust

- Finally, you sell shares in the trust to investors

From a layman’s perspective, these seem pretty similar. But the IRS views them as distinct enough that ownership of DST shares are equivalent to direct property ownership.

This means DSTs are 1031 eligible while REITs are not.

And people are catching on. In fact, in recent years, many REITs have been adopting DST structures.

That’s a smart move, considering the huge benefits you get.

1031 exchanges + DSTs = Winning.

When using a DST, real estate investors get all the benefits of passive investing. But it turns out using a DST also makes it easier to execute a 1031 exchange.

- Better timing. It’s challenging to find the perfect real estate property within the 45-day and 180-day window that 1031s require. DST opportunities come pre-vetted by institutional sponsors, making it easier to perform the due diligence and execute the transaction in time.

- Smaller sizing. Like other passive real estate investments, DSTs are fractional, meaning you can buy as few or as many shares as you want (subject to minimum investments, which can run in the $100K range). Therefore, it’s much easier to satisfy the “greater or equal value” condition of 1031 exchanges.

- Smoother QI process. In a 1031 exchange, funds have to flow through a qualified intermediary (QI). DST sponsors are real estate pros experienced at dealing with QIs, making this process way smoother than in a regular real estate deal.

What is BV Capital?

BV Capital is a real estate private equity company that offers a range of passive real estate opportunities — including DSTs that are 1031 compliant.

The company was launched to democratize access to high-end real estate opportunities, a space traditionally dominated by the ultra-rich. Without the capital or connections needed to source and finance expensive properties, many investors have historically been excluded from this market.

Plus, most investors lack the knowledge or experience needed to pull off successful 1031 exchanges (which is why this tax loophole has been criticized for catering exclusively to wealthy investors.)

BV Capital is starting to change all that, leveraging their network to offer deals with great tax opportunities. The company has already completed multiple successful exits – including the Jefferson Alpha West apartment complex, a Class A development that BV Capital sold in 2021 for $92 million (~$224,900 per unit).

Vertically integrated operations

In part, BV’s success is due to their focus on Texas real estate, which has been growing tremendously in recent years.

But they’re also vertically integrated.

BV Capital is one arm of Bridgeview Real Estate, who can facilitate nearly every aspect of the real estate process, including acquisition, construction, development, property management.

Most real estate investment firms have to pay top dollar to outsource these components, so being part of Bridgeview provides BV Capital a true competitive advantage.

Moreover, Bridgeview contains a securities arm in the form of an in-house broker-dealer. This helps investors save on fees and commissions, which can add up quickly.

Investing with BV Capital

BV Capital is always searching for attractive opportunities.

While BV focuses on Texas, their portfolio has holdings across the United States. Most assets are in bread-and-butter real estate categories like multifamily, office, and industrial, but BV also holds some specialty properties like medical buildings, student housing, and senior living.

Accredited investors get access to a range of private investment options, which have lower volatility than public investments. It’s important to note that BV does not offer investment access to international or non-accredited investors, and has no plans to start.

Currently, BV Capital is offering investors access to an exclusive opportunity to participate in a new development in one of the fastest-growing parts of the country.

The Landhaus at Gruene

Texas is on the receiving end of a huge wave of domestic migration.

Americans are increasingly drawn to the state’s strong economic prospects, (mostly) good weather, and low cost of living. More than half of the state’s population growth over the past two decades is attributable to people moving in from other states.

BV’s latest offering sits at the epicenter of this growth in New Braunfels, Texas:

- It’s about 40 miles from both San Antonio and Austin

- The area has seen 66% population growth since 2012

- Rents are growing between 4-5% a year.

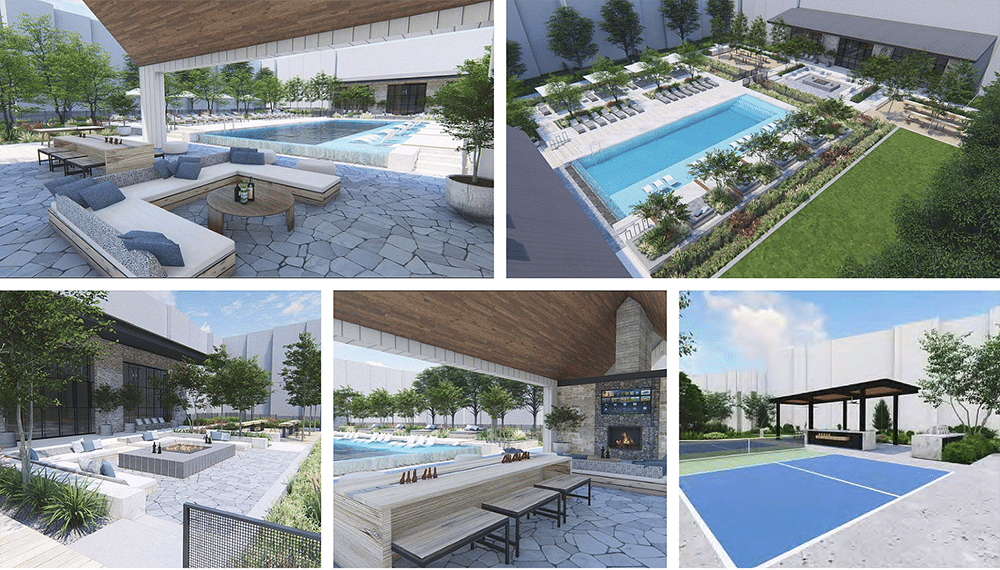

This new ground-up development, dubbed The Landhaus at Gruene, is a garden-style multifamily complex featuring 356 class A units and amenities such as a pool, a dog park, EV charging stations, private garages, and courts for pickleball – America’s fastest-growing alternative sport (and possibly it’s most over-hyped).

Here’s one of the best parts — BV got this project approved right before the city hiked impact fees for new developments. That results in a much higher barrier to entry, which should significantly lower local competition!

Quick highlights of what BV is offering:

- 8%-10%* preferred returns (depending on share class)

- 1.8-2.0X* estimated investor multiple

- 36 months estimated holding period

- 14%* land discount to market (as of May 2023)

- Q4 2023 estimated construction start

One downside is that this specific opportunity is not a DST, meaning it’s not 1031 eligible. But DSTs are a growing part of BV Capital’s offerings, and this is a great way to get involved with the firm and get notified of future 1031-compliant deals.

Note: BV Capital does have a 1031-eligible deal right now, but it’s what’s known as a 506(b) deal, so they can’t actually advertise it! (Like we said, laws are complex.)

Interested in seeing this special deal? If you’re accredited, click here and we’ll send you more info.

BV Capital Q&A

How did your company start out? Why was the company founded?

Our founder came out of the banking sector where he was one of the top real estate lenders in the country for two major banks. His experience has helped the company navigate the debt side of our business which has been extremely helpful in today’s market.

What is the problem you’re solving? Who is your target audience?

We help accredited investors participate in private real estate deals that were historically reserved for the super wealthy or the super connected. Our typical investor is either a high-income earner or an entrepreneur looking for an alternative to the stock market.

What is the biggest value you provide for your customers? Why do they pick you over another company?

We are a vertically integrated real estate firm which helps us navigate challenges that other firms have to outsource. For example, we own our own broker dealer and thus are audited by FINRA every year which gives investors comfort that we are held to a higher fiduciary standard than other real estate developers.

What do you offer that nobody else does? What are a few things that differentiate you from your competitors?

We offer high end Texas real estate deals. Due to our extensive local network, we are able to source deals that many of our competitors don’t get to see. We also offer 1031 DST products which help real estate investors defer capital gains on the sale of investment properties.

When did you know you were onto something special?

The feedback we get from our investors has been fantastic. It’s great confirmation when you get an email from an investor who is truly grateful that they found your company.

What are your future goals and plans?

We have 7 development deals in the works right now when most are putting their plans on hold. We are excited to get these deals moving forward as we’ll be one of the few firms offering new products due to the slowdown in financing. This will create a supply and demand imbalance that will benefit our investors.

See all BV Capital Offerings →

Further reading

- Alts community member Frank P. has lots of experience in DSTs and gave some solid advice

- This is a good Reddit thread on 1031s and Delaware Statutory Trusts

- You may be curious about the deal that BV Capital cannot advertise. Companies conducting an offering under Rule 506(b) can sell securities to an unlimited number of accredited investors. But no general solicitation or advertising is allowed.

- Wyatt did an excellent report on how climate change will affect American residential real estate

Disclosures

- This issue was sponsored by BV Capital

- Our ALTS 1 Fund does not have any holdings with BV Capital or Bridgeview Real Estate

- The authors of this article does not have any personal holdings with BV Capital or Bridgeview Real Estate

- This issue contains no affiliate links

Disclosure from BV Capital: *Due to various risks and uncertainties, actual returns and timeframes may differ materially from the returns reflected or contemplated herein.The information contained herein does not constitute an offer to sell nor is it a solicitation of an offer to purchase a security. Offers will only be made through a private placement memorandum to accredited investors and where permitted by law. The preferred return is not guaranteed as it relies on the asset’s performance. Past performance may not be indicative of future results.

Disclosure from Alts: This issue is a sponsored deep dive, meaning Alts has been paid to write an independent analysis of WebStreet. WebStreet has agreed to offer an unconstrained look at its business & operations. WebStreet is also a sponsor of Alts, but our research is neutral and unbiased. This should not be considered financial, legal, tax, or investment advice, but rather an independent analysis to help readers make their own investment decisions. All opinions expressed here are ours, and ours alone. We hope you find it informative and fair.